By Francisco Rodrigues (All times ET unless indicated otherwise)

Crypto traders are deleveraging after Wednesday’s FOMC minutes showed the Fed is looking to hold rates steady until inflation improves and discussed pausing or slowing the balance sheet runoff.

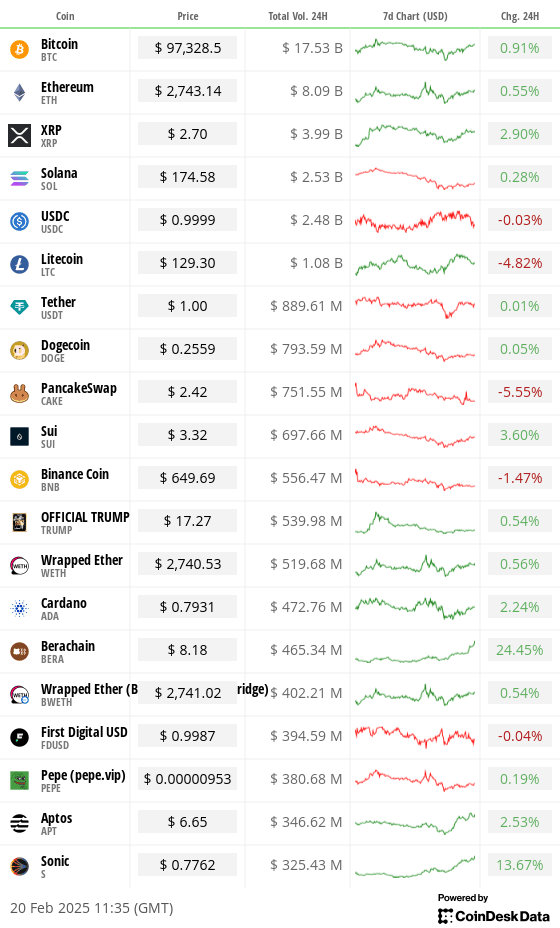

Still, the yield on the 10-year Treasury dropped and the dollar weakened. Cryptocurrencies are higher, with the CoinDesk 20 Index up 1.4% and bitcoin 1.2% over 24 hours. The gains follow remarks by Czech National Bank Governor Ales Michl, who reiterated the case for bitcoin as a reserve asset, and President Donald Trump saying he’d ended “Joe Biden’s war on Bitcoin and crypto.”

Bitcoin traders are taking a wait-and-see approach as waning demand, a lack of blockchain activity and faltering liquidity inflows point to potential pullback to $86,000. It’s currently over $97,000. Their stance is visible not only in declining volatility, but also a significant drop in open interest.

Open interest on bitcoin futures contracts has fallen below $60 billion from nearly $70 billion in late January, Coinglass data shows. The decline comes amid what appears to be an unraveling of the memecoin craze as recent struggles, such as Argentina’s Libra debacle, dampened enthusiasm.

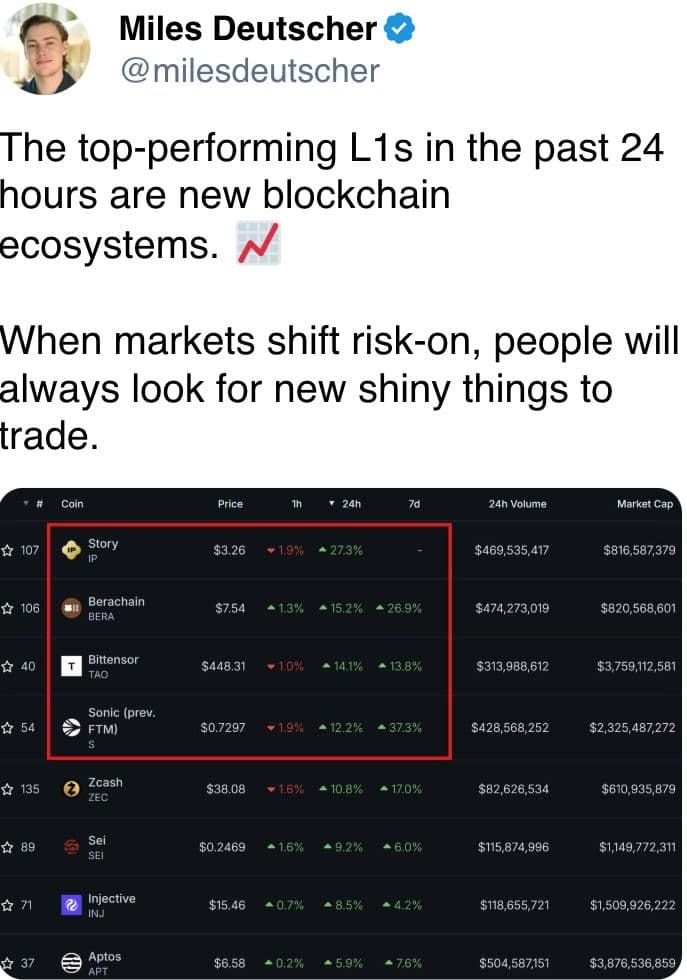

“Right now, the market is in a bit of a cooldown phase,” David Gogel, VP of strategy and operations at the dYdX Foundation, told CoinDesk. “Bitcoin’s been holding up, but after failing to break past $105k in January, we’ve seen capital inflows slow down and speculative assets like Solana and memecoins take a hit.”

That hit is visible in the aggregate open interest for futures contracts for SOL, the Solana blockchain’s native token. OI dropped from around $6 billion late last month to around $4.3 billion now, according to data from TheTie. Solana is one of the leading networks for memecoins.

“The market should stay attuned to broader macro-drivers and geopolitical developments that could trigger moves,” Wintermute OTC trader Jake O told CoinDesk. These geopolitical developments include rising tensions between Trump and Ukrainian President Volodymyr Zelensky that led to a not-so-subtle public exchange.

Declining leverage and a shift away from riskier plays suggest the market may be entering a new phase. What that actually entails remains to be seen. Stay alert!

What to Watch

- Crypto:

- Macro

- Feb. 20, 8:30 a.m.: Statistics Canada reports January’s producer price inflation data.

- PPI MoM Est. 0.8% vs. Prev. 0.2%

- PPI YoY Prev. 4.1%

- Feb. 20, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims report for the week ended Feb. 15.

- Initial Jobless Claims Est. 215K vs. Prev. 213K

- Feb. 20, 5:00 p.m.: Fed Governor Adriana D. Kugler gives a speech titled “Navigating Inflation Waves While Riding on the Phillips Curve” in Washington. Livestream link.

- Feb. 20, 6:30 p.m.: Japan’s Ministry of Internal Affairs & Communications reports January’s consumer price inflation data.

- Core Inflation Rate YoY Est. 3.1% vs. Prev. 3%

- Inflation Rate YoY Prev. 3.6%

- Inflation Rate MoM Prev. 0.6%

- Feb. 21, 9:45 a.m.: S&P Global releases February’s U.S. Purchasing Managers’ Index (Flash) reports.

- Composite PMI Prev. 52.7

- Manufacturing PMI Est. 51.5 vs. Prev. 51.2

- Services PMI Est. 53 vs Prev. 52.9

- Feb. 20, 8:30 a.m.: Statistics Canada reports January’s producer price inflation data.

- Earnings

Token Events

- Governance votes & calls

- Unlocks

- Feb. 21: Fast Token (FTN) to unlock 4.66% of circulating supply worth $78.6 million.

- Feb. 28: Optimism (OP) to unlock 1.92% of circulating supply worth $34.23 million.

- Mar. 1: Sui (SUI) to unlock 0.74% of circulating supply worth $81.07 million.

- Token Launches

- Feb. 20: Pi Network (PI) to be listed on MEXC, OKX, Bitget, Gate.io, CoinW, DigiFinex and others.

Conferences:

CoinDesk’s Consensus to take place in Hong Kong on Feb. 18-20 and in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

Token Talk

By Oliver Knight

- PI, the native token of the Pi Network, debuted at $1.70 and immediately rose to $2.00 before losing 50% of its value in the next two hours.

- The network claims to have 60 million users. There are fewer than 1 million active wallets.

- Based on a self-reported circulating supply figure of 6.3 billion, PI currently has a market cap of $7.8 billion.

- The premise behind Pi Network is a blockchain that allows users to mine tokens on their smartphones. It captured a considerable amount of attention from retail traders and has drawn comparison to viral tokens from previous cycles like SafeMoon.

- Token holders face the risk of a lack of liquidity. The token’s most liquid exchange is OKX, but 2% market depth — the amount of capital required to move the price by 2% in either direction — is between $33K and $60K. This means an order of say $100K would shift the market considerably to present volatile trading conditions.

Derivatives Positioning

- BTC volatility on derivatives has reached a monthly low, declining from an annualized 36.09% to 28.43%.

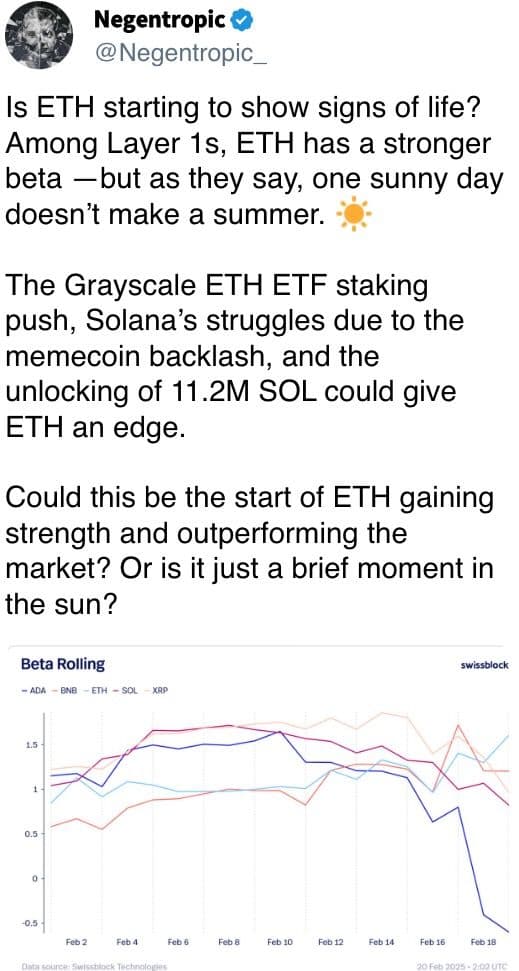

- That contrasts with ETH, which has seen its annualized volatility rise from 49.43% to 74.72%, according to data published by Deribit.

- Roughly $1.5 billion worth of BTC and ETH options are set to expire tomorrow, with almost $5 billion expiring in a week’s time.

- The total open interest across all trading pairs on retail centralized exchanges has risen by 2.10% on the day to $80.8 billion.

Market Movements:

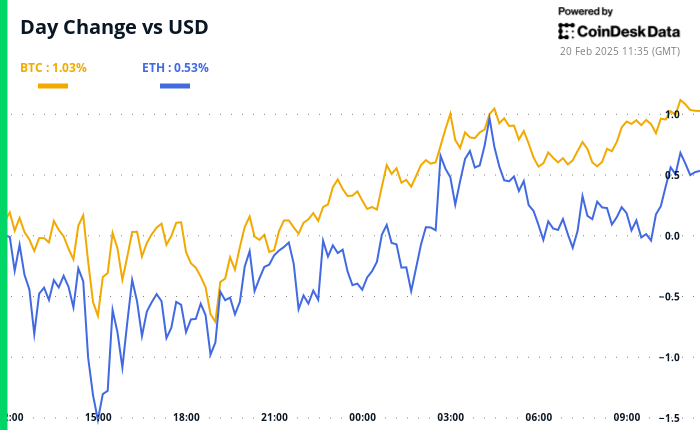

- BTC is up 1.10% from 4 p.m. ET Wednesday to $97,300.67 (24hrs: +1.09%)

- ETH is up 0.60% at $2,738.90 (24hrs: +0.51%)

- CoinDesk 20 is up 1.72% to 3,250.68 (24hrs: +1.67%)

- Ether CESR Composite Staking Rate is down 6 bps to 2.99%

- BTC funding rate is at 0.0037% (4.0920% annualized) on Binance

- DXY is down 0.18% at 106.98

- Gold is up 0.60% at $2,950,84/oz

- Silver is up 1.52% to $33.19/oz

- Nikkei 225 closed -1.24% at 38,678.04

- Hang Seng closed -1.60% at 22,576.98

- FTSE is down 0.24% at 8,690.90

- Euro Stoxx 50 is up 0.62% at 5,494.99

- DJIA closed Wednesday up 0.16% at 44,627.59

- S&P 500 closed +0.24% at 6,144.15

- Nasdaq closed +0.07% at 20,056.25

- S&P/TSX Composite Index closed unchanged at 25,626.16

- S&P 40 Latin America closed -1.35% at 2,463.68

- U.S. 10-year Treasury rate was down 1 bps at 4.53%

- E-mini S&P 500 futures are down 0.2% to 6,150.50

- E-mini Nasdaq-100 futures are down 0.22% at 22,200.75

- E-mini Dow Jones Industrial Average Index futures are down 0.15% to 44,643

Bitcoin Stats:

- BTC Dominance: 61.10 (0.04%)

- Ethereum to bitcoin ratio: 0.02819 (0.28%)

- Hashrate (seven-day moving average): 831 EH/s

- Hashprice (spot): $54.24

- Total Fees: 5.127 BTC / $499,118

- CME Futures Open Interest: 172,360 BTC

- BTC priced in gold: 32.8 oz

- BTC vs gold market cap: 9.32%

Technical Analysis

- Bitcoin has rebounded from the yearly open at $93,385, reclaiming the 100-day exponential moving average on the daily timeframe.

- Over the last three deep sell-offs, the price has formed higher lows, indicating strong buyer interest at the current range lows.

- However, the short-term 20-day and 50-day EMAs on the daily timeframe recently crossed for the first time since August 5th, signalling a need for caution in the near term.

Crypto Equities

- MicroStrategy (MSTR): closed on Wednesday at $318.67 (-4.58%), up 2.01% at $325.08 in pre-market

- Coinbase Global (COIN): closed at $258.67 (-2.25%), up 1.76% at $263.22

- Galaxy Digital Holdings (GLXY): closed at C$25.32 (-3.76%)

- MARA Holdings (MARA): closed at $15.78 (-1.68%), up 1.33% at $15.99.

- Riot Platforms (RIOT): closed at $11.56 (unchanged), up 1.04% at $11.68

- Core Scientific (CORZ): closed at $12.02 (-2.99%), up 1.41% at $12.19

- CleanSpark (CLSK): closed at $9.89 (-1.88%), up 1.81% at $10.07

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $22.78 (-0.26%), unchanged

- Semler Scientific (SMLR): closed at $52.22 (+2.96%), up 0.06% at $52.25

- Exodus Movement (EXOD): closed at $48.41 (+4.00%), unchanged

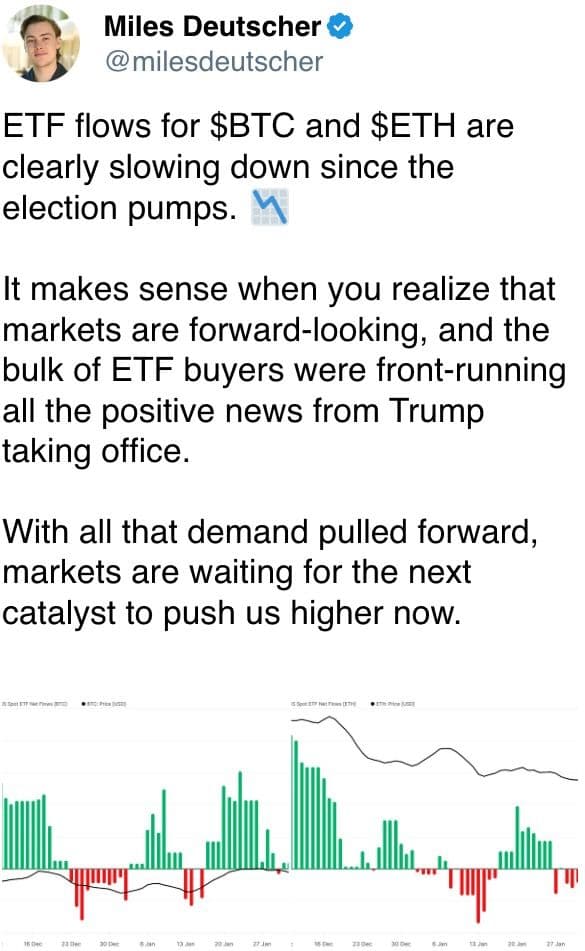

ETF Flows

Spot BTC ETFs:

- Daily net flow: -$64.1 million

- Cumulative net flows: $40.00 billion

- Total BTC holdings ~ 1.170 million.

Spot ETH ETFs

- Daily net flow: $19 million

- Cumulative net flows: $3.18 billion

- Total ETH holdings ~ 3.795 million.

Source: Farside Investors

Overnight Flows

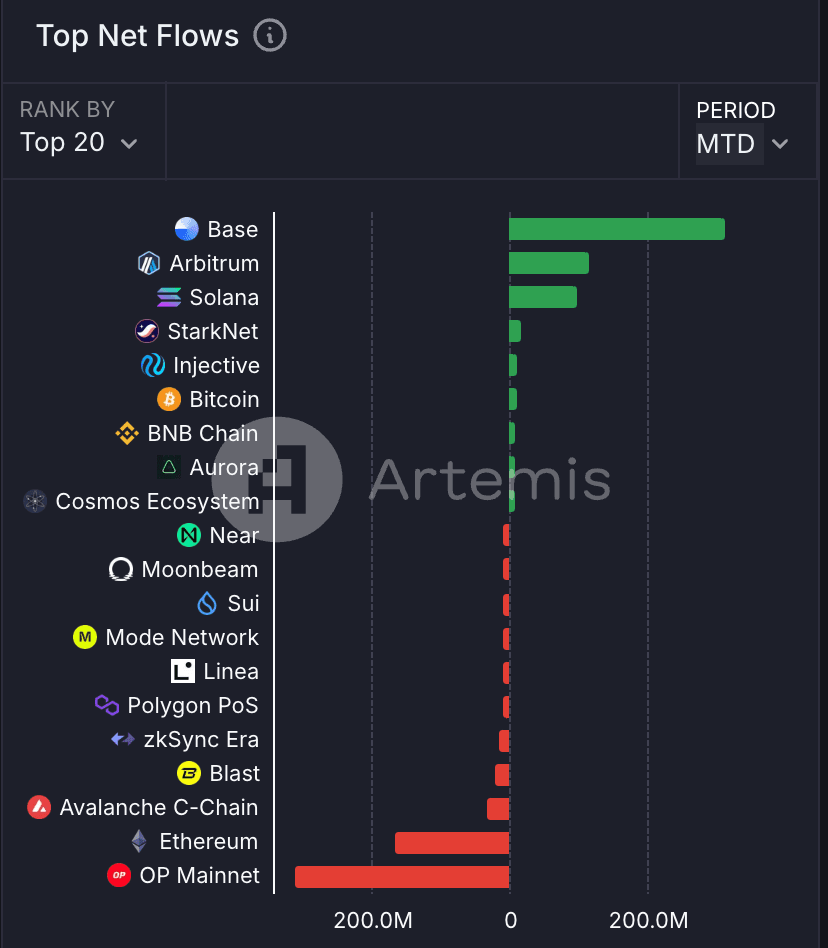

Chart of the Day

- Month-to-date data for top bridged netflows by network highlights a strong capital inflow into the Base network since the start of the month.

- The layer-2 blockchain had a net inflow of $314 million, more than twice the amount of the second-placed Arbitrum, which has seen an inflow of $115 million.

- Inflows to Solana slowed amid liquidity drains caused by multiple high-profile celebrity memecoin launches over the past month.

While You Were Sleeping

- LIBRA Memecoin Fiasco Destroyed $251M in Investor Wealth, Research Shows (CoinDesk): Nansen’s on-chain analysts say 86% of people who traded the LIBRA token lost money, with the total loss of $251 million. The winners enjoyed a total profit of $180 million.

- HK to Expand, Open Up Virtual Assets Market (The Standard): At Consensus Hong Kong, SFC CEO Julia Leung announced ASPIRe — a 12-point roadmap to correct market imbalances with improved licensing, custody, token frameworks, derivatives trading and margin lending for professional investors.

- MANTRA Launches Program for Real-World Asset Startups With Google Cloud Support (CoinDesk): Layer-1 blockchain MANTRA’s RWAccelerator backs startups working on tokenizing real-world assets by providing mentorship, with technical support and cloud credits coming from Google.

- China Is Likely to Cut Its Benchmark Policy Rate Next Month (CNBC): China’s central bank held its key lending rates steady on Thursday, prompting expectations of a policy easing in March.

- Bank of England’s Gold-Diggers Grapple With Trump-Fueled Frenzy (Bloomberg): Speculation over impending U.S. tariffs has forced a small BoE team to extract 12.5 kg gold bars as traders exploit gaps between London spot and U.S. futures prices.

- ‘Stagflation’ Fears Haunt U.S. Markets Despite Trump’s Pro-Growth Agenda (Reuters): While investors have largely remained bullish on U.S. stocks, some worry that the president’s new tariff measures might drive up prices and stifle economic growth.

In the Ether