Key Notes

- Bitcoin price retraced below $105,000 on June 18, as bulls struggled to maintain early momentum from European trading hours.

- Miner wallets have offloaded 30,000 BTC since May 27, according to IntoTheBlock data.

- BTC 24-hour peak presses against the Keltner channels mid-band confirming major short-term resistance at the $105,800 level.

Bitcoin price retraced towards $104,800 in early US trading down 2% from the 24-hour peak of $105,500. On-chain data trends show active selling pressure from miners continues to dampen BTC rebound prospects.

Bitcoin Faces Resistance at $105,500 as Miners offload 30,000 BTC

Bitcoin

BTC

$104 840

24h volatility:

0.2%

Market cap:

$2.08 T

Vol. 24h:

$30.67 B

price action on Wednesday reflects growing caution as investors react to escalating tensions in the Middle East. Amid a positive start in the European trading session, Bitcoin initially gained 0.5% rising to a daily timeframe peak of $105,500.

However as US trading opened, BTC saw a flurry of sell-orders, with price retracing towards $104,500 at press time, according to Binance trading data.

While short-term traders maintain a cautious outlook, a closer look at on-chain metrics shows active selling frenzy among Bitcoin miners.

Validating this stance, Miner reserves’ data from Sentora’s IntoTheBlock shows changes in balances held by recognized miner wallets and mining pools over the past month.

Bitcoin miners reserves | June 2025 | Source: IntoTheBlock

As seen above, BTC miners held an aggregate balance of 1.94 million BTC as of May 27. That figure has declined over the last three weeks, hitting 1.91 million BTC at press time. This implies that the Bitcoin miners have offloaded 30,000 BTC worth approximately $3.2 billion within the last 20 days.

Based on recent news reports, the rising geopolitical tensions has sparked expectations of higher energy costs and mining difficulty surge —prompting the current selling frenzy among miners.

Despite global demand from institutional investors, miners offload newly-mined BTC on the market, effectively inflating short-term market supply, exerting downward pressure on prices. This may explain why BTC price has failed to advance after briefly retaking the $105,000 level earlier on Wednesday.

BTC Price Forecast: KC Indicator Nullfies $110K Rebound Prospect

The daily chart shows BTC hitting intraday resistance at the midline of the Keltner Channel (KC) currently near $105,800, reinforcing this level as a short-term ceiling.

Bitcoin price forecast | June 18, 2025 | Source: TradingView

With miner wallets inflating short-term supply by $3.2 billion in the last 20 days, further outflows may further compound the downside risks.

Failure to reclaim $105,800 increases the probability of a slide toward $100,020, the KC lower band. A daily close below that support may expose BTC to deeper retracement toward $96,000–$94,000.

On the upside, a breakout above $105,800 could open the door to a retest of $111,636, at the KC upper band, which also aligns with the June local top. However, BTC markets will require a sustained volume uptick to fuel this move.

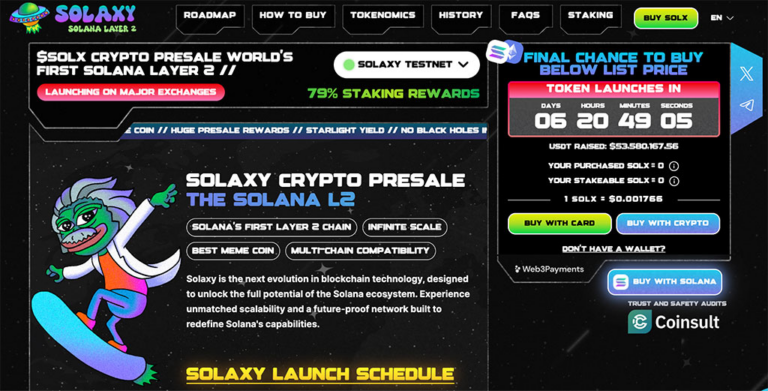

As BTC Struggles for Momentum, Solaxy ($SOLX) Draws Investor Attention

While Bitcoin battles to hold above the $104,000 mark amid mounting resistance and miner sell-offs, investor focus is shifting toward emerging projects with high-growth potential like Solaxy ($SOLX).

Solaxy is a next-gen Layer 2 network purpose-built to supercharge Solana’s ecosystem.

Solaxy presale

Solaxy tackles Solana’s recurring congestion by offloading much of the transaction volume off-chain, boosting efficiency and throughput — all while maintaining the base-layer security and decentralization Solana offers.

Currently priced at $0.001766, Solaxy has already raised over $52.96 million in its presale, which is now entering its final phase. Early buyers can also stake $SOLX tokens at an impressive 79% APY.

To buy $SOLX at the current price of $0.001766, proceed to the official Solaxy website and connect a supported wallet like Best Wallet.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.