This week’s news from Japan included additional comments against crypto trading from China, Binance’s potential involvement in Japan, positivity from the International Monetary Fund (IMF), more crypto exits from European Union (EU) regions, and stablecoin positivity from France.

Check out some of this week’s crypto and blockchain headlines, originally reported by CryptoX Japan.

China reaffirms its stance against crypto trading

Crypto-hostile China has once again confirmed its ban on crypto asset trading, according to comments from Beijing’s director of Financial Supervisory Administration Huo Xuewen.

“Virtual currencies cannot be used as legitimate digital currencies,” Huo said to a Chinese news outlet on Jan 11, also adding that distributing and trading such assets is also unlawful.

“China does not allow cross-border cryptocurrency trading,” Huo continued. “No company can sell foreign cryptocurrencies in China and exchange cryptocurrencies with RMB.”

Binance aims to enter Japanese market through Tao Tao collaboration

Crypto exchange giant Binance is reportedly discussing collaborative terms with Z Holdings’ daughter company Z corporation, and Tao Tao, a digital asset trading platform in which Z corporation is invested. Z Holdings was previously known as Yahoo! Japan.

The three entities are reportedly working on a deal that would result in a trading platform for citizens of Japan, in line with regulation.

New Japanese working group to consider security token offering regulations

As CryptoX Japan reported, on Jan. 16, the Japan STO Association has announced the formation of a new working group to develop guidance for regulating security token offerings in the country.

The new working group plans to focus on the mechanics of token operations, the functions of token holders, their use of blockchain, and their storage.

Crypto exchange Coincheck has begun distributing Stellar airdrop

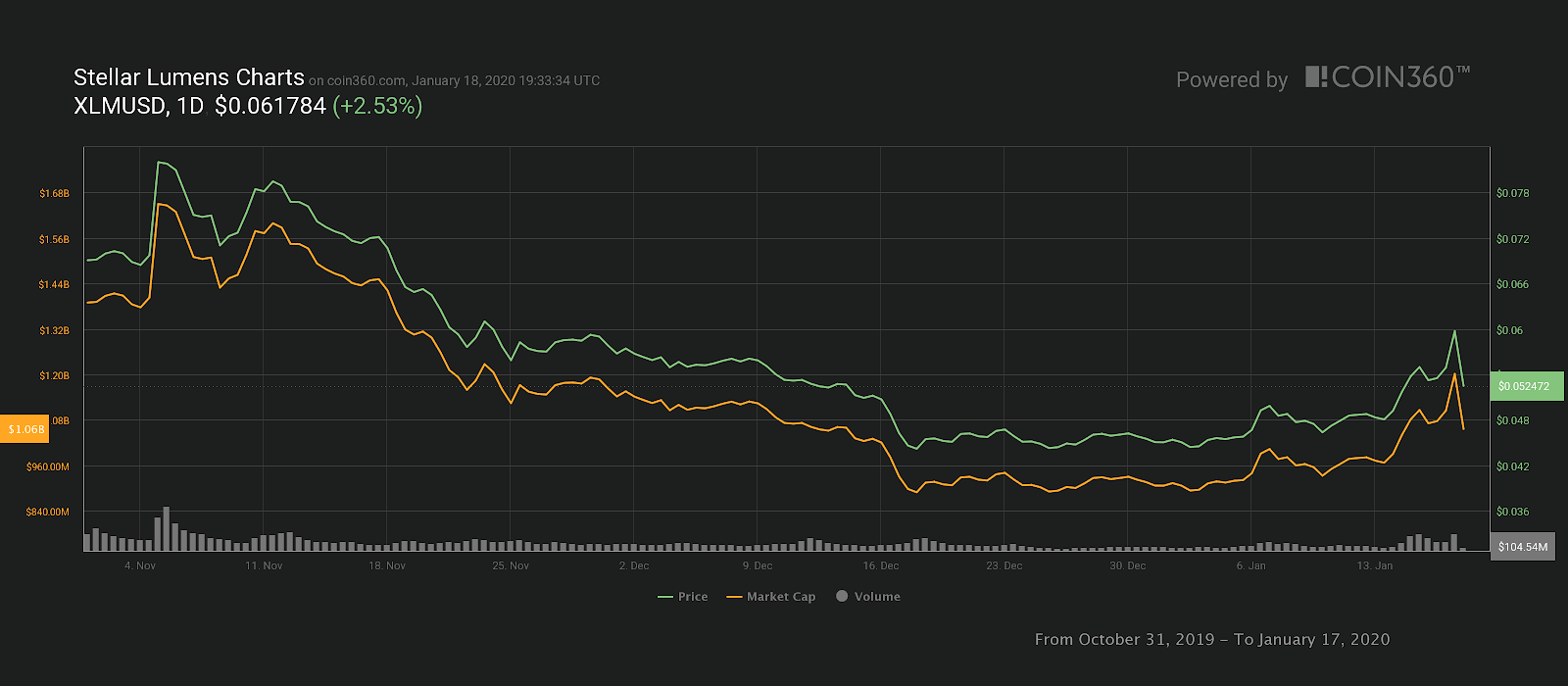

Major Japanese crypto exchange Coincheck announced on Jan. 14 that they have begun distributing the 28 million Stellar XLM ($1.7 million) received in a 2017 airdrop.

Stellar, which launched in 2017, burned nearly $5 billion in tokens on Nov. 5. Shortly after, the token’s price rose substantially, only to slip for the next several months before seeing some gains in early January alongside a major bull market across the crypto world.

Source: Coin360