Bitcoin (BTC) fell immediately on the latest United States consumer price index (CPI) data Feb. 10 in a surprise move that deflated bulls.

Spot the Bitcoin bear trap

Data from Cryptox Markets Pro and TradingView tracked BTC/USD as it dropped $1,800 after January’s CPI print came in at 7.5%.

Despite being 0.2% higher than expectations, surging inflation failed to have the positive impact on risk assets such as Bitcoin that characterized recent months.

Given the pace of year-on-year price increases, analysts argued, the Federal Reserve may now have more impetus to begin interest rate hikes sooner.

“The Consumer Price Index (CPI) results for the U.S.A. are coming in at 7.5% year-over-year, the expectations were 7.3% year-over-year. $DXY is shooting up and risk-on assets are dropping down like Bitcoin & equities,” Cryptox contributor Michaël van de Poppe reacted.

“Likelihood that the FED will start rate hikes in March”

Fellow trader and analyst Scott Melker, known as the “Wolf of All Streets,” was unimpressed by the market.

Funny, I thought Bitcoin was supposed to go up whenever they admit that inflation is bad, but instead people dump it because they are afraid the Fed will actually try to deal with inflation, proving once again that humans are dumb af.

— The Wolf Of All Streets (@scottmelker) February 10, 2022

For economist Lyn Alden, however, it was cash savers w inflation was dealing the real pain.

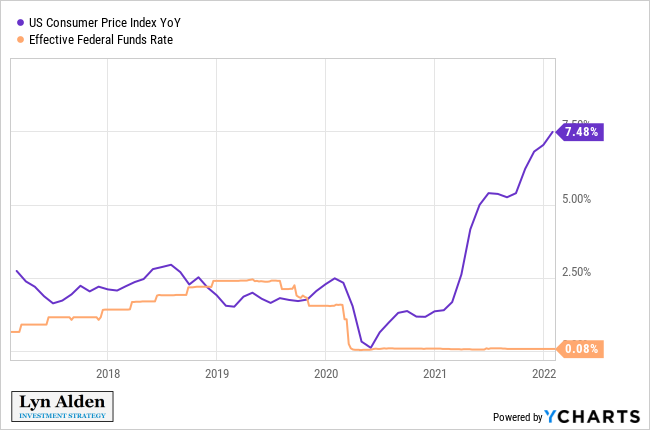

“Official inflation currently has its biggest gap over short-term interest rates since 1951,” she noted alongside a chart.

“People holding cash in a bank or T-bills over the past year lost over 7% of their purchasing power.”

BTC price recovers above $44,000

No sooner had Wall Street trading begun on Thursday, however, did Bitcoin not only reverse its losses but put in a higher high of nearly $45,400.

Related: Bitcoin centers on $44K as BTC price MACD delivers long-awaited bull signal

BTC/USD likewise avoided a retest of recent support, with $42,000 and lower still yet to see a retest.

Previously, Cryptox reported on the likely resistance zones now in play for bulls to grapple with in order to continue higher.

“A Bitcoin uptrend in the face of macro uncertainty would be quite powerful. Shifts the narrative from tradfi’s court with BTC being a risk-on asset to purely a story of global adoption and ensuing game theory. Have to wonder how many macro bros have offloaded inventory by now,” analyst William Clemente added on the day.