According to a crypto data platform CoinMarketCap, 20 crypto exchanges contributed $1.67 trillion in total spot trade volume in Q2 2023, which represents a 36% drop from the previous quarter.

Binance, despite its current legal hurdles, still maintains a majority hold on the market with a total spot trading volume of 59.99%.

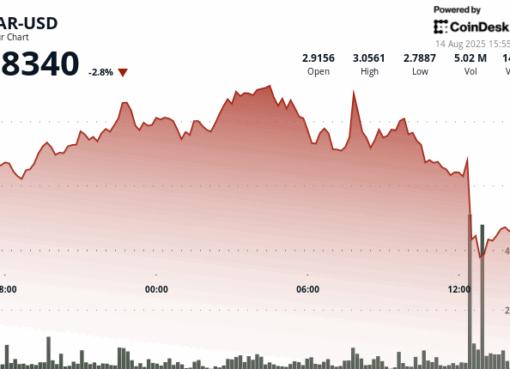

The market is slowing down

The 36% drop indicates a notable slowdown in market activities. In part, this may be attributed to the surge in withdrawals that followed the SEC lawsuit on June 5, CoinMarketCap points out. However, despite this finding, Binance and the other top 5 exchanges continue to maintain their spot in the crypto community holding 85% of the entire spot market activity.

Moreover, major players, including Binance, Coinbase, and Kraken, continue to maintain the highest average liquidity scores >700. It is worth noting that a perfect score is 1000, indicating no slippage.

The report states that the present trade volume shows similarities to the market conditions observed during the recovery phase after the FTX crash.

The research also describes the state of the DEX market, pointing to Uniswap for its dominance in the DEX market, capturing a market share of 57.5%, sharing that its monthly volume has been on par with Coinbase’s spot volume. The top 3 DEXs — Uniswap, Pancake, and Curve — accounted for 82% of the total market in H1 2023.

Still, the report suggests that centralized exchanges are currently the preferred choice over their decentralized counterparts, which may be likened to regulatory developments and lower gas fees, among other reasons.

Although ethereum (ETH) had traditionally held the majority of decentralized trading volume, another interesting trend in Q2 was that BNB has shown rapid acceleration to catch up.

Trouble in major exchanges

Alongside these reports is the news that Gemini, the exchange created in 2014 by Cameron and Tyler Winklevoss, filed a lawsuit against Digital Currency Group (DCG), accusing them of fraud. Despite the fact that the tension between these two companies has been growing, the legal actions came as a surprise to the cryptocurrency community.

Coinbase and Binance are also tied in the legal battle with the SEC, which has accused both exchanges of operating as unregistered security exchanges, among other alleged violations.