The phrase “hindsight is 20/20” is a perfect expression for financial markets because every price chart pattern and analysis is obvious after the movement has occurred.

For example, traders playing the Feb. 28 pump that took Bitcoin (BTC) above $43,000 should have known that the price would face some resistance. Considering that the market had previously rejected at $44,500 on multiple instances, calling for a retest below $40,000 made perfect sense, right?

This is a common fallacy, known as “post hoc” in which one event is said to be the cause of a later event merely because it had occurred earlier. The truth is, one will always find analysts and pundits calling for continuation and rejection after a significant price move.

Usually after strong #Bitcoin rallies like the one we just saw today, we tend to get follow through.

As I said earlier, the sheer disbelief during this rally has me optimistic in the short-term.

Still no guarantees of new highs immediately, but at least maybe a local uptrend.

— Benjamin Cowen (@intocryptoverse) March 1, 2022

Meanwhile, on March 2, Cryptox reported that Bitcoin “could force a $34K retest.” The analysis cited an “ailing momentum” because Russia had just announced its invasion of Ukraine.

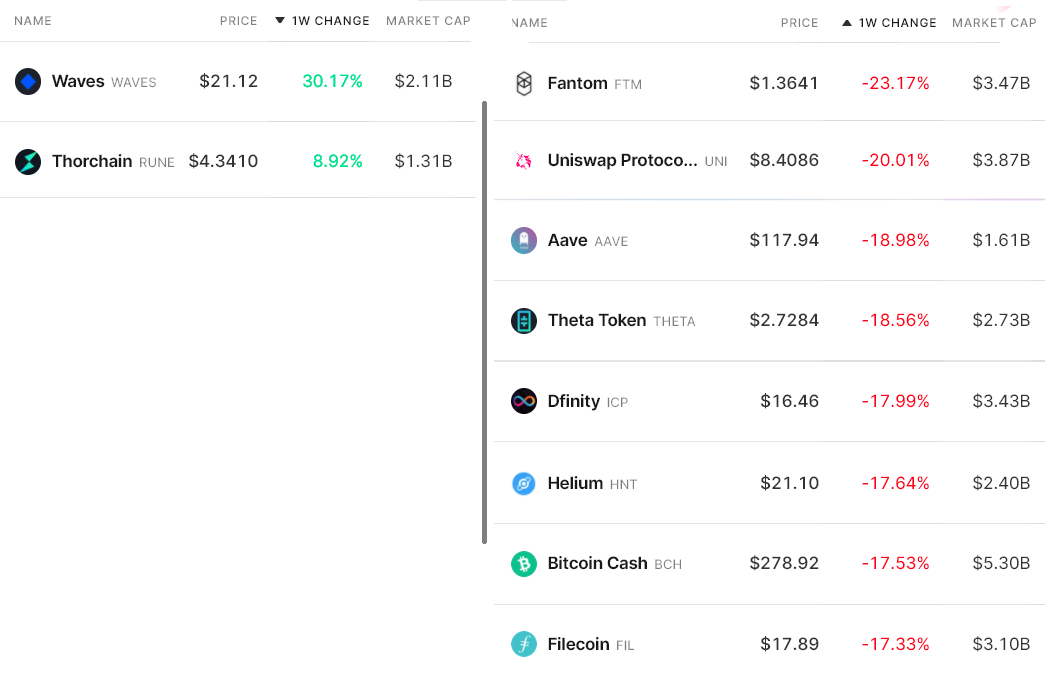

In the past seven days, the aggregate market capitalization performance of the cryptocurrency market showed an 11.5% retrace to $1.76 trillion and this move erased the gains from the previous week. Large cap assets like Bitcoin, Ether (ETH) and Terra (LUNA) were equally impacted, reflecting nearly 12% losses in the period.

Only two tokens were able to present positive performances over the past seven days. WAVES rallied for the second consecutive week as the network upgrade to become Ethereum Virtual Machine (EVM)-compatible advanced. The transition is scheduled to start in the spring and the new consensus mechanism will provide a “smoother transition to Waves 2.0.”

THORChain (RUNE) jumped after completing its Terra (LUNA) ecosystem integration, enabling the blockchain to support all Cosmos-based projects. ThorChain users now have more trading and staking options available, including TerraUSD (UST) stablecoin.

Funding rates flipped positive

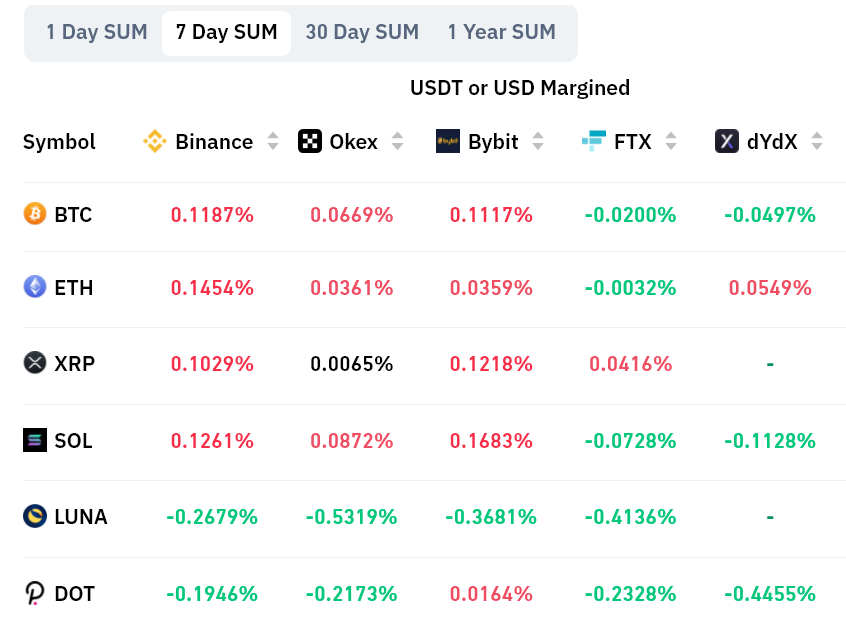

Perpetual contracts, also known as inverse swaps, have an embedded rate usually charged every eight hours. Perpetual futures are retail traders’ preferred derivatives because their price tends to track regular spot markets perfectly.

Exchanges use this fee to avoid exchange risk imbalances. A positive funding rate indicates that longs (buyers) demand more leverage. However, the opposite situation occurs when shorts (sellers) require additional leverage, causing the funding rate to turn negative.

Notice how the accumulated seven-day funding rate flipped positive in all of the top four coins. This data indicates slightly higher demand from longs (buyers) but is not yet significant. For example, Bitcoin’s positive 0.10% weekly rate equals 0.4% per month, which is not eventful for traders building futures’ positions.

Typically, when there’s an imbalance caused by excessive optimism, the rate can easily surpass 4.6% per month.

Options data is pricing in a potential price crash

Currently, there is not any clear direction in the market, but the 25% delta options skew is a telling sign whenever market makers overcharge for upside or downside protection.

If professional traders fear a Bitcoin price crash, the skew indicator will move above 10%. On the other hand, generalized excitement reflects a negative 10% skew.

As displayed above, the skew indicator held 10% until March 4, but slightly reduced to 7% or 8% during the week. Despite this, the indicator shows that pro traders are pricing higher odds for a market crash.

There are mixed feelings coming from retail traders’ futures data, which shows a shift moving away from a slightly negative sentiment versus options market makers pricing in a higher risk of a further crash.

Some might say that the third failure to break the $44,500 resistance was the nail in the coffin because Bitcoin failed to display strength during a period of global macroeconomic uncertainty and strong commodities demand.

On the other hand, the crypto sector’s current $1.76 trillion market capitalization can hardly be deemed unsuccessful, so there’s still hope for buyers.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cryptox. Every investment and trading move involves risk. You should conduct your own research when making a decision.