Bitcoin is now experiencing a break from last week’s steady decline, which saw the asset drop as low as $94,000. As of today, BTC’s price has steadily climbed, hovering above $97,000 at the time of writing—a 1.3% gain in the past day.

Amid this Bitcoin price performance, a CryptoQuant analyst known as Crypto Lion has identified a meaningful decline in leverage and open interest (OI) ratios since November 21, following the presidential election. What does this indicate for the Bitcoin market?

Leverage Ratio Decrease And Its Implications

In a recent QuickTake post titled “Leverage ratio decreased. Risk Off,” Crypto Lion explained that the leverage ratio of Bitcoin has fallen, along with the derivatives buy-sell ratio and the OI-to-market-cap ratio. This suggests a gradual unwinding of leverage as more Bitcoin leaves centralized exchanges (CEXs).

The analyst also highlighted that much of this Bitcoin has shifted to Coinbase Prime or been used to back exchange-traded funds (ETFs), indicating a shift toward long-term holding and possibly a broader “risk-off” stance among large investors. The analyst particularly wrote:

The large decrease in the leverage ratio means that OI is decreasing relative to the CEX BTC reserve. It is important to note that the CEX reserve has been declining for a long time and has been moved to the coinbase prime and bought to back ETFs. This means that risk-off may be more advanced than it appears.

Bitcoin Exchange Outflows Reach 2022 Levels

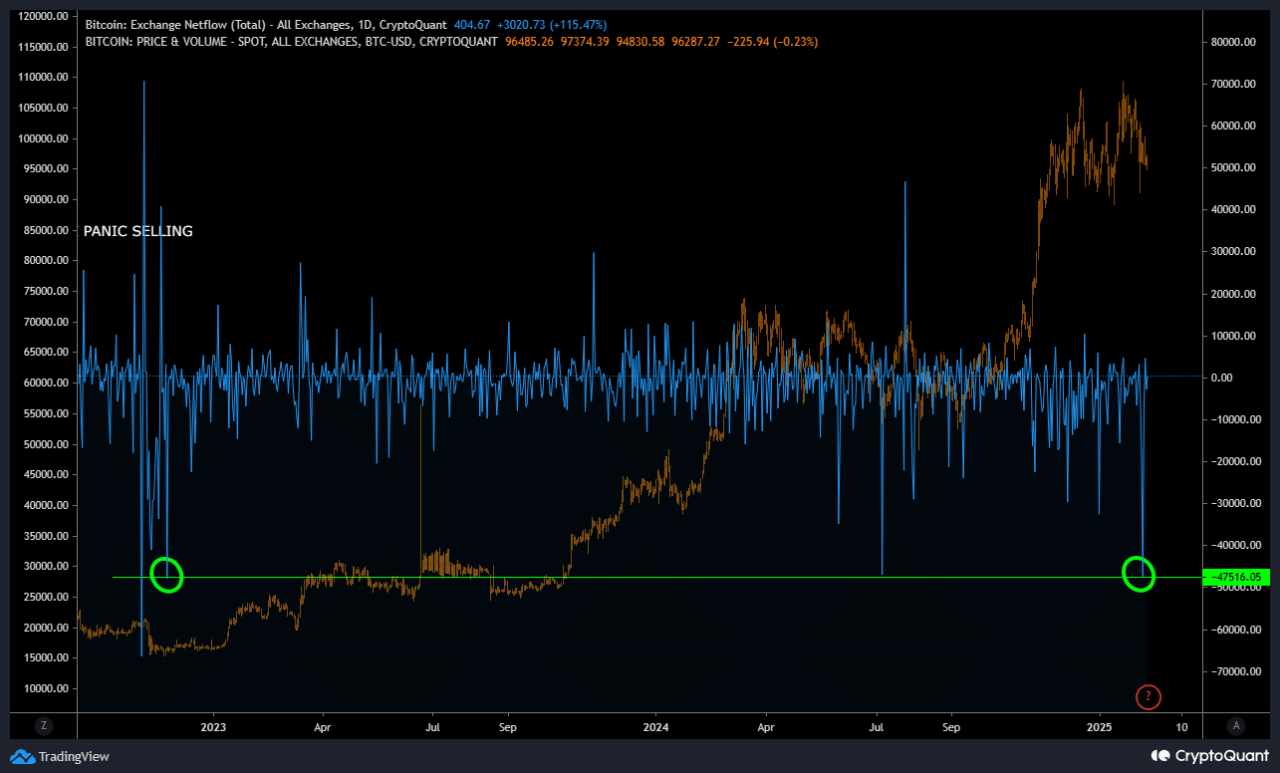

Adding to this narrative, another CryptoQuant analyst, Papi, reported a significant development in Bitcoin’s exchange dynamics. According to Papi, the largest net outflow of Bitcoin from exchanges since 2022 occurred last week, reducing the supply of Bitcoin on these platforms by 3%.

The last time outflows reached a comparable scale was shortly after the collapse of FTX, a major exchange event that reshaped market sentiment. This latest exodus of Bitcoin from exchanges may signal growing confidence among institutional players and long-term holders.

Despite recent price fluctuations, large buyers appear to be “stacking on dips,” as Papi noted. This behavior suggests that these entities anticipate future price appreciation and are accumulating while prices remain comparatively low.

The shift of funds off exchanges into private wallets or institutional custody often reflects a strategy of long-term holding rather than short-term trading, potentially providing a stable foundation for future market growth.

Looking ahead, the reduced leverage ratios, coupled with significant outflows from exchanges, could point to a more cautious yet optimistic market sentiment. If these patterns continue, they may set the stage for a more sustained recovery in Bitcoin’s price and a shift toward healthier market conditions over time.

Featured image created with DALL-E, Chart from TradingView