Bitcoin overtakes amazon in 2025

On July 14, 2025, Bitcoin crossed a historic threshold. Its price surged past $122,600, pushing its market capitalization to approximately $2.4 trillion — surpassing Amazon’s estimated $2.3 trillion.

With that, Bitcoin officially joined the ranks of the top five most valuable assets on Earth.

It wasn’t a slow burn. Bitcoin (BTC) climbed nearly 13% in just one week, driven by record-breaking spot Bitcoin exchange-traded fund (ETF) inflows and rising institutional demand.

In overtaking Amazon, Bitcoin also surpassed the market caps of silver (around $2.2 trillion) and Google (Alphabet, around $2.19 trillion).

Bitcoin vs. Amazon market cap: What’s fueling the rise?

Inflows, institutions and policy set the stage for the rise in Bitcoin’s market cap.

Spot Bitcoin ETF inflows

Spot Bitcoin ETFs saw unprecedented demand. On July 10 and 11 alone, US-listed products pulled in $1.17 billion and $1.03 billion, respectively, marking the first time since their January 2024 debut that back-to-back daily inflows crossed the $1-billion mark.

These flows helped propel Bitcoin past the $120,000 mark and reinforced the asset’s responsiveness to ETF demand.

BlackRock’s IBIT, a market leader, now holds over $80 billion in assets under management. The continued ETF buying streak is reshaping access, liquidity and perception.

“Crypto Week”

At the same time, Washington rolled out a slate of crypto-focused legislation. The CLARITY Act, GENIUS Act and Anti-CBDC Surveillance Act advanced through Congress under a unified push dubbed “Crypto Week.”

For years, regulatory uncertainty held back institutional participation. But these bills offered rare alignment: clearer frameworks, stronger protections and explicit political support. The US government signaled that crypto has a place in regulated finance, further legitimizing Bitcoin’s role in institutional portfolios.

A supportive macro backdrop

Bitcoin’s climb is also about timing. Under the newly elected Trump administration, crypto policy has shifted toward a friendlier stance. That shift, paired with a weakening dollar and a push for alternatives to centralized money, is fueling interest.

At the same time, Bitcoin’s correlation with equities has risen sharply. A January 2025 study showed BTC’s rolling correlation with the Nasdaq and S&P 500 hitting 0.87 — a sign that investors now view Bitcoin as part of the broader risk asset landscape. No longer a fringe bet, Bitcoin is behaving more like a technology stock with asymmetric upside.

Together, these forces (strong ETF flows, regulatory clarity and macro tailwinds) explain why Bitcoin’s rise is accelerating now.

Bitcoin top 5 asset: From zero to trillions

Bitcoin’s price in 2010: $0.10. In July 2025: over $122,000. That’s a gain of more than 1.2 million times (1,219,999%) in just 15 years. Few assets in history have experienced a trajectory this steep or this transformative.

Bitcoin scarcity

At the heart of Bitcoin’s design is scarcity. With a hard cap of 21 million coins, Bitcoin mimics the economics of gold, except it’s digital, transparent and borderless.

Bitcoin is part of a broader conversation about the future of money. For many, it has replaced gold as a long-term store of value and inflation hedge. The Bitcoin vs. gold debate is giving way to a new question: How high can Bitcoin’s market cap go?

Did you know? In 2013, a Welsh IT engineer accidentally threw away a hard drive containing 8,000 BTC (now worth hundreds of millions) in a Newport landfill. Despite attempts to excavate it, recovery efforts have been refused.

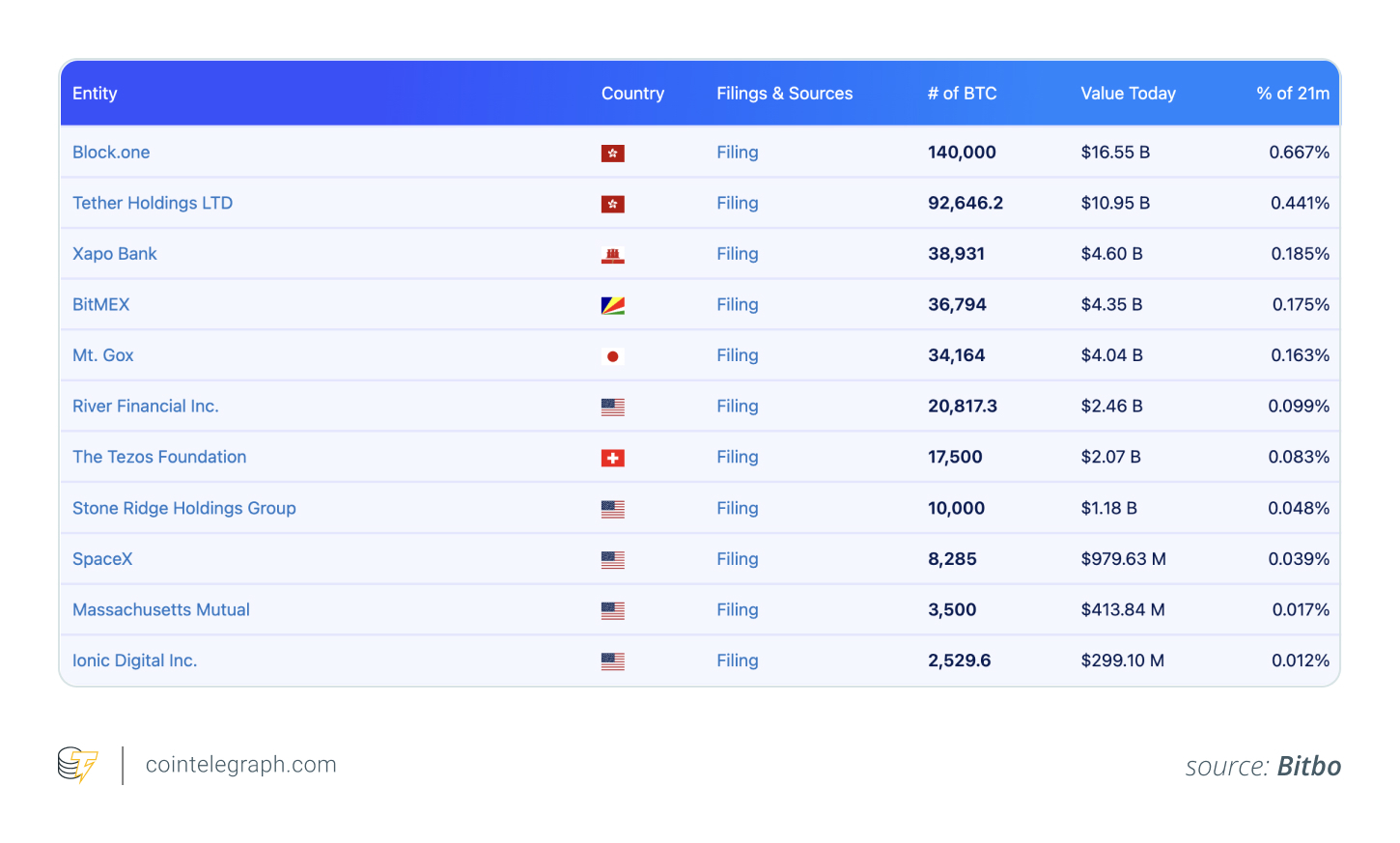

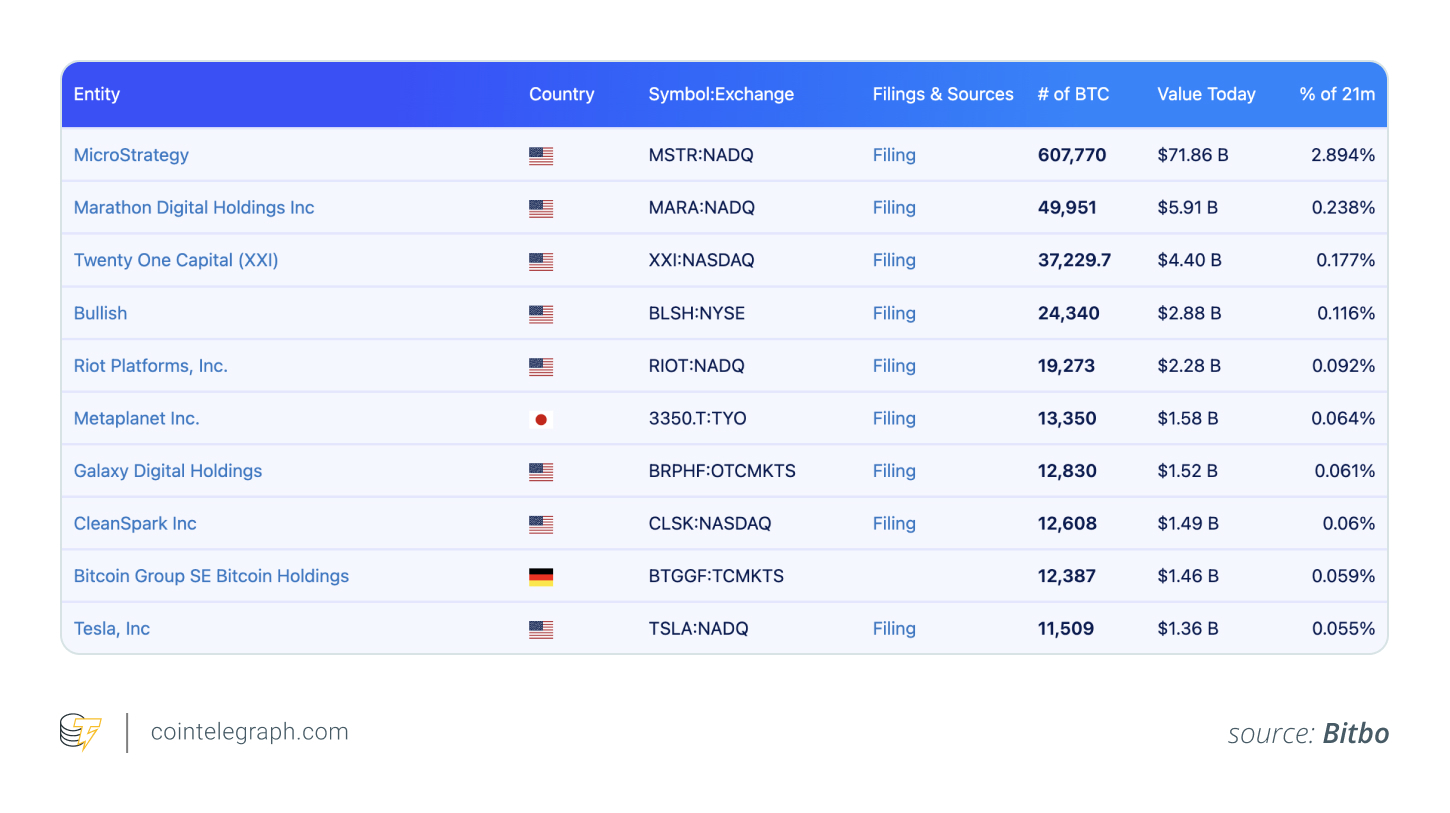

Companies holding Bitcoin in 2025

Bitcoin’s adoption story is also about who’s holding it.

As of July 2025:

- Over 265 public and private companies hold a combined 853,000 BTC, or about 4% of the total supply. These include names such as Strategy, Tesla and Square.

- Spot Bitcoin ETFs now hold approximately 1.4 million BTC (6.6% of the supply), making ETFs one of the largest custodians of BTC globally.

This institutional footprint supports Bitcoin’s market capitalization today and sets the foundation for future growth. Bitcoin’s climb toward the valuations of Apple or Microsoft no longer looks like wishful thinking.

Did you know? Semler Scientific, a US-listed medical device firm, has transformed into a significant Bitcoin treasury player. As of June 2025, it held approximately 4,450 BTC (worth nearly $472 million) after spending $20 million on Bitcoin in just a few months.

Bitcoin price prediction: $167,000

Now that Bitcoin has surpassed Amazon, Google and silver, attention has shifted to the remaining giants. The next targets: Apple and Microsoft.

The next milestones

Enmanuel Cardozo of Brickken believes that if macro conditions remain favorable and institutional demand keeps accelerating, Bitcoin could soon challenge Apple’s $3.1-trillion market cap. That would require a BTC above $142,000.

Go one step further, and Microsoft’s $3.6-trillion valuation comes into view. At that level, Bitcoin would need to hit approximately $167,000.

Bullish market forecasts

Major financial institutions are updating their models. Standard Chartered projects that Bitcoin will have reached $135,000 by Q3 and could breach $200,000 by year-end, citing strong ETF demand and continued institutional accumulation.

Anthony Scaramucci, founder of SkyBridge, puts his forecast in the $180,000-$200,000 range. He points to growing wallet adoption, rising interest in Bitcoin as a strategic reserve and the accelerating ETF buying streak as key drivers.

The shared assumption is that Bitcoin’s shift into mainstream financial infrastructure is still in its early stages.

What could go wrong?

Bullish projections depend on two things:

- ETF inflows must continue at scale. If interest dries up, so could momentum.

- Regulatory clarity must advance, not stall. The gains seen after Congress’s “Crypto Week” legislation won’t hold if there’s backpedaling or political resistance in the long term.

Moreover, Bitcoin has become sensitive to interest rate signals, policy changes and broader market liquidity in the past, all of which could swing prices sharply in either direction.

Why does Bitcoin surpassing Amazon matter for the future of finance?

Crossing Amazon’s valuation is symbolic for Bitcoin’s presence as a top-5 asset.

1. Legitimization

With a market cap above $2.4 trillion, Bitcoin has joined the shortlist of assets that define capital markets today. Once questioned for its legitimacy, Bitcoin is now being embraced by institutional allocators, sovereign wealth funds and regulated investment products.

2. Portfolio evolution

A key takeaway from 2025 is how Bitcoin’s correlation with equities has evolved. It now tracks the broader market more closely than ever.

In other words, Bitcoin is becoming part of the diversified portfolio conversation, alongside stocks, bonds and real-world asset tokenization strategies.

3. Regulation meets adoption

The CLARITY Act, GENIUS Act and others helped cement crypto’s place in the US legal framework. Regulation may finally be catching up to adoption.

Bitcoin’s rise to this point was once unimaginable. But now, with Apple and Microsoft in its sights, the next leg up could be even more dramatic.