One analyst on X thinks Bitcoin bulls may be in for a treat in the coming months after one key indicator printed a buy signal for the first time in nearly a decade. While pointing to a bullish crossover on the 2-month chart’s Golden Moment Indicator, the analyst said the signal is again flashing green in almost nine years.

Further cementing this outlook, this is forming as yet the Supertrend indicator, which has historically preceded every major Bitcoin uptrend, is also bullish.

Bitcoin On A Bullish Path?

Though the analyst might be bullish on the world’s most valuable coin, the asset remains consolidated. Technically, reading from the formation in the daily chart, the coin is slowly losing the uptrend momentum. This week, Bitcoin failed to build on to late last week’s spike to push above $72,000 in a buy trend continuation.

In the daily chart, Bitcoin is trading above the 20-day moving average. However, prices have been moving horizontally below $72,000. Despite this, traders are hopeful.

Whether bulls will flow back and thrust the coin to fresh highs above $74,000 will depend on many other factors.

Inflows Into Spot BTC ETFs Pick Up Momentum

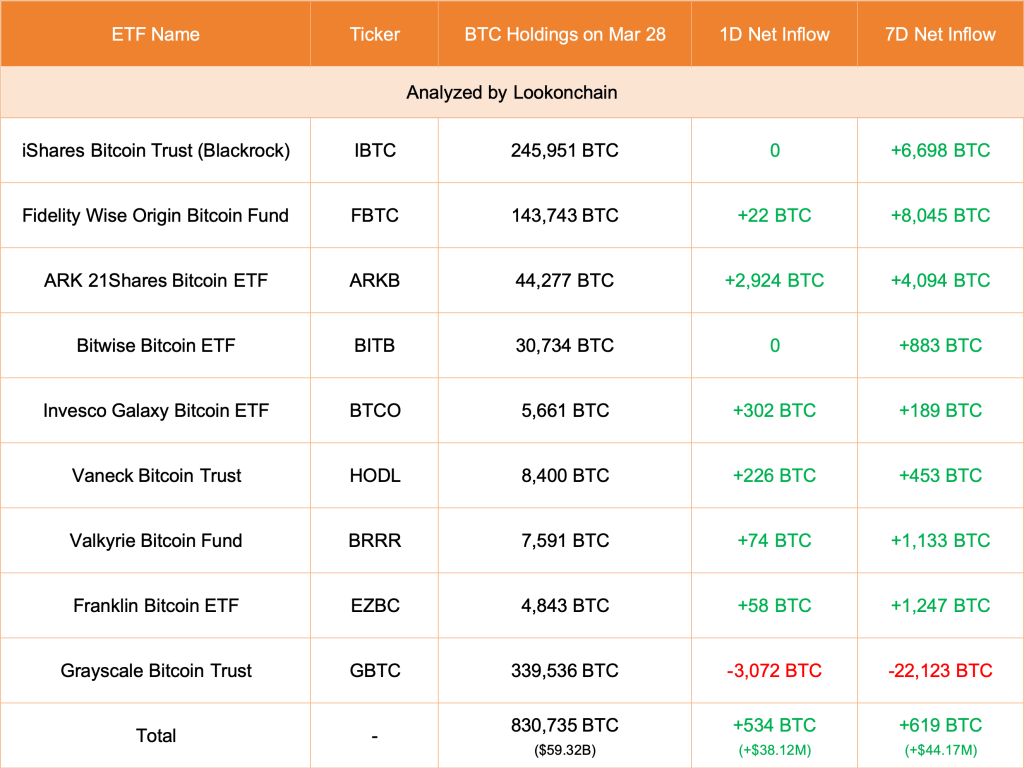

A key influencer on price and sentiment remains spot Bitcoin exchange-traded funds (ETFs) and their flow trend. Since launching, nine out of the ten spot Bitcoin ETFs have accumulated over 500,000 BTC, or roughly 2.5% of the total supply.

When Grayscale’s BTC holding is factored in, all spot Bitcoin ETF issuers in the United States control 830,000 BTC. Cumulatively, this figure translates to roughly 4% of the total supply.

Of note, after last week’s slowdown, inflows continued throughout this week, pushing their holdings even higher—a net positive for the price and, most importantly, investor confidence. By March 28, Lookonchain data shows that 21Shares led the charge, adding 2,924 BTC.

Despite the general lull in Bitcoin prices, the uptick in demand for these derivative products indicates growing interest among institutional and retail investors.

It remains to be seen how prices react going into April, an important month. In less than four weeks, the network will halve miner rewards from 6.25 BTC to 3.125 BTC, making the coin scarce. If the current level of demand remains, BTC prices will likely rise as market forces automatically adjust prices.

Feature image from DALLE, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.