The price of Nexo (NEXO) continued to fall on June 15 as crypto lending firms continue to be shaken by the falling cryptocurrency market.

Meanwhile, Nexo has denied rumors of exposure to Three Arrows Capital (3AC), a Dubai-based crypto fund facing insolvency risks.

NEXO price suffers on DeFi contagion fears

NEXO, which serves as a security token at a cryptocurrency lending platform of the same name, fell nearly 25% to $0.61 a unit, its lowest price reading since January 2021.

The massive intraday decline came as a part of a broader downside move this week, which stretched NEXO’s losses to 40%.

An ongoing contagion in the crypto lending sector contributed to NEXO’s underperformance.

Traders fear that most decentralized finance (DeFi)/centralized finance (CeFi) firms, which offer high yields to clients on their cryptocurrency deposits, will default on their debts due to the wipeout of nearly $1.5 trillion from the crypto market in 2022.

The concerns continue to mount after the collapse of Terra (LUNA) — now known as Luna Classic (LUNC) — a $40 billion algorithmic stablecoin project, in May.

A month later, Celsius Network, which offers clients up to 18% yields, paused withdrawals due to “extreme market conditions.” Its clients have pulled almost half of their assets out of the platform since October 2021, thus leaving it about $12 billion as of May 17 to meet debt obligations.

I am definitely rooting for Celsius not to get liquidated. That is customer money. And fuck the funds who are hunting this stop loss. I hope they get rekt. #bitcoin

— Lark Davis (@TheCryptoLark) June 14, 2022

Meanwhile, 3AC, a crypto hedge fund, has witnessed liquidations of at least $400 million. In addition, on-chain data reveals that the firm may also have a minimum debt of $183 million against a collateral position of $235 million (derived in Staked Ether).

The address uses USDT/USDC to repay the debt and withdraws ETH, and then converts ETH to USDT/USDC through “sinofate.eth” and repays it, and so on. In almost 24 hours, the address has sold about 50kETH. https://t.co/TUzqXBXBwF

— Wu Blockchain (@WuBlockchain) June 15, 2022

The fund could transfer the economic risks to its lenders if it becomes insolvent.

“The lenders will bear the PnL [profit and loss] difference between how much they are owed versus what they get in liquidating their collateral,” noted Degentrading, a market commentator known for highlighting the Celsius Network’s liquidation issues.

He added:

“That means defaults will cause SIGNIFICANT EQUITY erosion […] Not all lenders are made equal. Celsius is the worst. It has gone under. Nexo, I don’t know. BlockFi is pretty bad as well.”

However, Nexo says it currently has no exposure to 3AC despite partnering with the fund over a nonfungible token (NFT) lending product in December 2021. The firm asserts that the partnership with 3AC did not take off.

All Nexo has ever done with Three Arrows Capital is sign a partnership with their NFT fund, but it did not take off and we currently have $0 business and exposure with them.

— Nexo (@Nexo) June 15, 2022

What’s next for the NEXO token?

Nexo has 100% liquidity to meet its $4.96 billion worth of debt obligations, according to U.S.-based audit firm Armanino. That raises the firm’s potential to avoid a liquidity crisis in the event of a rising withdrawal rate, unlike Celsius.

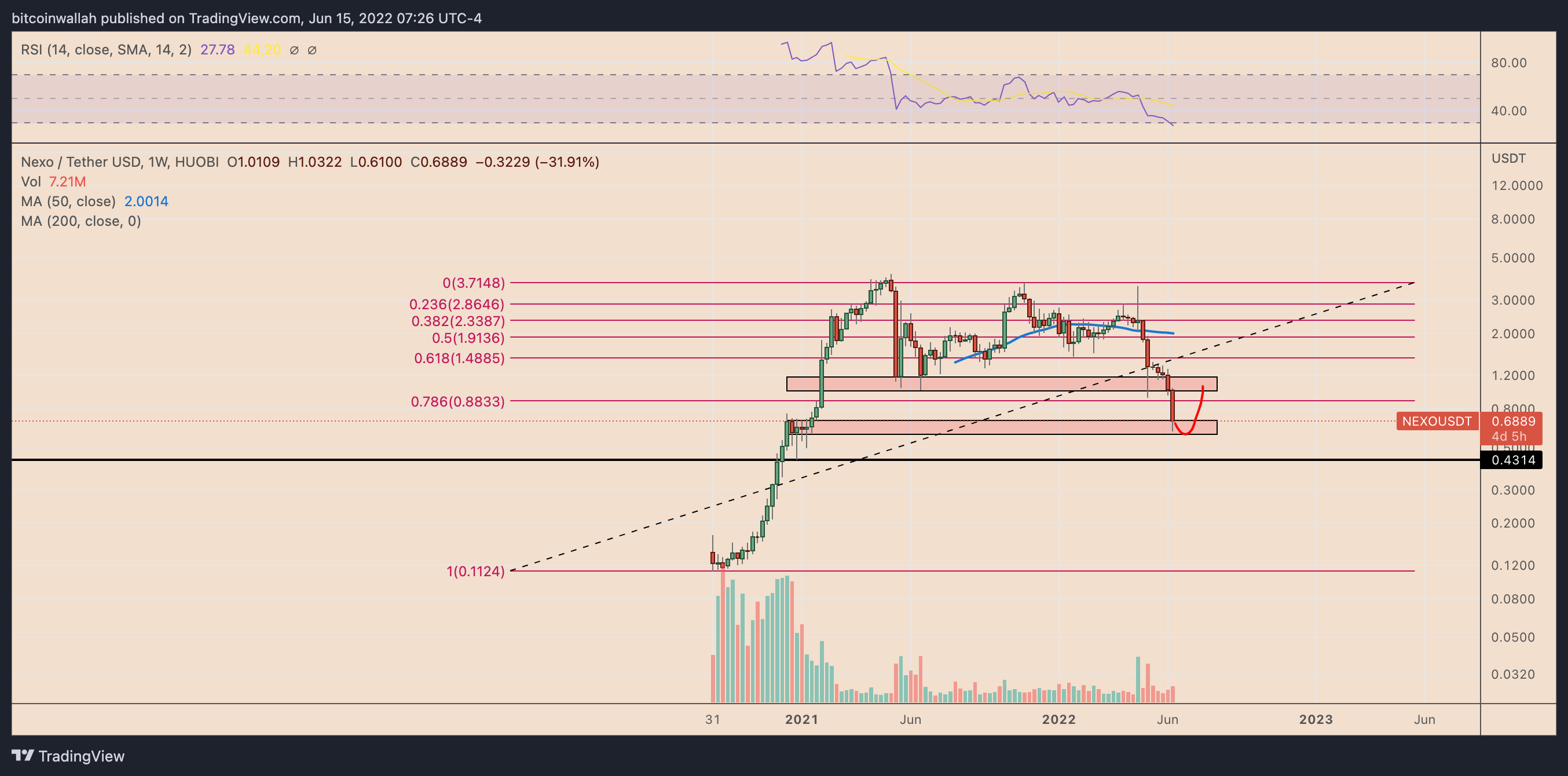

Nonetheless, NEXO price treads ahead under persistent bearish risks, primarily due to the crypto market’s dire state in a high-interest rate environment. The NEXO/USD pair now eyes the $0.58–$0.69 range as its interim support due to its historical significance from December 2020 to January 2021.

A rebound from the $0.58–$0.69 range could have NEXO bulls eye $0.883 as their interim upside target. This level was instrumental as support during the early-May price crash; it now coincides with the 0.786 Fibonacci retracement graph drawn from the $0.11-swing low to the $3.71-swing high.

Related: Is the bottom in? Raoul Pal, Scaramucci load up, Novogratz and Hayes weigh in

Conversely, a decline below the $0.58-$0.69 range could have NEXO watch December 2020’s support level near $0.43, down around 35% from June 15’s price.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.