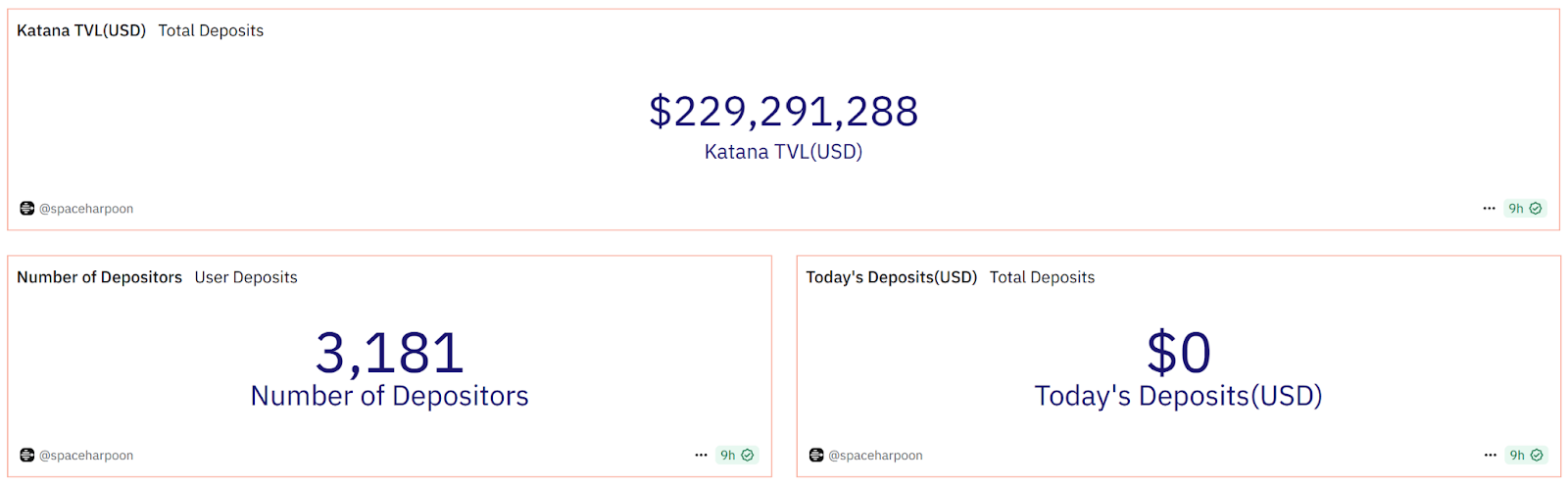

Katana, a new DeFi-first layer-2 blockchain, went live on mainnet with over $200 million in pre-deposits just weeks after its public reveal, making it one of the most capitalized debuts of any layer-2 network this year, according to a Monday announcement.

Developed by the Katana Foundation, the Polygon Agglayer Breakout Program graduate is designed to support high-yield decentralized finance activity at scale. Katana integrates with decentralized exchange Sushi and lending protocol Morpho, offering incentives to liquidity providers.

Unlike traditional models that issue new tokens to incentivize participation, Katana’s design integrates yields from multiple sources, including VaultBridge strategies, which enable users to earn native Ethereum yields within Katana’s ecosystem, Chain-owned Liquidity (CoL) reserves and AUSD-backed treasury flows.

Through its launch partner, Universal, Katana allows trading of popular non-Ethereum Virtual Machine tokens like SOL (SOL), XRP (XRP) and SUI (SUI) directly onchain. Universal has also integrated with Coinbase Prime to support institutional-grade custody and minting of supported assets without needing decentralized exchange-based pre-seeded liquidity.

Related: Polygon-backed, high-yield blockchain Katana launches for institutional adoption

Speaking to Cointelegraph, Marc Boiron, CEO of Polygon Labs, said Katana’s primary goal is “to address the liquidity demands of the Agglayer ecosystem while meeting users’ needs for deeper liquidity and higher yields.”

“Assets aren’t just idle — they are actively deployed, driving real usage, sequencer fees and app-level fees, all of which flow back into sustaining deeper liquidity,” he added.

Katana has earmarked around 15% of its KAT token supply for an upcoming airdrop to Polygon (POL) token stakers, including those holding liquid staking derivatives. The move aims to reward early supporters and deepen ties to the broader modular Ethereum ecosystem.

Katana measures asset effectiveness with productive TVL

Katana introduces a new benchmark for measuring DeFi capital efficiency: productive total value locked (TVL). Unlike traditional metrics that track idle asset deposits, productive TVL only accounts for capital actively deployed into yield-generating strategies or core DeFi protocols. Ahead of its mainnet launch, Katana accumulated over $200 million in productive TVL.

Katana said its coordinated yield mechanisms turn passive capital into a self-circulating economic engine. VaultBridge redirects bridged assets such as Ether (ETH), USDC (USDC), USDt (USDT) and wBTC (WBTC) into offchain yield-bearing positions, primarily on Ethereum. These returns are looped back into Katana’s onchain DeFi pools, benefiting users who keep their assets in motion. Chain-owned liquidity aims to ensure sequencer fees are continuously recycled into liquidity reserves.

Boiron explained the benefits of “productive TVL” to Cointelegraph, saying it “provides a clearer picture of what’s really happening behind the scenes.”

He added, “It reflects actual usage, economic efficiency and long-term sustainability.”

The launch follows recent DeFi infrastructure advances, including Agora’s AUSD, a yield-bearing stablecoin that channels returns from US Treasury and repo markets into Katana’s protocols. These flows, combined with Katana’s smart yield routing, form the foundation of its productive TVL model.

Magazine: DeFi will rise again after memecoins die down: Sasha Ivanov, X Hall of Flame