The journey towards the approval of an Ethereum ETF in the United States has seen a new development yesterday as the US Securities and Exchange Commission (SEC) has announced a delay in the decision for Grayscale’s Ethereum trust conversion into a spot Exchange Traded Fund (ETF). The SEC has stated the need for an extended period to evaluate the proposed rule change, pushing the new deadline Grayscale to January 25, 2024.

In its reasoning, the SEC has reiterated, “The commission finds it appropriate to designate a longer period within which to take action on the proposed rule change so that it has sufficient time to consider the proposed rule change and the issues raised therein.” Notably, the delay comes at a time where the US agency is working with now 13 spot Bitcoin ETF applicants on presumably the final amendments before a January 10 approval.

Timeline For A Spot Ethereum ETF Approval

Despite the latest delay, the crypto community remains optimistic about the future of spot Ethereum ETFs. Bloomberg ETF analyst James Seyffart has suggested that delays are par for the course, tweeting, “Update: As expected Grayscale’s Ethereum trust filing just got delayed. It was due by 12/6/23 so this is completely normal.”

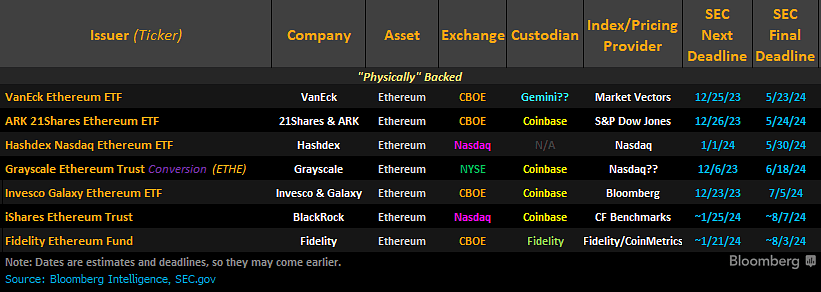

Seyffart also shared a table of all seven spot Ethereum ETF applicants: VanEck, 21Shares & ARK, Hashdex, Grayscale, Invesco & Galaxy, BlackRock, Fidelity and their deadlines. He further hinted at potential approvals by mid-2024, responding to criticisms from Adam Back, CEO of Blockstream, with “Unfortunately I think you’re gonna be really upset by June of next year.”

In response to queries about the probability of an Ethereum ETF approval following a Bitcoin ETF, Eric Balchunas of Bloomberg has indicated that the first filers, Ark and VanEck, have strong odds of approval by their final deadline on May 23, 2024, as they are expected to use the same mechanics as spot Bitcoin ETFs, and due to the fact that Ether futures have already received the green light from the US SEC.

Queried about for the odd of a spot Ethereum ETF approval, he remarked, “Not formally yet, but final deadline for the first filers Ark and VanEck is May 23rd so strong odds they approved by then given they’d be using same design as btc etfs and ether futures were Ok’d.”

The Next Deadlines

The table by Seyffart shows that the next Ethereum ETF deadlines are from December 23 to 26 for VanEck, Ark Invest and Invesco & Galaxy, followed by Hashdex on January 1. Since a spot Bitcoin ETF is very unlikely to be approved by then, delays by the SEC are more than likely for this batch of filings.

Both iShares by BlackRock and the Fidelity Ethereum Fund have their next deadlines on January 25 and January 21, 2024 respectively. These dates are crucial as they could involve either an extension, a request for more information, or a final decision.

But things only get really tense towards the final deadlines for all Ethereum ETF filers, as outlined by both Bloomberg ETF experts. With VanEck poised for May 23, 2024, and ARK Invest for May 24, 2024 and other notable filers like Hashdex Nasdaq Ethereum ETF and Grayscale’s Ethereum Trust Conversion (ETHE) scheduled for decisions by May 30, 2024, and June 18, 2024, respectively, the timeline for potential approvals is taking shape.

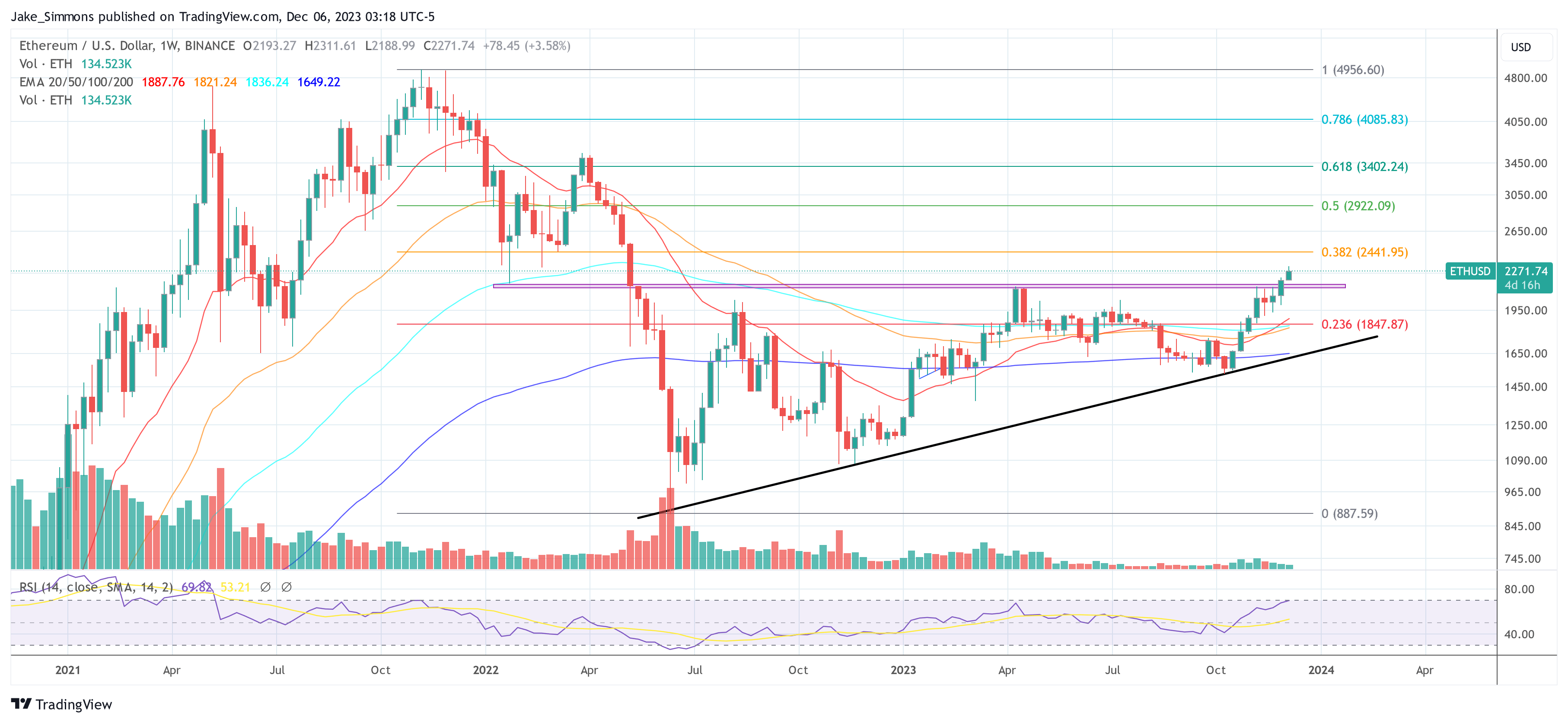

At press time, ETH traded at $2,271.

Featured image from Shutterstock, chart from TradingView.com