The Consensys CEO lashed out at CeFi companies stating that the recent events have exposed their ill behavior and further opened the gates for DeFi to flourish.

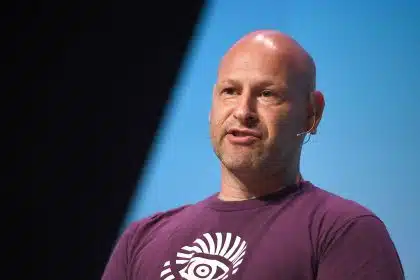

In the latest development, blockchain engineering firm ConsenSys CEO Joseph Lubin announced that the company will be cutting 97 jobs this year. This comes as some of the biggest tech giants are laying off employees amid an uncertain macro environment. In his latest blog post, Lubin wrote:

“Today we need to make the extremely difficult decision to streamline some of ConsenSys’ teams to adjust to challenging and uncertain market conditions. This decision will impact 96 employees, which represents 11% of ConsenSys’ total workforce. We are extremely grateful for their contributions and the work they’ve accomplished. Each of the impacted employees will be notified today by their manager”.

All the departing ConsenSys employees from across the globe will receive severance packages depending on their tenure. Besides, they would be getting personalized support from an external placement agency. ConsenSys also noted that they would provide an extension of healthcare benefits in relevant jurisdictions.

Headquartered in New York City, ConsenSys has more than 900 employees as of date. However, alike other crypto firms announcing mass layoffs, ConsenSys has been forced to take the move in this strong bear market. The crypto industry has lost a total of 97,000 jobs since the crypto winter of the last year.

Amid the difficult times, Lubin said that ConsenSys’ strategy will be focusing on its core products and exploring other opportunities in Web3 commerce. In the blog post, he wrote:

“We will also pursue innovative new offerings to empower developers and creators to thrive in web3, grow web3 commerce and DAO communities, and amplify the decentralized identity and verifiable credentials ecosystems”.

DeFi vs CeFi

Amid the current macroeconomic headwinds and uncertain market conditions, Lubin took this opportunity to lash out at the centralized finance (CeFi) companies. “If we hadn’t had such ridiculous behavior and such a cataclysmic collapse in the CeFi part of our ecosystem, then my guess is those CeFi actors would have continued to play their games and continue to get away with it,” he said.

However, he said that it was unfortunate that several people had to become the victim of the CeFi collapse. But Lubin believes that this development will ultimately help the crypto companies to emerge stronger and benefit the decentralized finance (DeFi) space.

“It will highlight what’s good in tech crypto: decentralized mechanisms, not exploiting consumers by providing easy access to that mechanism. And even more importantly, hopefully all of this is really good for the general world of finance, because it points out that decentralization: good. Centralization: often not so good,” he noted.

Bhushan is a FinTech enthusiast and holds a good flair in understanding financial markets. His interest in economics and finance draw his attention towards the new emerging Blockchain Technology and Cryptocurrency markets. He is continuously in a learning process and keeps himself motivated by sharing his acquired knowledge. In free time he reads thriller fictions novels and sometimes explore his culinary skills.