Binance Coin (BNB) has been moving sideways around the critical level at $300 and might gather momentum for a rally. The cryptocurrency saw significant losses over the past months, but it has been able to recover faster than other altcoins.

At the time of writing, BNB’s price trades at $290 with a 4% and 17% profit over the past 24 hours and 7 days, respectively. Thus, making this cryptocurrency one of the best-performing assets in the crypto top 10 by market cap only surpasses Polkadot’s (DOT) 22% profit in one week.

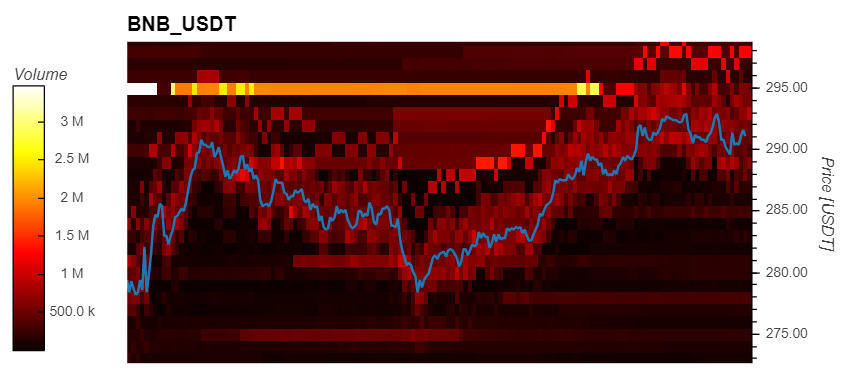

Data from Material Indicators records an increase in buying pressure for this token on short timeframes. Retail investors and mid-size investors have been jumping into BNB’s price action as the cryptocurrency attempts to flip $300 into support.

Additional data shows that ask liquidity for the BNB/USDT trading pairs has been reducing between $300 and $320 recording a high amount of sell orders. There are over $2 million in asks orders around those levels, and there is a lot of potential for price volatility.

This is because the order book records liquidity gaps between higher levels. This could translate into bullish momentum if the price of BNB is able to break above those critical resistance levels.

However, in order to continue the bullish trend, the price of BNB might need assistance from larger investors. BNB whales have been sitting on the sidelines for the time being with no interaction with the price action.

If whales decide to buy and sustain the bullish momentum, the cryptocurrency might successfully break above $300. According to the crypto community, the CEO of Binance Changpeng “CZ” Zhao hinted at potential price appreciation for this token when he posted the following tweet:

BNB Impervious To The Crypto Winter

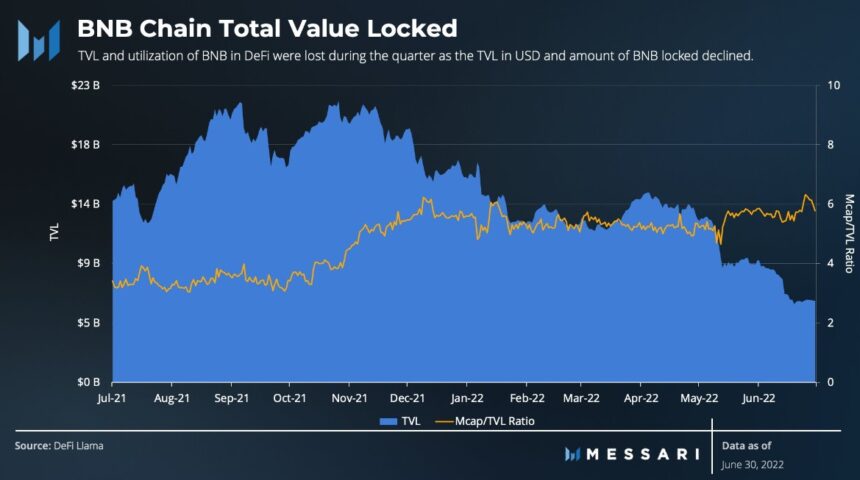

Research firm Messari highlighted the growth in BNB developments as the crypto market trends to the upside. This has translated into an uptick in total value locked (TVL) for the Binance Smart Chain ecosystem as the Ethereum ecosystem lags.

The Binance Smart Chain ecosystem has also recorded an increase in its non-fungible token (NFT) trading volume and its GameFi activity. In other chains, these metrics have been trending to the downside as user interest follows the general sentiment in the market.

James Trautman, an analyst at Messari, believes BNB’s recent strengthening of its fundamentals is mainly based on the collapse of the Terra ecosystem. This left a big hole for crypto users looking for a low-cost blockchain which Binance Smart Chain seems to be filling. Trautman said:

Ultimately, NFTs, GameFi, and to some extent the Terra collapse, brought more unique users to the BNB Chain ecosystem. The resulting user adoption and its deflationary fee-burning mechanism contributed to BNB Chain’s resilience and outperformance of its peer group during Q2.