Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Cardano is showing signs of resilience after days of consolidation, holding firmly above the crucial $0.70 support level. Despite the broader market facing turbulence from ongoing macroeconomic uncertainty and heightened trade war fears, ADA has managed to maintain stability—offering hope to investors watching for a breakout. While Bitcoin and other altcoins have struggled under selling pressure, Cardano’s current structure could be setting the stage for a strong recovery rally.

Related Reading

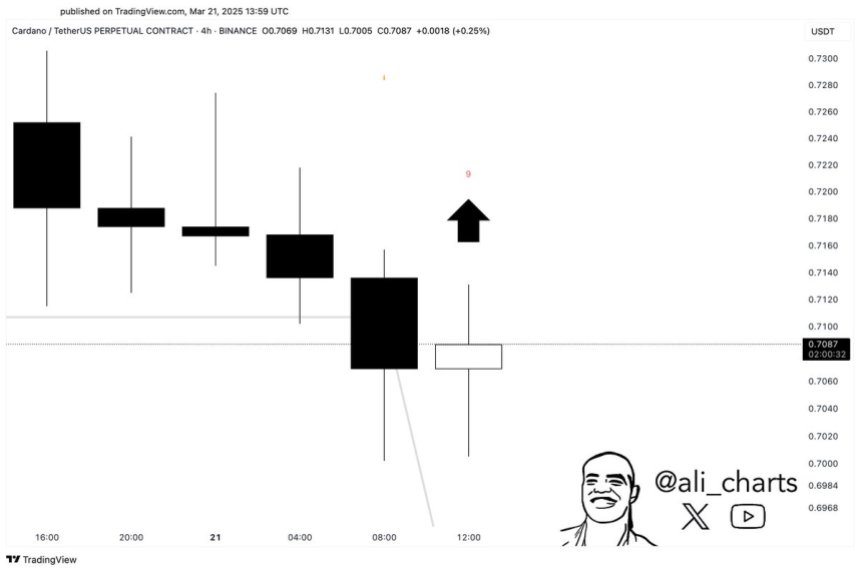

Bulls now face the task of reclaiming higher levels to confirm a bullish reversal and capitalize on this window of opportunity. According to top analyst Ali Martinez, Cardano has just flashed a buy signal on the TD Sequential indicator on the 4-hour chart—an early sign that momentum may shift in favor of the bulls. Historically, this technical pattern has been a reliable indicator for short- to mid-term price rebounds, especially during consolidation phases like the one ADA is currently experiencing.

If this signal holds and buyers step in with strength, Cardano could soon challenge its next resistance zones and begin a new upward move. With sentiment across the market cautiously optimistic, ADA might be one of the first altcoins to lead the way in a broader recovery.

TD Sequential Signal Sparks Hope For Cardano

Cardano (ADA) has been standing out as one of the more resilient altcoins during a critical period of heightened selling pressure across the crypto market. While broader macroeconomic conditions—such as trade war fears and policy uncertainty—have pushed equities and crypto into volatile zones, ADA has managed to hold its ground above crucial support levels. This performance has caught the attention of investors and analysts who believe Cardano could lead the next leg up once the market finds its footing.

Related Reading

With the market beginning to form local lows and signs of a potential rebound emerging, sentiment is cautiously optimistic. Still, some experts warn that this could be a temporary pause in a larger corrective phase. The lack of clarity around global economic direction continues to cast a shadow over all risk assets, including crypto. For Cardano, however, a new technical development has sparked renewed hope.

Martinez’s analysis on X reveals the TD Sequential indicator has just flashed a buy signal on ADA’s 4-hour chart. Historically, this signal is known for predicting potential reversals or short-term trend changes, especially during periods of consolidation. If the pattern plays out, Cardano could be preparing for a breakout move, positioning itself ahead of many other altcoins.

A successful rebound would require ADA to reclaim higher resistance levels and confirm bullish momentum. But with a technical buy signal in place and market-wide signs of stabilization, the stage could be set for Cardano to initiate a recovery in the days ahead.

ADA Struggles Below $0.73

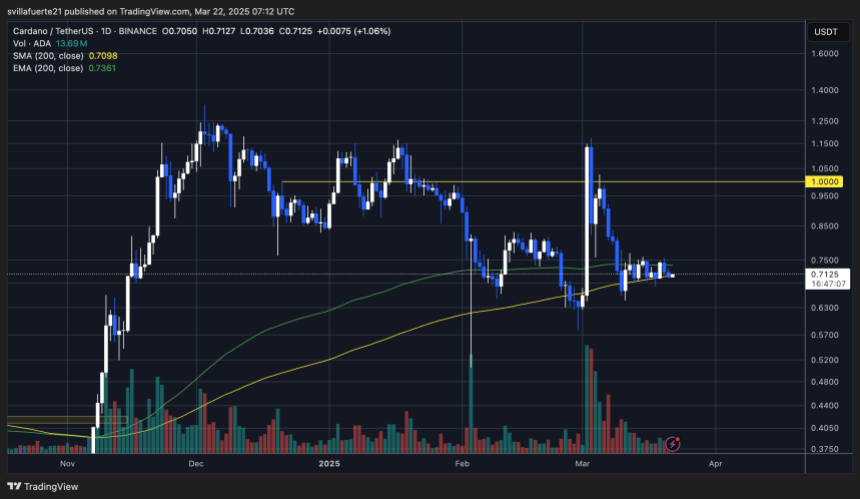

Cardano (ADA) is currently trading at $0.71 after several days of struggling to reclaim the 200-day exponential moving average (EMA) near $0.73. Despite the resistance, ADA has held firmly above the 200-day simple moving average (MA) around $0.70, a level acting as key demand support in recent sessions. This tight range between the 200-day MA and EMA reflects growing pressure on bulls and bears as ADA approaches a critical decision point.

For bulls to regain control and shift momentum in their favor, a decisive push above the $0.85 level is essential. Reclaiming this price zone would confirm a breakout from the current consolidation and potentially trigger a recovery rally toward higher resistance levels. Such a move would signal renewed bullish sentiment and open the door for ADA to revisit early 2024 highs.

Related Reading

On the downside, failure to hold the $0.70 level could spell trouble. If ADA drops below this support, a sharp move toward $0.60—or even lower—could follow, especially amid broader market weakness. A break below $0.60 would mark a significant technical breakdown, potentially wiping out recent gains and resetting ADA’s bullish structure. As price action tightens, the next few days will be critical for determining Cardano’s short-term direction.

Featured image from Dall-E, chart from TradingView