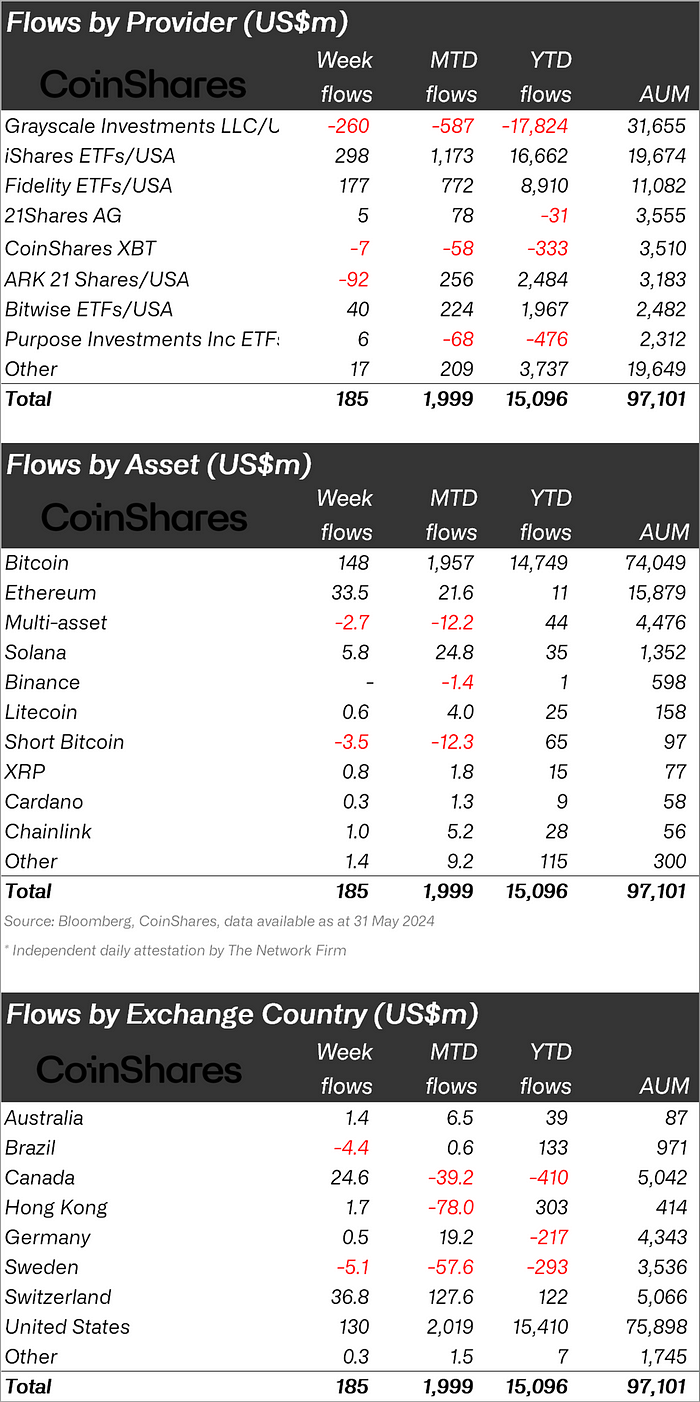

Digital asset investment products experienced their fourth consecutive week of inflows, totaling $185 million and pushing May’s inflows to $2 billion.

According to CoinShares, the surge has driven year-to-date inflows past the $15 billion mark, a record achievement. Despite this positive trend, weekly volumes declined to $8 billion from $13 billion the previous week.

The United States led the inflows with $130 million, even as incumbent ETF issuers faced outflows of $260 million. Switzerland recorded its second-largest weekly inflow of the year at $36 million, while Canada reversed its trend with $25 million in inflows after a net outflow of $39 million in May.

Bitcoin (BTC) continued to dominate with $148 million in inflows, while short-bitcoin products saw outflows of $3.5 million, indicating sustained positive sentiment among ETF investors. Ethereum (ETH) also saw its second week of inflows following the SEC’s approval of a spot-based ETF, set to launch in July 2024. It marks an influential turnaround after a 10-week outflow streak totaling $200 million. Ethereum’s positive momentum also benefited Solana (SOL), which attracted $5.8 million in inflows last week.

Conversely, blockchain equities struggled, experiencing $7.2 million in outflows last week and $516 million year-to-date. Despite the mixed performance, the overall trend in digital asset investments remains robust.