Bitcoin (BTC) passed $21,000 at the Nov. 4 Wall Street open as bulls tackled a formidable sell wall.

Sellers move aside for new multi-week highs

Data from Cryptox Markets Pro and TradingView breaking through resistance to hit local highs of $21,262 on Bitstamp.

The pair had struggled to return to higher levels during the week, but the latest order book data from Binance showed asks now shifting up to north of $21,500.

The day’s high marked Bitcoin’s best performance since Sep. 13, beating previous local peaks.

Material Indicators, which provided the order book charts, noted that above-expected United States unemployment figures may be aiding risk assets by increasing the chances of a Federal Reserve interest rate pivot.

“Unemployment came in at 3.7% which is 0.2% higher than forecasted and BTC whales see it as a sign that FED rate hikes may be working,” it summarized.

“Note, that one month’s report doesn’t make a trend, but right or wrong, this market reacts to every data point.”

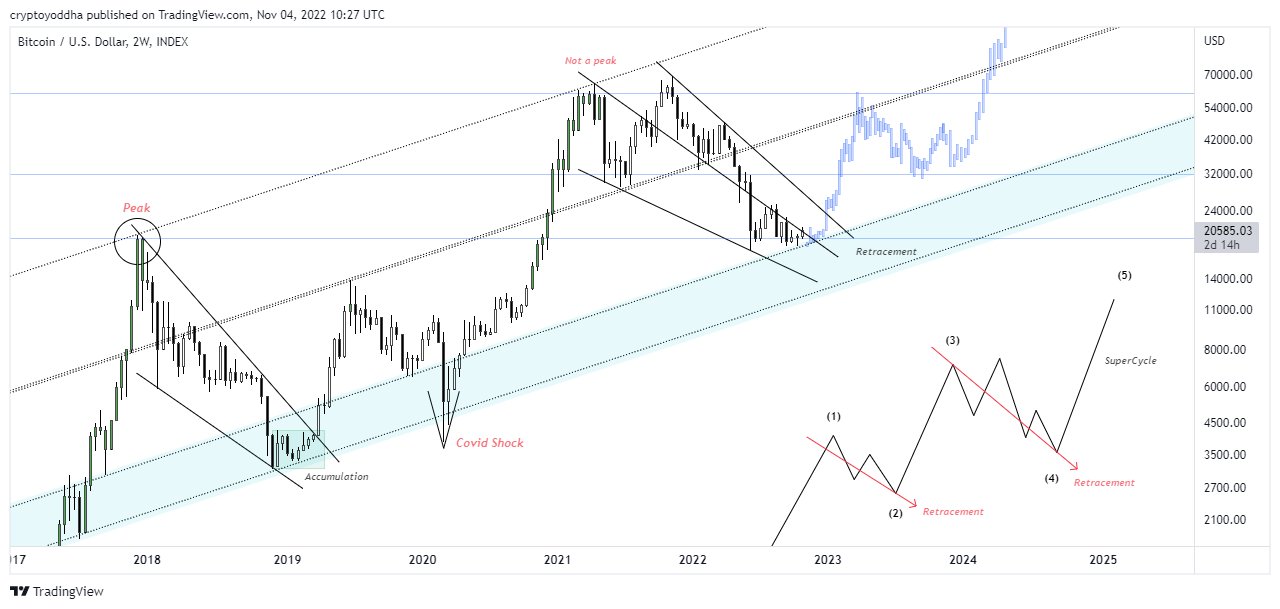

Zooming out, popular Twitter account Bitcoin Bull reiterated a characteristically positive take on BTC price action, arguing that cycle lows were near.

“This was just a pullback from a bigger bullish extension. The major peak is not in yet, but the bottom zone is here,” a tweet read.

“The cycle continues.”

$30,000 on the cards for November

Macro markets performed similarly strongly on the day.

Related: Analyst puts Bitcoin price at $30K next month with breakout due

An hour after the open, the S&P 500 was up nearly 2% and the Nasdaq Composite Index up 1.75%.

The U.S. dollar meanwhile lost ground, the U.S. dollar index (DXY) dropping to 111 support from 113 in a single day.

“$DXY is tanking. Yields are ready to drop. Bitcoin at $21K,” Michaël van de Poppe, founder and CEO of trading firm Eight, reacted.

“It’s time for the run towards $30k in coming weeks.”

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cryptox.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.