Ark Invest, the investment firm led by Cathie Wood, has again sold a substantial portion of its holdings in Coinbase Global Inc. (COIN) as the crypto exchange’s stock value soared to a 20-month high.

The latest move comes amidst a broader reshuffling of the firm’s portfolio in response to recent market dynamics.

On Dec. 13, Ark Invest sold 283,104 shares of Coinbase, valued at approximately $42.6 million, across two of its funds. The sale is part of a larger trend with the firm’s weekly sales reaching $56 million, as per their latest trade filing.

Ark sold 239,237 Coinbase shares ($36 million) from its Innovation ETF and 43,867 ($6.6 million) from its Next Generation Internet ETF. This follows the disposal of COIN shares worth $13.4 million on Dec. 11 and 12 and a $100 million sale last week.

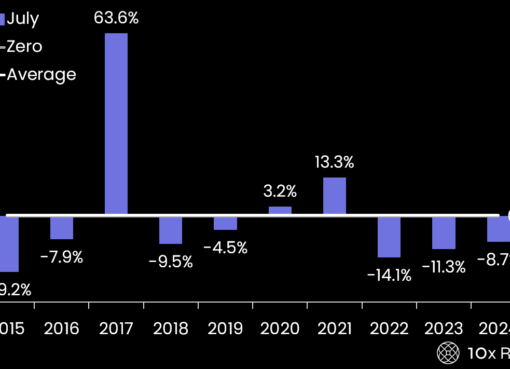

Coinbase’s stock closed at $150.46 on Dec. 13, marking a 7.8% increase on the day. Over the past month, the stock has surged by 64%, reaching its highest level since April 2022.

Despite this recent upswing, the stock remains approximately 60% below its all-time high of $343, recorded in November 2021.

In addition to Coinbase, Ark also offloaded 45,864 shares of the Grayscale Bitcoin Trust (GBTC), valued at around $1.6 million, on Wednesday.

This decision coincides with a notable reduction in the discount to net asset value (NAV) for GBTC. From over 40% in the summer, it has reduced to just 7.4% as of yesterday, the smallest margin in approximately two and a half years.

Discount to net asset value (NAV) refers to the extent to which the market price of each share falls below the actual value of the Bitcoin it represents.

GBTC shares closed at $35.59 on Dec. 13, reflecting a 6.5% increase for the day and a 19% rise over the past month.