Exchanges use the funding rate mechanism to keep perpetuals prices aligned with spot prices. A positive funding rate indicates that perpetuals are trading at a premium to the spot price, indicating increased demand for bullish bets. As such, a high funding rate, as seen early this week, is said to reflect over-optimism, often observed at interim market tops.

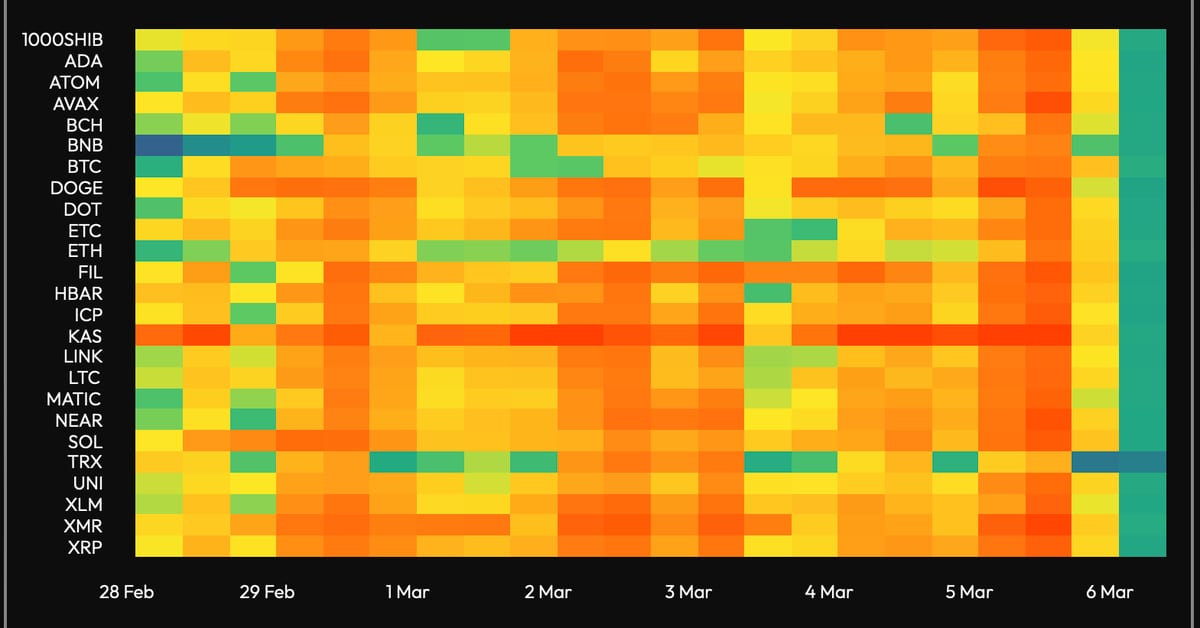

Crypto Funding Rates Reset After Bitcoin’s Sharp Pullback From $69K