Chainalysis reported a 29% decline in crypto money laundering activity in 2023 as U.S. authorities and other world governments sanctioned mixing services.

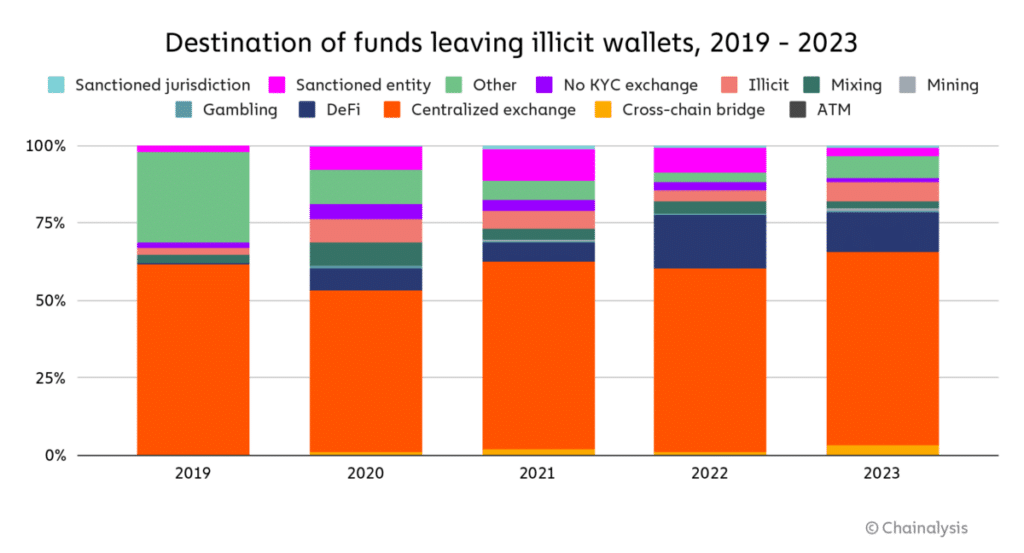

Bad actors have altered their crypto money laundering strategies following crackdowns worldwide, resulting in a drop in illicit wealth transacted on blockchain networks and decentralized protocols.

Last year, criminals sent $22.2 billion in crypto through a basket of services, down from $31.5 billion the previous year, per Chainalysis. The research provider also noted that less value flowed into cryptocurrency mixers such as Tornado Cash and Sinbad, likely due to imposed sanctions.

Chainalysis claims cybercriminals like North Korea’s Lazarus have migrated to Bitcoin-powered tumbler YoMix as a substitute. These illicit players had previously turned to Ethereum-based Tornado Cash for defi assets and Sinbad for Bitcoin money laundering. The U.S. government has blacklisted both platforms.

Additionally, hackers are deploying laundering tactics through a broader range of protocols and entities to evade law enforcement. For instance, the sum sent from illicit wallets to mixers halved in 2023 to $504 million. Criminals transferred over $1 billion to these crypto mixers the year before.

Overall, it’s possible that crypto criminals are diversifying their money laundering activity across more nested services or deposit addresses to better conceal it from law enforcement and exchange compliance teams. Spreading the activity across more addresses may also be a strategy to lessen the impact of any one deposit address being frozen for suspicious activity.

Chainlysis report

Despite hundreds of millions in crypto being laundered, virtual currencies account for 1% or less of global illicit finance. Worldwide criminal operations launder around $2 trillion per year, Deloitte reported.

Fiat and non-blockchain assets remain the preferred medium for bad actors and money laundering. The U.S. Treasury also indicated minimal crypto use by Hamas and other designated terror groups.

Legislators such as Congressman Tom Emmer have called on fellow lawmakers to refrain from using incorrect data for rule-making and drafting regulatory frameworks to oversee the nascent crypto industry.