Key takeaways:

• Analysts from VanEck, Fundstrat, and Standard Chartered forecast a 2025 BTC top between $180,000 and $250,000, citing institutional adoption and historical market cycles.

• Rising global liquidity and record spot BTC ETF inflows have reinforced Bitcoin analysts’ most bullish price projections.

As Bitcoin (BTC) continues its bull run and sets new highs, one of the most pressing questions among investors is: how high can it really go?

Timing a market top is a notoriously tricky task. Mastering the art of “buy low, sell high” demands both conviction and precision, especially when expectations for a new all-time high are mounting. In this phase of the cycle, old and new forecasts offer value: the former help contextualize the big picture, while the latter reflect today’s evolving macro and market dynamics.

And timing matters. If Bitcoin tops in 2025, should investors cash out entirely in fear of another brutal crypto winter, or will this time be different?

Top Bitcoin price projections in 2025

The first round of price targets emerged in late 2024 and early 2025, when Bitcoin broke above $90,000. Analysts from VanEck, Galaxy Digital, and Fundstrat began sharing forecasts in the $180,000–$250,000 range, mainly citing historical price cycles, institutional adoption, and regulatory tailwinds as the primary catalysts.

A fresh surge in spot Bitcoin ETF inflows and the growing realization that global liquidity is expanding are new reasons backing BTC price estimates. As BitMEX co-founder Arthur Hayes noted, “Bitcoin trades solely based on the market expectation for the future supply of fiat,” and those expectations are soaring.

Interestingly, many of the predictions made at the end of 2024 remain unchanged in May 2025. That’s because the core assumptions—rising institutional demand and pro-crypto regulatory signals—have largely played out as expected. Newer macro developments have only reinforced the case.“Liquidity” has become the buzzword among analysts, as it becomes increasingly clear that Treasury yields remain stubbornly high and a debt crisis is approaching.

As The Bitcoin Layer author Nik Bhatia noted,

“Bitcoin rose with yields in 2021, on growth, stimulus, and reflation. It’s rising with yields again in 2025. But this time, the context is different. It’s not optimism driving this move, it’s a search for neutrality.”

Will a crypto bear market start in 2026?

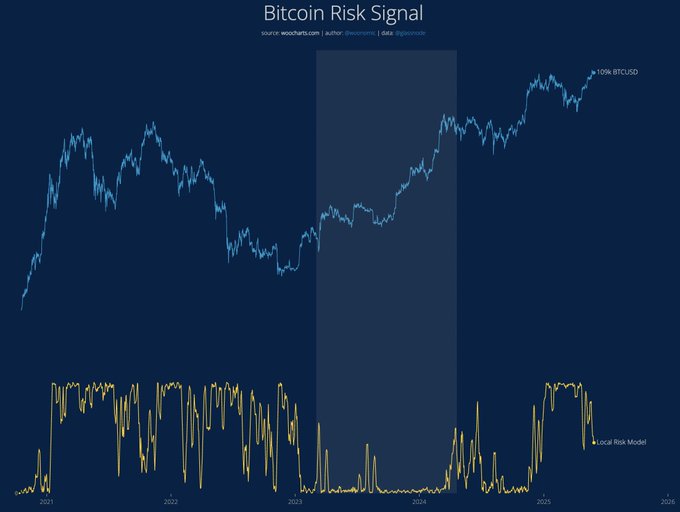

Most analysts agree that Bitcoin is firmly in a bull market. Onchain analyst Willy Woo recently pointed to the “Risk Signal” trending downward, suggesting buy-side liquidity continues to dominate the broader environment. The last time this occurred, between 2023 and 2024, Bitcoin gained over 200%. “We are setting up for another solid run on the long time frame,” Woo wrote.

However, many Bitcoin market cycle-based models anticipate a sharp correction in 2026, possibly leading to a full-blown crypto winter. Still, even that logic is being questioned. “BTC is global macro this cycle,” Woo warned.

“Don’t necessarily bet on nicely manicured 4-year cycles. BTC is transitioning. Internal forces, the halving is getting weak, and global liquidity powers BTC. Hence, BTC is becoming the canary in the coal mine for global macro moves.”

Related: Crypto has a structural optimism built to withstand crises

From a macro lens, the setup looks more fragile than ever, indeed. As crypto analyst Stack Hodler noted, the Trump administration’s attempt to lower 10-year yields—using tariffs and spending cuts to signal fiscal discipline—has fallen short. Now, the US deficit is set to rise. History is repeating: mounting debt, currency devaluation, and a global financial reset. As the analyst put it,

“There’s still ~$7 trillion sitting in money market funds. All of that will eventually rush into something that can’t be printed. And as the only credibly finite store of value asset which has consistently outperformed… Bitcoin will ultimately be the biggest winner.”

That capital, once unleashed, could fuel a much larger move than most 2025 projections currently anticipate. Joe Burnett of Unchained even posits a coming “sovereign race” to accumulate Bitcoin, possibly driving its price to $1 million by 2030. Cathie Wood’s ARK Invest sees a wide band of potential between $500,000 and $2.4 million.

These numbers may seem extreme. But in a world where the US debt spiral shows no signs of slowing—and where fiat stability is increasingly questioned—they are no longer easy to dismiss. As the case for Bitcoin continues to strengthen, the market may only be beginning to price in its role in the coming financial realignment.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cryptox.