Bitcoin (BTC) has continued its ascent in recent weeks, reclaiming major highs. However, recent analysis suggests that the $57,000 level could be one of the most critical support points for the ongoing bull rally.

This insight comes from a CryptoQuant analyst, Burak Kesmeci, who highlighted the role of Bitcoin Spot Exchange-Traded Funds (ETFs) in shaping the market stance.

Bitcoin Resilience At The $57,000 Level

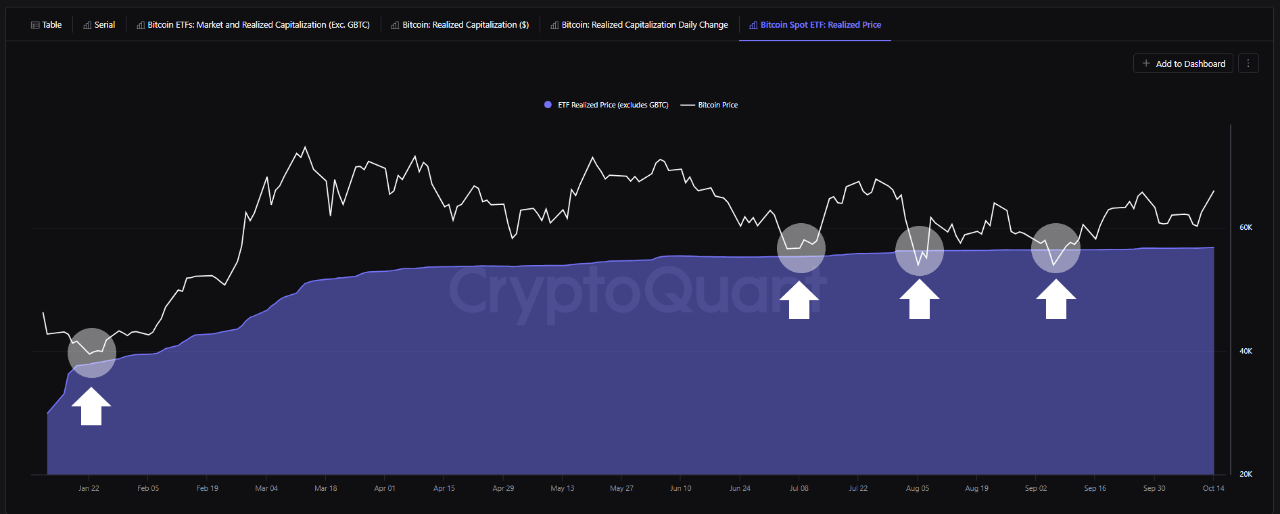

Spot ETFs have emerged as a major instrument in the Bitcoin ecosystem, offering a regulated entry point for institutional investors. According to Kesmeci, the average cost of Bitcoin Spot ETFs has been a key support level throughout 2024, providing a foundation for the asset’s price stability.

This level is pegged at $57,000 and has held firm throughout the year, with only two significant exceptions. The $57,000 price level is significant because of its technical support and the psychological implications for Spot ETF investors.

Could the Average $BTC Spot ETF Cost (57K) Be the Most Crucial Support Level in the Bull Rally?

“The price of #Bitcoin managed to stay above this level throughout the year, with only two exceptions.” – By @burak_kesmeci

Full post https://t.co/troZDKwKNw pic.twitter.com/IWqNJ2L6Kg

— CryptoQuant.com (@cryptoquant_com) October 16, 2024

Bitcoin’s price dipped below this support level twice in 2024. The first instance was in early August, driven by Japan’s market turbulence, and the second in September due to a sharp price correction.

Despite these market shocks, Spot ETF investors did not react with panic selling. Kesmeci wrote:

Bitcoin Spot ETF investors proved, contrary to the expectations of many, that they are not weak hands.

Foundation Set For Positive Move

According to the CryptoQuant analyst, these investors demonstrated resilience by holding onto their investments, even when unrealized losses mounted. Their ability to withstand market pressure contrasts with typical behavior in other speculative sectors, where sudden price drops often lead to mass sell-offs.

This suggests that Spot ETF investors have grown more comfortable with Bitcoin’s inherent volatility, recognizing its long-term potential.

The analyst highlighted that minor outflows during these turbulent periods were not significant enough to disrupt the broader market.

Even during Japan’s “carry trade” crisis, where many expected a stronger market correction, the overall sentiment among Spot ETF investors remained calm.

In conclusion, Kesmeci noted:

As you can see from the chart above, the average cost of Bitcoin Spot ETFs has become perhaps the most crucial support level in the 2024 bull rally. With this long-term perspective, the contribution of Spot ETFs to the Bitcoin rally has laid a solid foundation for the potential developments in the market’s future.

Featured image created with DALL-E, Chart from TradingView