On-chain data shows the Bitcoin investors have been capitulating recently, a sign that FUD has been gripping the market.

Bitcoin Total Amount Of Holders Has Seen A Drop Recently

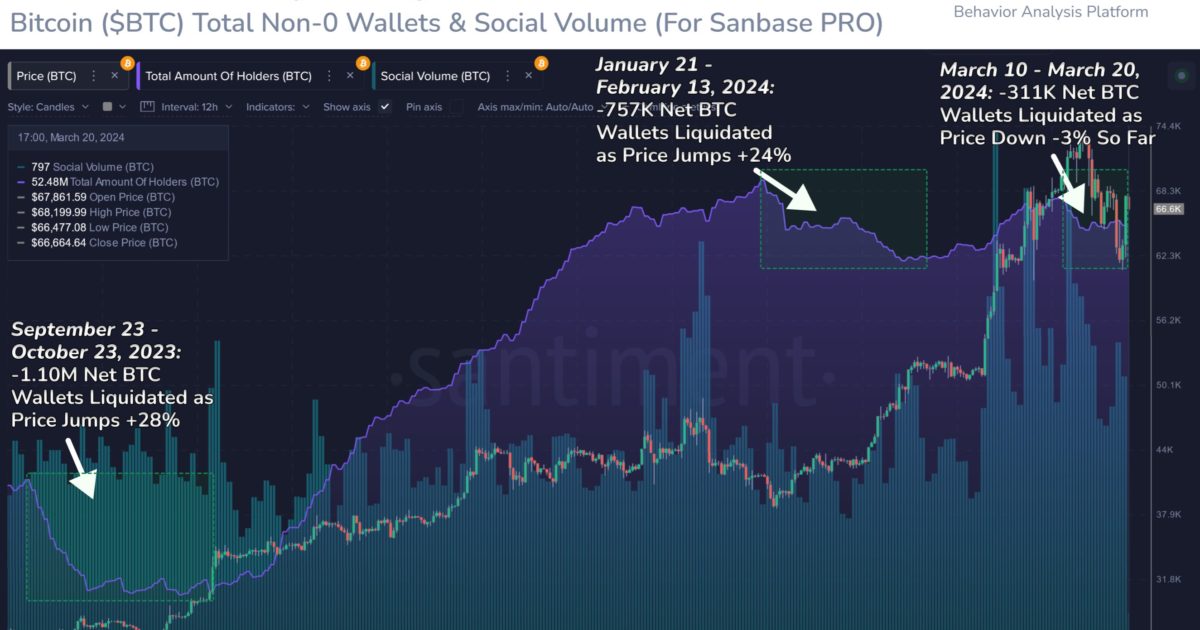

According to data from the on-chain analytics firm Santiment, the Bitcoin Total Amount of Holders has registered a notable decline recently. The “Total Amount of Holders” here is an indicator that measures the total number of addresses on the BTC blockchain that are carrying some non-zero balance right now.

When the value of this metric trends up, it can mean that fresh hands are potentially investing into the cryptocurrency, opening new addresses and adding coins to them.

The indicator would naturally also increase if any investors who had left the asset before are returning back to it and filling up their wallets again. Another possible reason for the trend can also be due to holders breaking up their holdings into multiple wallets, for purposes like privacy.

In general, though, an increase in the Total Amount of Holders is usually a sign that net adoption of the coin is taking place, which can be a bullish sign in the long term.

On the other hand, a decline in the indicator can signal that some investors have decided to leave the cryptocurrency behind, as they have completely liquidated their holdings.

Now, here is a chart that shows the trend in the Bitcoin Total Amount of Holders over the past few months:

As displayed in the above graph, the Bitcoin Total Amount of Holders has suffered a decrease during the past 10 days or so. In all, 311,000 addresses have completely emptied themselves inside this window.

“To a novice trader, this may appear to be a concern with less overall active participants. However, historically this stat has reflected FUD moments in the market, indicating small BTC wallets are typically capitulating as large wallets scoop up their coins,” explains Santiment.

From the chart, it’s visible that there have also been two other instances of mass capitulation within the past few months. More specifically, 1.1 million addresses exited between the 23rd of September and 23rd of October, while 757,000 capitulated between the 21st of January and 13th of February.

Interestingly, during these capitulation events, the price went up 28% and 24%, respectively. So far since the latest selloff from the small hands has started, the cryptocurrency is down about 3%.

“If history is any indication, Bitcoin has a strong chance of putting up positive returns before this exodus of non-0 wallets this round (due to traders thinking the top is in) finally stops,” notes the analytics firm.

BTC Price

Since Bitcoin’s low at $60,600, the asset has enjoyed some sharp recovery as its price has now surged to the $66,800 level.