The daily pump & dump is a weekday update on the crypto market providing you with an abbreviated breakdown of price action related to Bitcoin, Ethereum, and other trending altcoins.

Today’s summary:

- Bitcoin retests $30,000 after a rejection.

- Why is Ethereum lagging behind the rest of crypto?

- ICP posts insane intraday rally.

Bitcoin Retests $30,000, Can The Key Level Hold?

Bitcoin price was fiercely rejected from resistance at $32,000, sending the cryptocurrency back to retest support at $30,000.

The fall took BTCUSD daily to the middle-Bollinger Band – which is a 20-day simple moving average. Holding the line could lead to further upside, while losing it suggests continuation of downside.

Bitcoin is trying to hold above the 20-day SMA | Source: BTCUSD on TradingView.com

A close above $32,000 is now the immediate hurdle for bulls to overcome, while bears remain within striking distance of new lows.

Related Reading | Hammer Time: The Bullish Signal That Could Save Bitcoin

Ethereum Losing Its Head (And Shoulders) Against BTC

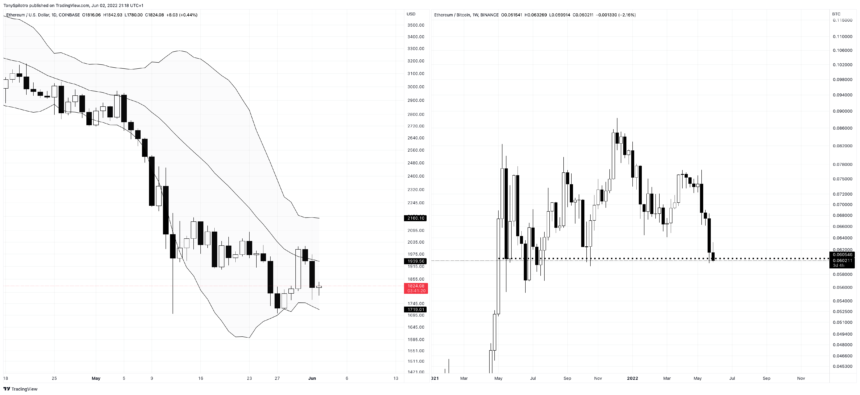

Compared to Bitcoin, Ethereum isn’t performing as well. The top altcoin is not representative of the state of alts as a whole, which have in some cases seen strong recoveries today.

Ethereum could head down further against BTC | Source: ETHUSD on TradingView.com

Upon closer inspection, ETHUSD is far below the same middle-Bollinger Band and 20-day SMA as Bitcoin on daily timeframes. The discrepancy is demonstrated in the ETHBTC pair, which is at risk of further breakdown if horizontal support is breached.

Internet Computer Boots Up 20% Rally

One outlier across the market today is Internet Computer. The Dfinity Foundation coin posted double digit gains on the day. Much like Bitcoin is visually more bullish than Ethereum considering price action and its location within the Bollinger Bands, ICP looks the most poised for aggressive expansion.

The Bollinger Bands are a volatility measuring tool. When the bands tighten, it indicates volatility will soon arrive. Closing outside of the upper band isn’t always a bullish signal and can result in reversal. If volume does arrive as price closes outside of the upper band, a strong move higher is possible.

ICP requires strong volume to keep the recovery going | Source: ICPUSD on TradingView.com

The 20% intraday climb is to be expected given a 98% fall since its crypto market debut. At launch, it bid at more than $500 per ICP putting the coin immediately in the top ten cryptocurrencies by market cap.

Related Reading | LUNA Aftermath: Total Crypto Market More Oversold Than Black Thursday

From a risk versus reward perspective, returning anywhere near close to debut prices from today’s price of $9 per ICP would represent nearly a 5,000% ROI or a 50x on the capital. This may be proving too enticing to pass up.

Follow @TonySpilotroBTC on Twitter or join the TonyTradesBTC Telegram for exclusive daily market insights and technical analysis education. Please note: Content is educational and should not be considered investment advice.

Featured image from iStockPhoto, Charts from TradingView.com