Coinspeaker

ETH Speculators Keep Ethereum Price to $3,000 Preventing Any Rally

The world’s second-largest cryptocurrency Ethereum (ETH) has been facing continuous selling pressure with its price staying just above the $3,000 support. In comparison to Bitcoin, Ethereum has once again “underperformed” with new ETH holders facing the risk of falling into losses.

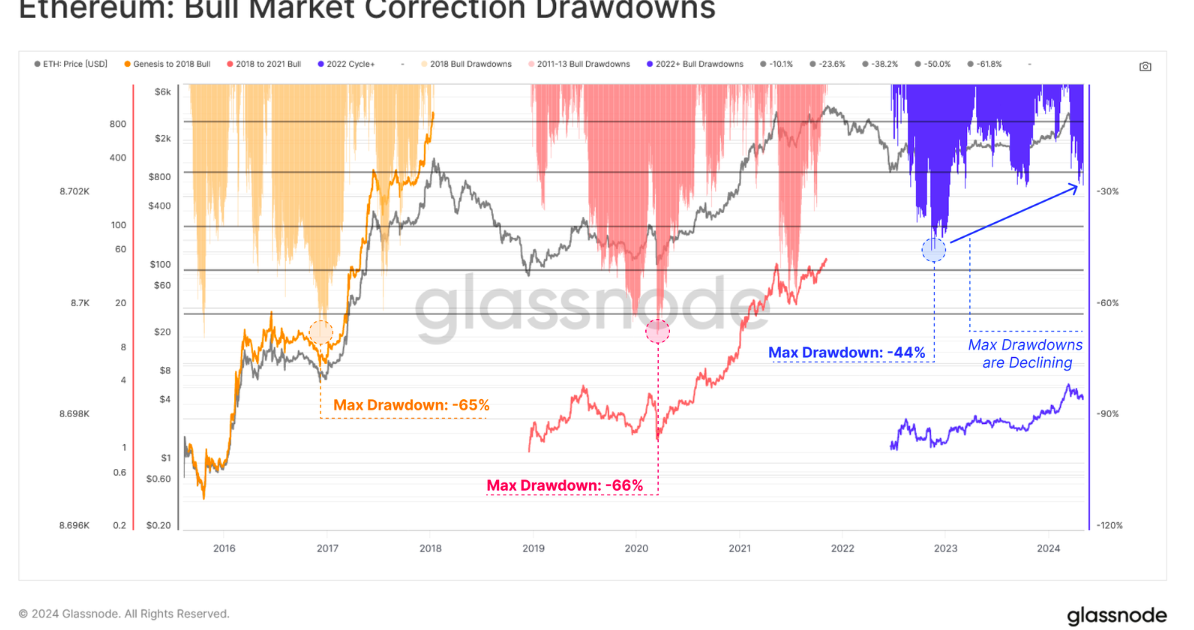

Crypto analytics platform Glassnode recently revealed how the ETH speculators are holding the altcoin price close to $3,000. The month of April witnessed a strong pullback both in the price of Bitcoin and Ethereum, witnessing its biggest monthly retracement since the FTX collapse back in April 2022. Glassnode added:

“However, it is worth noting that Ethereum’s deepest drawdown of the cycle has been -44%, which is just over twice as severe as Bitcoin’s at -21%. This highlights Ethereum’s relative under-performance over last 2 years, which is manifesting in a weaker ETH/BTC ratio also.”

- Courtesy: Glassnode

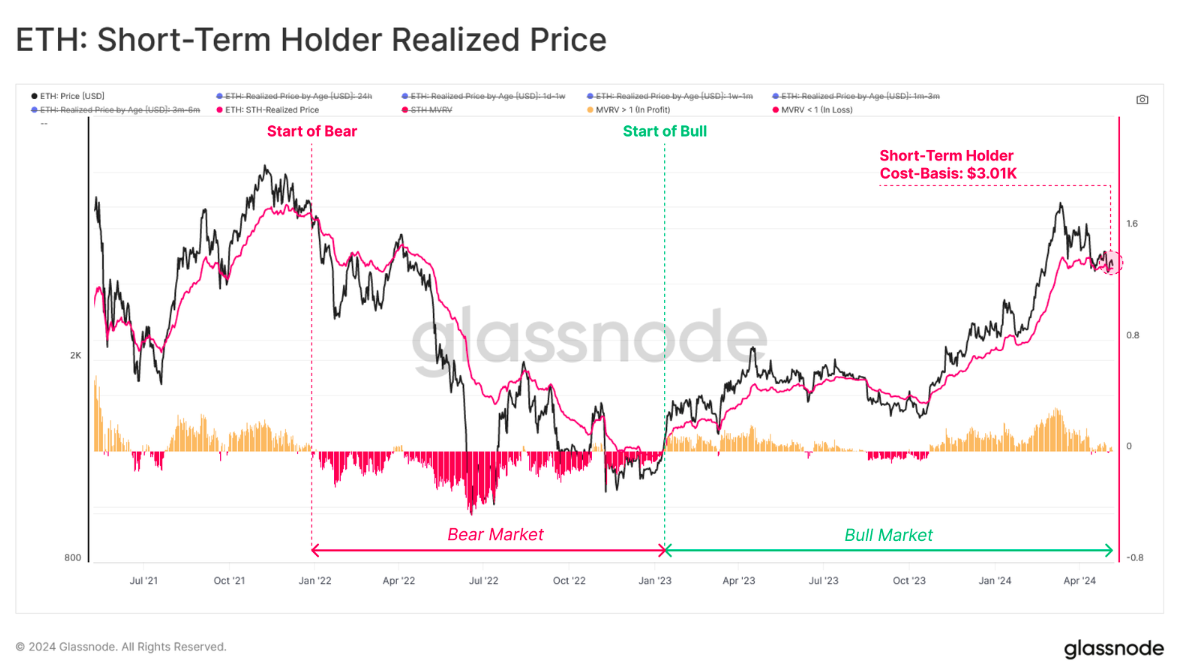

As the severity of Ethereum (ETH) price downturns diminishes, some groups of investors are now finding themselves at risk of experiencing losses on their holdings. Short-term holders (STHs) of Ethereum, defined as entities holding coins for 155 days or less, currently have an aggregate cost basis of approximately $3,000.

Citing Ethereum’s other metric of market cap to realized cap (MVRV), Glassnode stated that a fresh market drop could create further panic among holders. Glassnode warned:

“Ethereum’s STH-MVRV is trading at a very slight premium at the moment, which could suggest that spot prices are very close to the cost basis of recent buyers, who may panic should the market experience downside volatility”.

Meanwhile, long-term holders (LTHs) seem reluctant to engage in mass selling at present prices, even though many have already attained considerable profit margins.

Dencun Upgrade Is Making Ethereum Inflationary Again

Crypto analytics firm CryptoQuant stated that the Dencun upgrade has made Ethereum (ETH) inflationary once again while killing its characteristics of being “ultra sound” money. In its report earlier this week, CryptoQuant stated that amid the drop in the Ethereum transaction fees after the Dencun upgrade, the total ETH burned has dropped to the lowest levels since the Merge event of September 2022.

Thus, since the Merge event, the supply of ETH has been growing at its fastest daily rate. The CryptoQuant analysts stated: “Before the Dencun upgrade, the higher network activity on Ethereum meant higher fees burned and hence less ether supply. However, after the Dencun upgrade, the total amount of fees burned has decoupled from the network activity”.

ETH Speculators Keep Ethereum Price to $3,000 Preventing Any Rally