Key points:

-

Bitcoin selling pressure increases as US stocks dip at the Wall Street open.

-

BTC price almost hits $113,500 as over $100 million in longs gets liquidated in an hour.

-

ETF flows are now key as onchain fundamentals start “weakening.”

Bitcoin (BTC) fell to near two-week lows at Tuesday’s Wall Street open as US selling pressure surged.

BTC price action “not a sign of strength”

Data from Cryptox Markets Pro and TradingView showed BTC/USD dropping beneath $114,000.

Bitcoin and altcoins fell with US stocks, with the Nasdaq Composite Index down 1.2% at the time of writing.

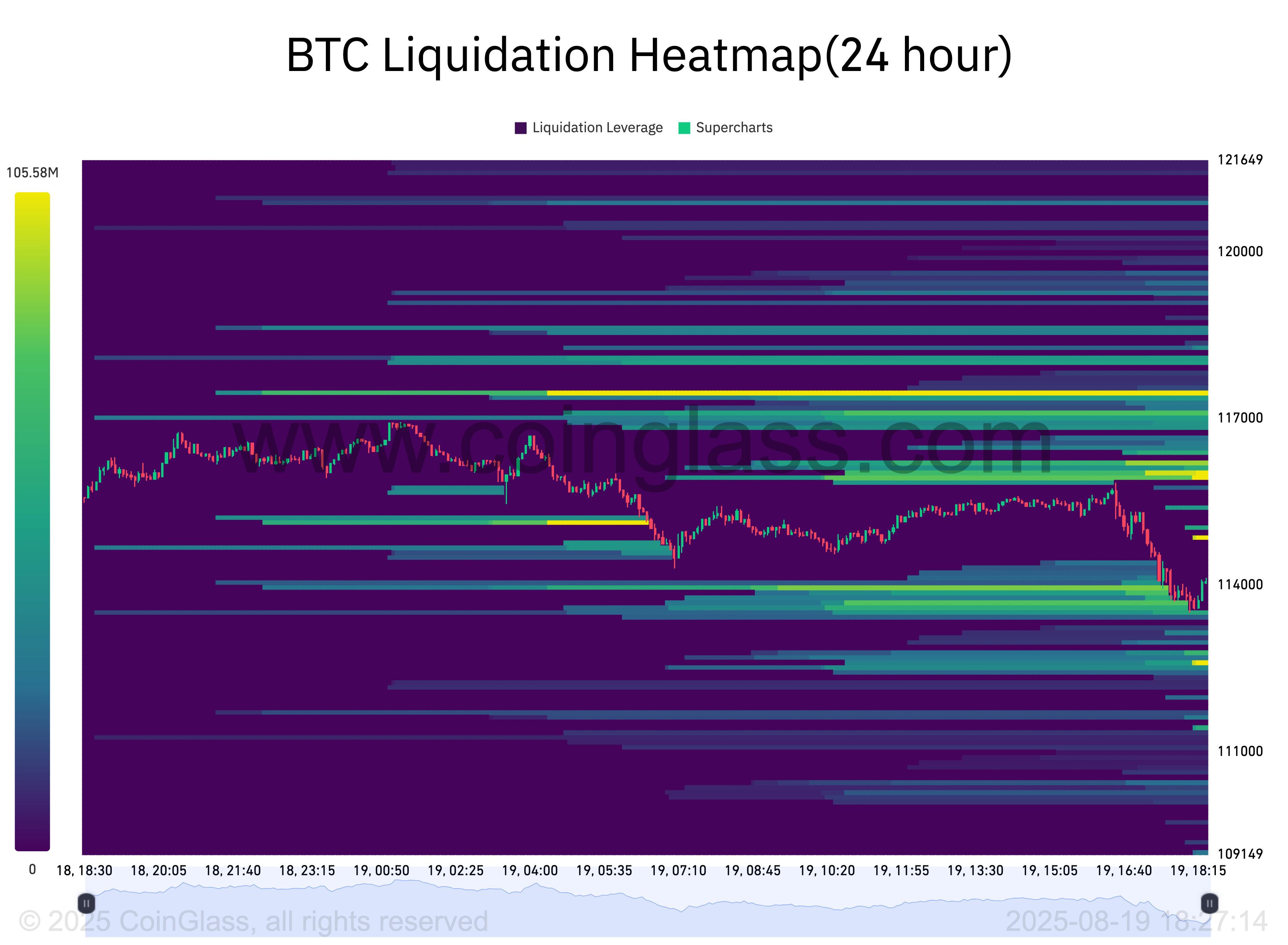

Long BTC positions, subject to an ongoing squeeze, added another $116 million to their liquidation tally in an hour.

Data from CoinGlass also showed bids lining up around the $112,000 mark — already a point of interest for market participants.

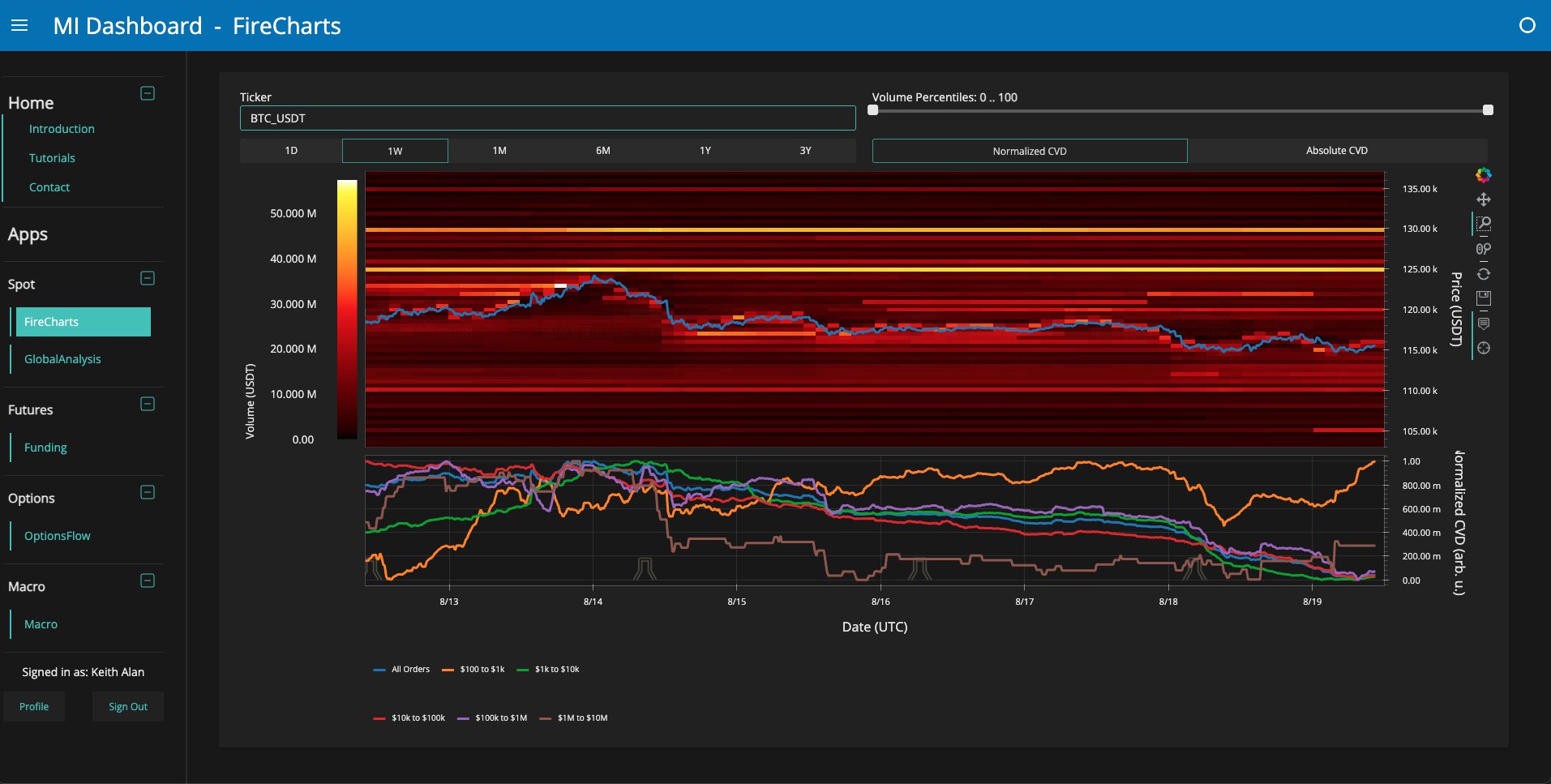

“TLDR: The $107k – $110k range is coming into focus,” Keith Alan, cofounder of trading resource Material Indicators, summarized in part of his latest post on X.

“This is not a sign of strength for $BTC. The downward pressure is palpable, but bulls are trying to find their footing.”

Alan flagged the 100-day simple moving average (SMA) at $110,950 as a potential support barrier, with the 50-day counterpart at $115,875 now important to reclaim.

On exchange order books, Material Indicators identified a $25 million band of liquidity at $105,000 — “plunge protection” against a deeper market rout.

“This bid liquidity does not look like it aims to get filled. It was placed to heard liquidity upward. If it fails to accomplish that and price reverts, I expect it to get rugged or moved before it gets filled,” it commented alongside a chart of liquidity and whale order volume.

Bitcoin ETF demand in the spotlight

In the latest edition of its Market Pulse updates, onchain analytics firm Glassnode meanwhile highlighted a growing divergence between institutional demand and price action.

Related: Bitcoin won’t go below $100K ‘this cycle’ as $145K target remains: Analyst

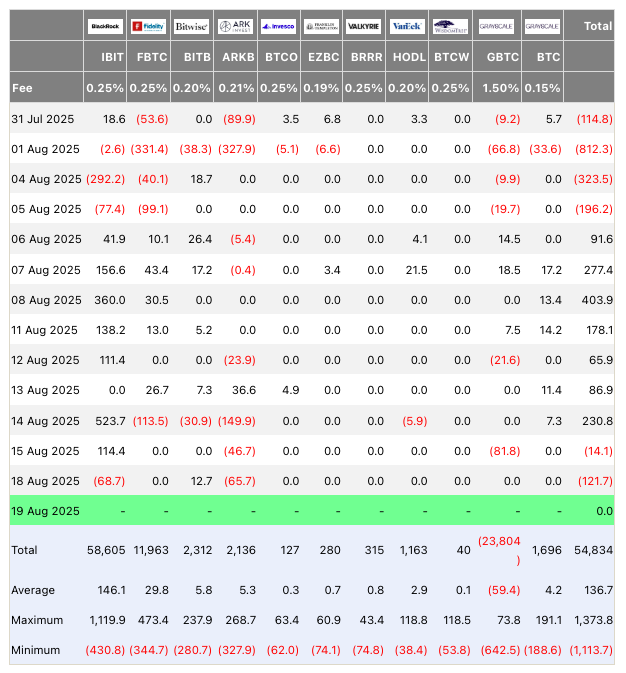

Investment vehicles, notably the US spot Bitcoin exchange-traded funds (ETFs), were seeing inflows despite “weakening” onchain signals such as volume.

“With profit-taking on the rise, the sustainability of institutional flows and renewed buyer conviction in both spot and futures will determine whether this contraction stabilizes into fresh upward momentum or extends into deeper consolidation,” it reported.

The ETFs recorded a net outflow of $121 million on Monday, per data from UK investment firm Farside Investors. The largest ETF offering, BlackRock’s iShares Bitcoin Trust (IBIT), saw its first outflows since Aug. 5.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.