Investment management powerhouse Ark Invest has added more Robinhood and Coinbase stock to its holdings amid tame tech developments.

According to reports, Ark Invest recently shored up on more Robinhood (NASDAQ: HOOD) and Coinbase (NASDAQ: COIN) stock. The Florida-based investment management firm purchased $9.97 million worth of HOOD stock and $3.44 million in COIN yesterday.

The purchase also translated to 1.06 million Robinhood shares acquired, with 47,568 Coinbase shares added to the flagship Ark Innovation ETF. In addition, Ark’s COIN purchase saw another 8,031 shares added to its Ark Next Generation Internet ETF.

Coinbase’s shares closed at $61.89 yesterday following the Ark development, while Robinhood dipped 3% to $9.42.

Latest Ark Invest Robinhood & Coinbase Stock Acquisition Follows February Move

The additional purchase of Coinbase and Robinhood stock by Ark Invest follows the company’s exertions last month. In February, Ark Investment Management LLC increased its Coinbase shares holding through its two ETFs, ARKK and ARKW. The Cathie Wood-led leading investment manager bought a total of 133,321 COIN, spending more than $20 million at the time since January.

Although Ark refrained from buying further COIN shares then, Wood showed no signs of relenting on the exchange’s stock. Ark, which has not offloaded COIN stock in a while, purchased a total of $10.47 million COIN between January 5th and 11th. On January 5th alone, the St. Petersburg-based investment management platform snapped up 172,276 COIN stock worth $5.77 million. Meanwhile, Ark also acquired 74,792 COIN valued at $3.275 million on January 11th.

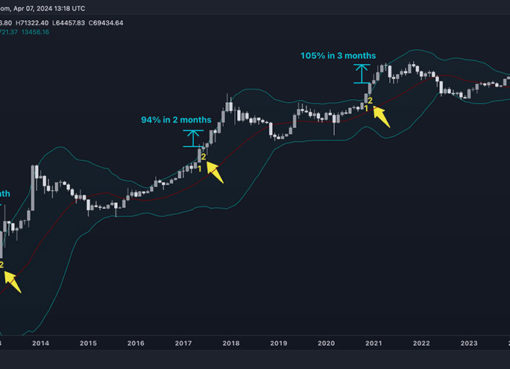

Wood has remained focused on volatile tech stocks, predicting that Bitcoin (BTC) could surpass $1 million by 2030. In addition, the Ark chief executive also forecasted Tesla (NASDAQ: TSLA) surging 800% by 2028. At the time, Wood said, “Our base case for Bitcoin in 2030 is $700,000. Our bull case is roughly double that,” before adding:

“Tesla is one of the most profound A.I. companies out there. It’s not an auto company; it’s a technology company. E.V.s have hit price parity with gas-powered vehicles. Now they are about to go into another accelerated decline in price that gas-power vehicles won’t be able to compete.”

Wood’s Unwavering Faith in Tech-Inclined Stocks Paying Off So Far

Cathie Wood’s intent to stockpile tech and crypto assets is a deviation in an industry that sustained a massive sell-off and still remains on edge. However, her stance could be justifiable at the moment due to the rise in the value of the flagship Ark Innovation Fund. As of February 20th, the Fund was up 42% after suffering a staggering 70% drawdown last year.

Ark Innovation also acquired Telehealth in addition to its Tesla share purchase at the beginning of 2023. As of mid-February, the investment manager held $12 million worth of shares in telehealth company Teladoc Health.

Ark also recently increased its stakes in several other telehealth and biotech platforms. These include Twist Bioscience (NASDAQ: TWST) and Intellia Therapeutics (NASDAQ: NTLA). In addition, the Fund holds a significant stake in popular video game developer Roblox Corporation (NYSE: RBLX).

Tolu is a cryptocurrency and blockchain enthusiast based in Lagos. He likes to demystify crypto stories to the bare basics so that anyone anywhere can understand without too much background knowledge.

When he’s not neck-deep in crypto stories, Tolu enjoys music, loves to sing and is an avid movie lover.