Bitcoin bulls may be hoping that the expected CPI report may present some respite for BTC, which has struggled to maintain momentum.

The general financial market is anticipating the Consumer Price Index (CPI) today to put some figures in perspective regarding the state of the economy. In addition to economic indicators, the content of the expected CPI will hopefully provide bulls with information that may pump Bitcoin.

Bitcoin and the CPI

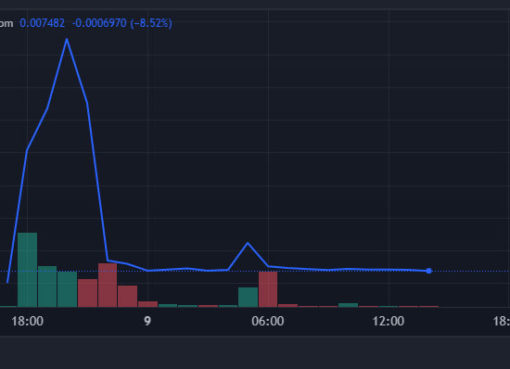

For a few weeks, the market witnessed an interesting rally that saw the price of Bitcoin climb almost 40%. However, the king coin has failed to hold up the rally and is struggling to maintain the momentum. According to CoinMarketCap, Bitcoin is trading at $36,436, after gaining 4.43% in the last 7 days but losing more than 2% in 24 hours.

Economists currently predict that monthly headline CPI, which was 0.4% in September, dropped to 0.1% in October. The predicted year-over-year (YoY) CPI is also expected to crash from 3.7% to 3.3%. For core CPI, which does not include food and energy prices, the figure is expected to remain unchanged from September at 0.3%. This reflects a flat YoY figure of 4.1%.

The last CPI report showed a 0.4% monthly and 3.7% YoY increase in the prices of goods and services. The report also indicated a 0.6% increase in shelter, 0.3% for medical care services, and 0.7% for transportation services. Furthermore, the Labor Department recorded a 0.3% increase in the prices of new vehicles.

Unfortunately, the figures are still not at the Federal Reserve’s target of 2%. This may suggest that the country’s apex bank is not yet done with its interest rate hikes. Nonetheless, the Fed has said it is not waiting until inflation hits 2% before stopping the rate hikes. A reduction in interest rates might benefit Bitcoin if the market becomes more palatable. However, the CPI could show disappointing figures, which could plunge Bitcoin further.

Bitcoin May Crash Before Spot ETF Approval

Longtime Bitcoin critic Peter Schiff has signaled a Bitcoin crash before the United States Securities and Exchange Commission (SEC) approves one of the spot Bitcoin ETF proposals currently under scrutiny. Nonetheless, a user debunked the Euro Pacific Capital Inc CEO and chief global strategist’s signaling, pointing out that Schiff predicted Bitcoin would crash to $750 in 2018, when the king coin was below $3,800.

On the other hand, there is no shortage of bullish Bitcoin predictions. Upbeat forecasts have been pouring for Bitcoin, especially as the market quietly awaits the asset’s halving event expected in April next year. For instance, international asset manager AllianceBernstein Holding LP believes Bitcoin could rise to $150,000 by 2025. According to the firm, the two major catalysts are the expected approval of a spot Bitcoin ETF, and the halving. Bernstein analyst Gautam Chhugani also states that up to 10% of Bitcoin’s circulating supply will enter the ETF market.

Bernstein also believes the SEC will likely approve a spot Bitcoin ETF by January 10.