Bitcoin (BTC) dipped below $8,500 on Jan. 23 as traders’ expectations of a slow downtrend from recent highs appeared to slowly come true.

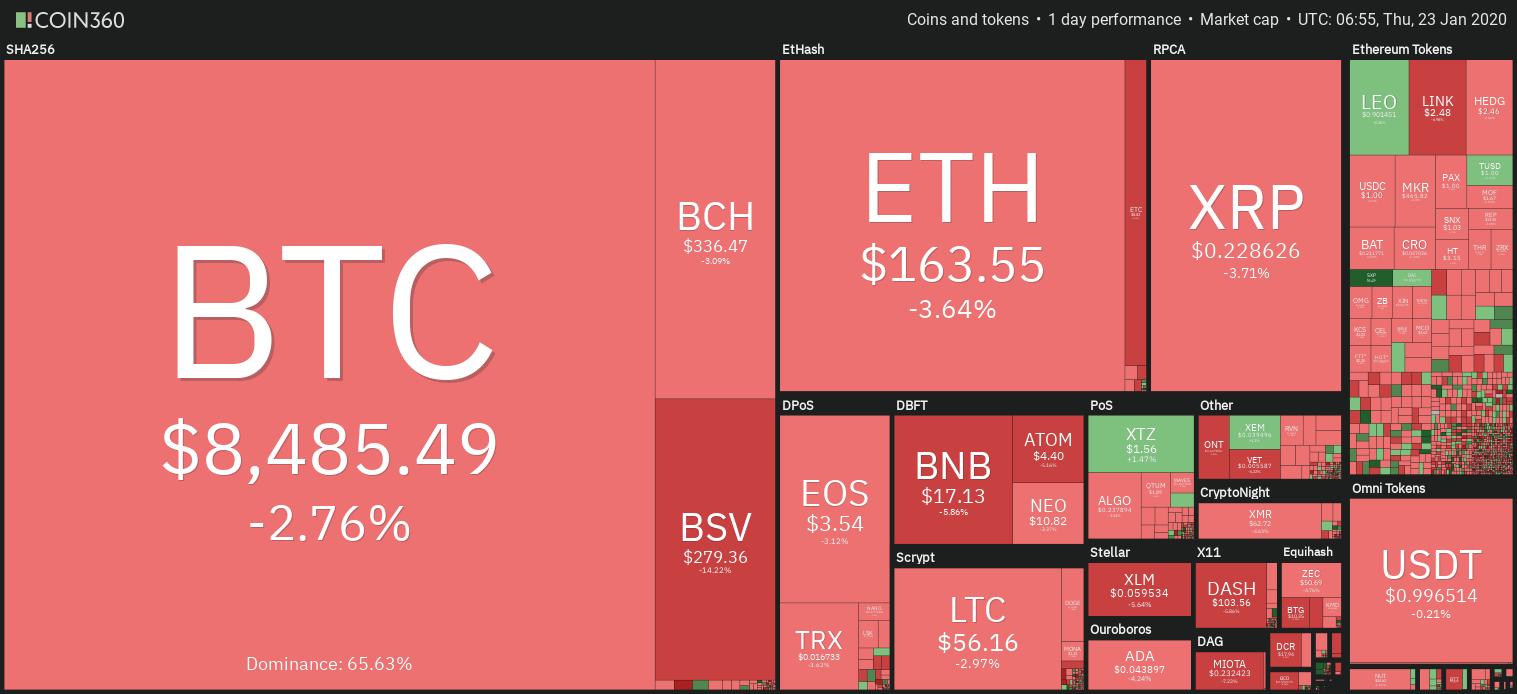

Cryptocurrency market daily overview. Source: Coin360

BTC returns to $8,400s

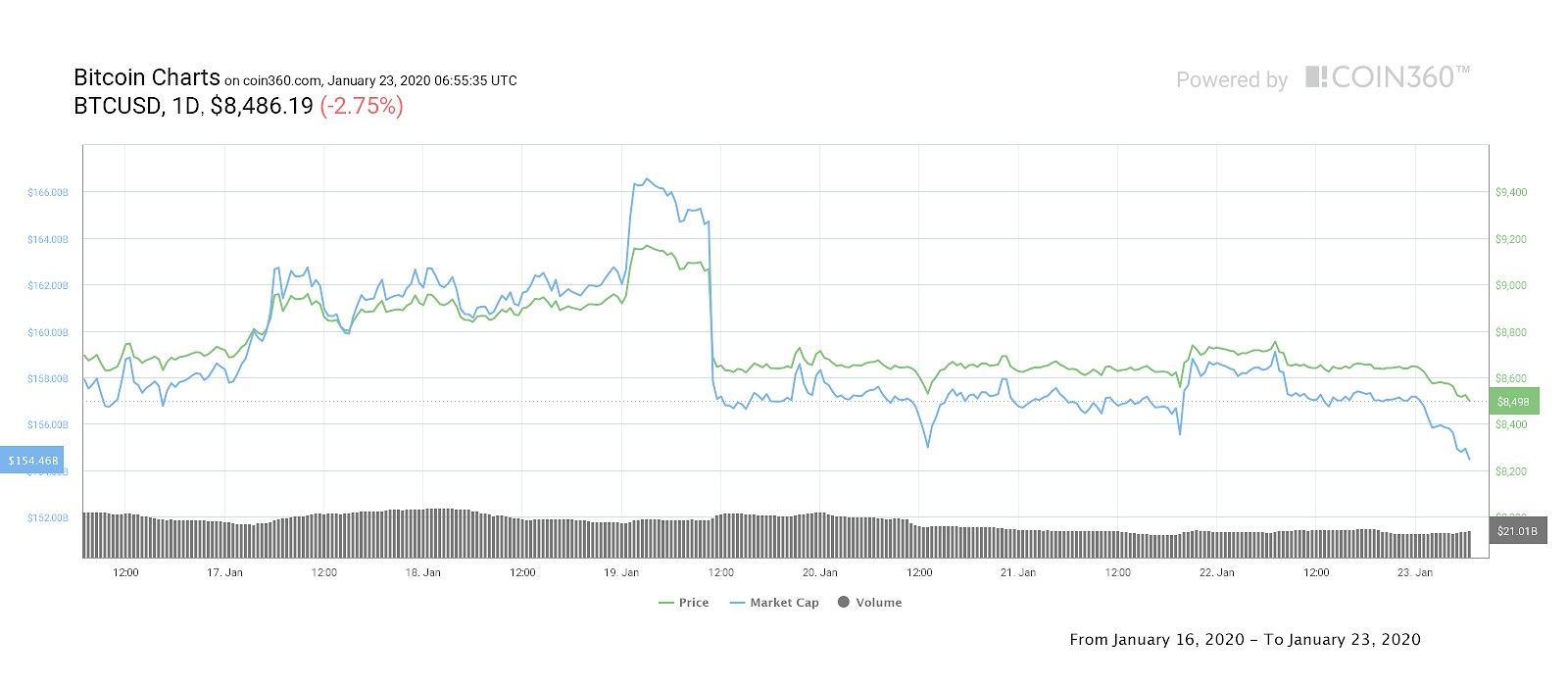

Data from Coin360 and CryptoX Markets showed BTC/USD reach lows of $8,480 overnight on Wednesday. At press time, Bitcoin hovered at around $8,505.

The former level matches two other brief lows seen this week, and represents the bottom of a range the pair has traded in since Jan. 14.

Bitcoin 7-day price chart. Source: Coin360

Over that period, traders saw highs of more than $9,150, while warning there was little chance of Bitcoin climbing higher still.

The reason, according to CryptoX contributor filbfilb among others, was resistance sparked by the Bitcoin price’s 200-day moving average.

At present, he said on Wednesday, he would favor less volatile price action in the short term, this nonetheless being to the upside, allowing BTC/USD to regain a higher position in its local range.

“I’m not saying the next thing that happens is we burst out of here… more expecting some sideways drifting to the upside to be honest but let’s see,” he summarized to subscribers of his Telegram trading channel.

As CryptoX reported, even the $8,500 zone is far from bearish according to some price performance measures.

In particular, the Stock-to-Flow model, historically uncannily accurate at charting Bitcoin’s journey to current levels, states that the mid-$8,000 area is exactly where the cryptocurrency should be at this point in time.

Bitcoin SV forms losing altcoin bet

Among altcoins, it was once again Bitcoin SV (BSV) and Dash (DASH), which led the losses for investors.

With 24-hour retracements of 11.1% and 6,1% respectively, the two tokens continued to erode previous gains from earlier in January.

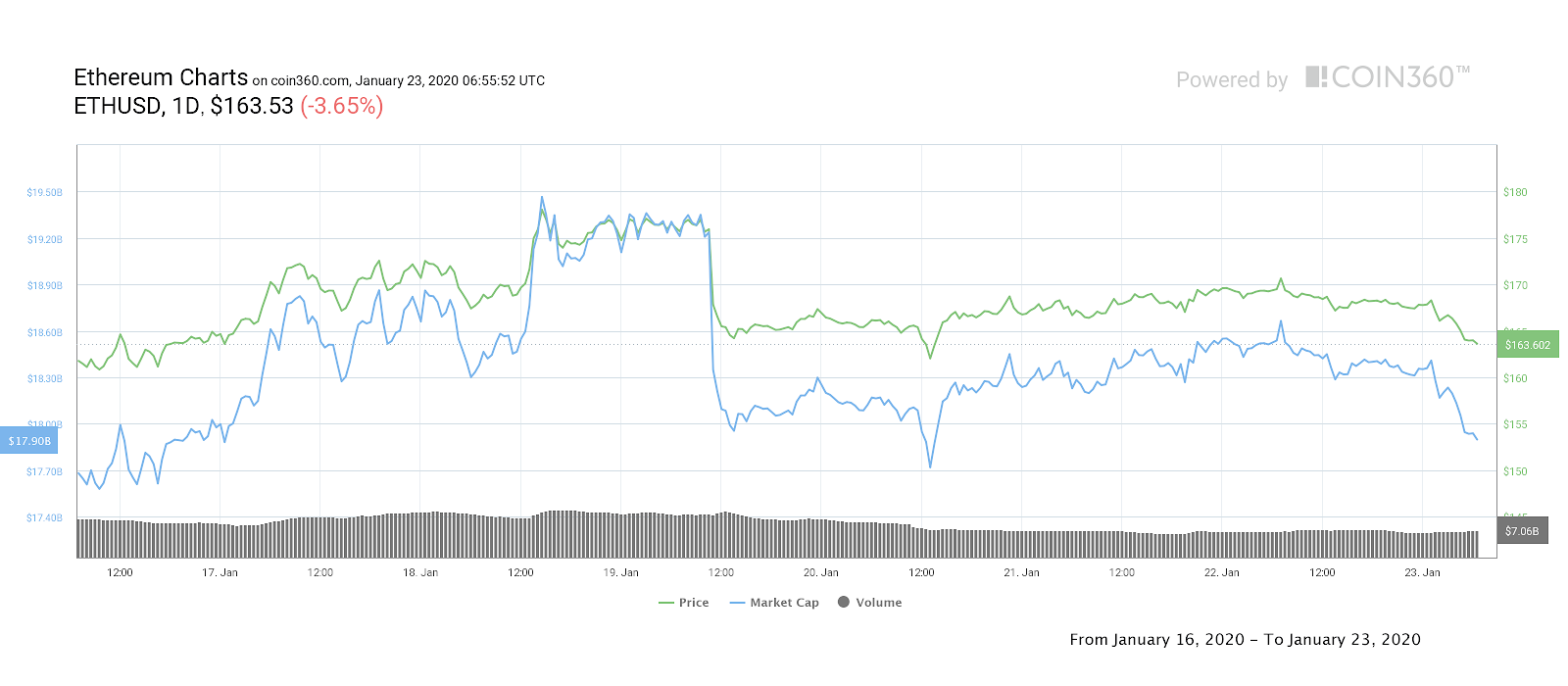

Ether (ETH), the largest altcoin by market cap, meanwhile shed 3.3% to trade at $164.

Ether 7-day price chart. Source: Coin360

The overall cryptocurrency market cap was $235.4 billion, with Bitcoin’s share at 66%.