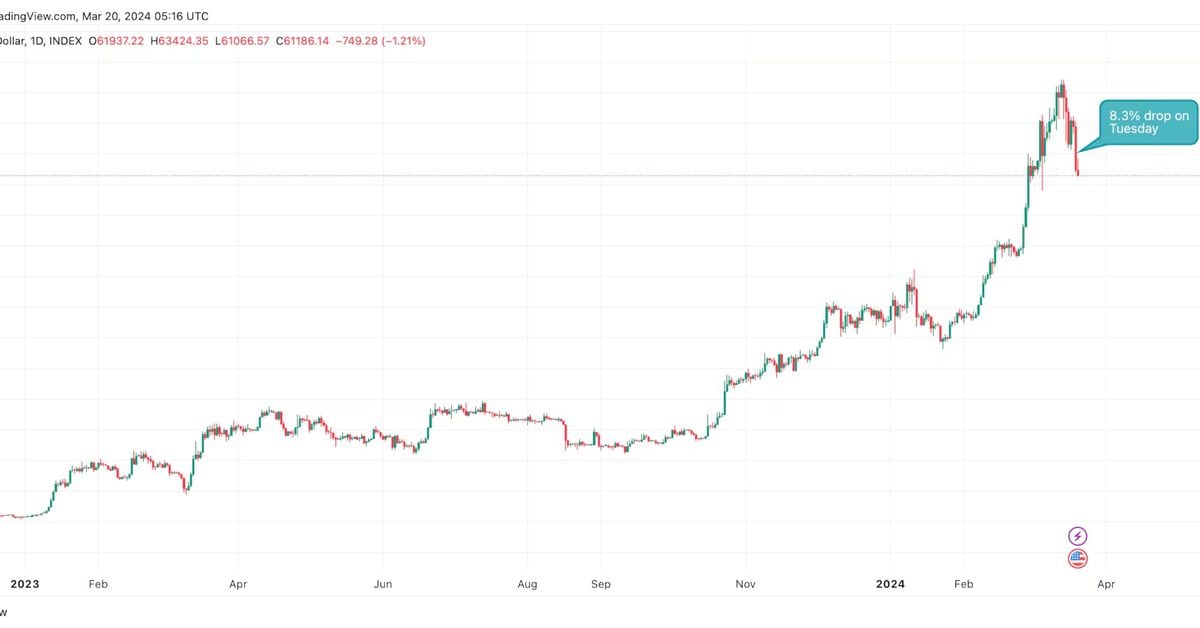

Bitcoin’s (BTC) price correction gathered pace Tuesday as the U.S.-listed spot exchange-traded funds (ETFs) fell out of favor. The leading cryptocurrency by market value fell over 8% to under $62,000, data from charting platform TradingView shows. That’s the biggest single-day percentage (UTC) decline since Nov. 9, 2022. That day, prices tanked over 14% as Sam Bankman Fried’s FTX, formerly the third largest crypto exchange, went bankrupt. Bitcoin’s latest price slide has been catalyzed by several factors, including outflows from the spot ETFs, according to trader and economist Alex Kruger. Provisional data published by investment firm Farside show that on Tuesday, there was a net outflow of $326 million from the spot ETFs, the largest on record. On Monday, Grayscale’s ETF witnessed a record outflow of $643 million. “Reasons for the crash, in order of importance: #1 Too much leverage (funding matters). #2 ETH driving market south (market decided ETF was not passing). #3 Negative BTC ETF inflows (careful, data is T+1). #4 Solana shitcoin mania (it went too far),” Kruger said on X.

Bitcoin’s Drop Below $62K Is the Biggest Single-Day Loss Since FTX’s Collapse