A market analyst, Conor Ryder, CFA, recently explored the liquidity state of the crypto markets. Parameters like market depth, spreads, slippage, and volumes helped expose the liquidity problem.

Post-FTX-implosion liquidity gap not resolved

Under market depth, the analyst realized that BTC pairs are currently at the lowest level of liquidity associated with BTC pairs in 10 months, more down than moments after FTXs collapse.

Ryder notes that the crypto market has not filled the post-FTX and Alameda implosion liquidity gap. Yet, the recent problems in the banking industry have only led to more liquidity problems for bitcoin.

The post-FTX implosion liquidity gap is one of the reasons why the markets have miniature liquidity at the moment.

The spread tightening

Moore also discovered that the spreads have recently tightened, discouraging market makers from adding liquidity. Amid the banking issues, USD pairs’ spreads seemed more volatile than those of USDT pairs.

There was a spike from 0.02% to 0.04% following the shutdown of Silvergate.

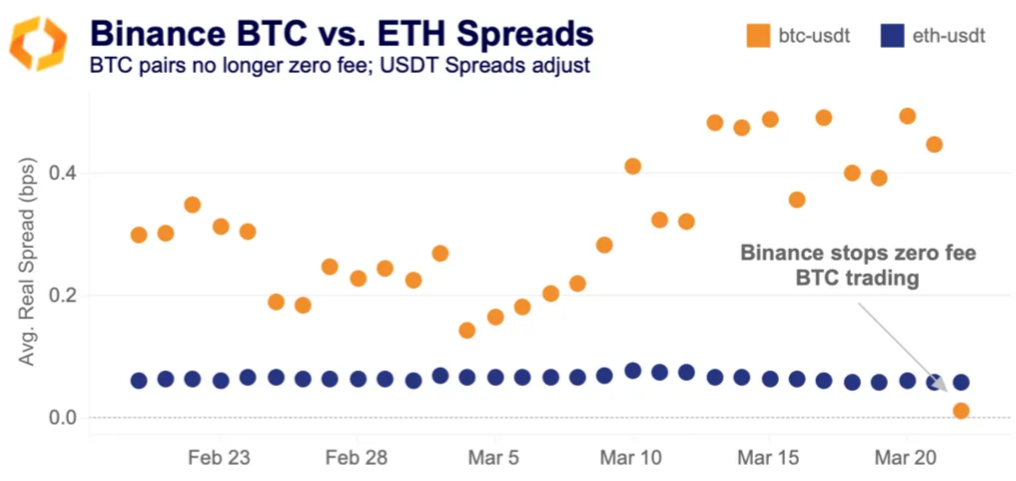

Moreover, Binance recently announced stopping the zero fee program for all BTC trading pairs except BTC-TUSD. Before removing the zero fee program, Binance gained a significant market share from zero fee pairs, with BTC-USDT being the largest.

Because of the introduction of takers fees, spreads tanked below 0.01%, meaning less profit for market makers. The result is liquidity depletion in major BTC pairs, with BTC-USDT plunging 70%.

According to the analyst, at the start of the month, both BTC-USD and BTC-USDT pairs had a slippage of 0.1%. The slippages rose, with the BTC-USD pair rising to 0.25%, mainly because of the banking problems affecting USD’s current liquidity.

Volumes are key

Yes, trading volumes increased this year compared to last year’s deep drops. That is visible based on exchange data and data from sites like Coinmarketcap.

However, Binance continues to pick up more market volume share than any competing exchange. Furthermore, stablecoin pairs continue to garner dominance when compared to USD pairs. Stablecoin pairs now hold 95% of the market share, up from 77% last year.

Due to the phasing out of USD pairs, market liquidity has been reduced because of a lack of proper payment modes akin to SEN or Signet. Based on the analyst, the current high volatilities in crypto markets are mainly because of low liquidity.