Bitcoin (BTC) plans to move higher and further squeeze bears in the short term, several price indicators suggest.

As the week begins, a group of measurements — some surprisingly accurate historically — are combining to make traders firmly bullish on BTC.

Guppy repeats April 2019 bull signal

Leading the positive signs is a useful but somewhat forgotten indicator dubbed the Guppy. This is a collection of exponential moving averages which has flashed green on the daily chart for the first time in around 300 days.

The interval is significant — the last flip from red to green for Guppy was on April 9, 2019, coinciding with Bitcoin’s rapid rise to highs of $13,800.

Before that, Guppy also turned bullish on Jan. 14, 2018, when Bitcoin briefly rose above $9,000 on the way down from the all-time high a month earlier.

Bitcoin’s Guppy indicator bull and bear phases. Source: Hsaka/ Twitter

Puell Multiple: Mined Bitcoins almost cost too little

A second sign that bullish momentum is building for Bitcoin lies in the so-called Puell Multiple.

Used to identify the cryptocurrency’s price cycles, the tool allows traders to tell from a miner’s perspective when the value of newly-mined Bitcoins is historically too high or too low.

Puell spiked during the 2017 highs, bottoming a year later in January 2019 when BTC/USD traded at under $4,000.

At present, the indicator suggests Bitcoin is significantly closer to the “too low” area than its lifetime highs.

Bitcoin Puell Multiple with peaks and troughs highlighted. Source: Glassnode/ Twitter

$8K flips from resistance to support

Zooming in, steady enthusiasm is already creeping into traders’ forecasts once again. For regular CryptoX contributor Michaël van de Poppe, current action means $8,000 has now formed a fresh support level.

BTC/USD has gained around 3.8% since Friday, having bounced off local lows around $8,200.

“Nice breakthrough of $8,600 level and we’re back in the range. This means that the $8,000-8,100 level has now flipped as support,” he summarized in a Twitter update on Jan. 27.

Van de Poppe continued:

“Eyeing to see a retest of $8,500. Holding that and we can aim for $8,900.”

Mayer Multiple hints at a firm buying opportunity

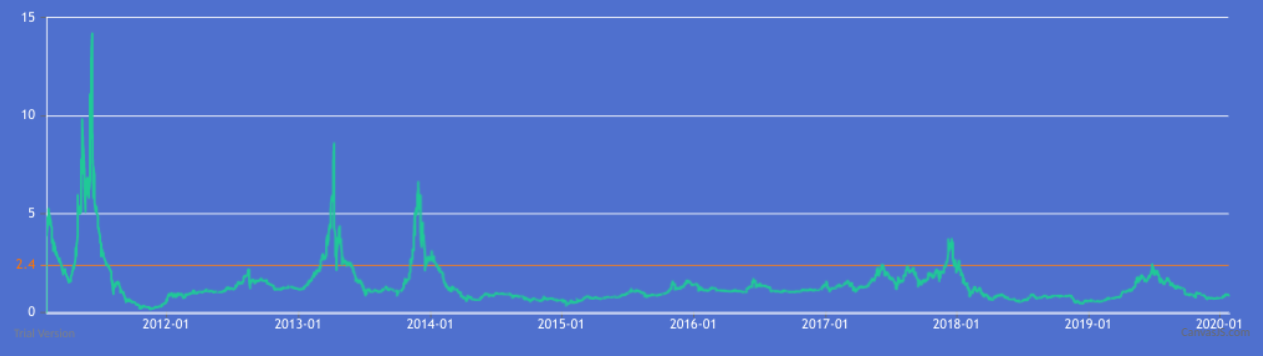

A classic guidance signal for Bitcoin comes in the form of the Mayer Multiple, which is also firmly supportive of Bitcoin as a buying opportunity this week.

The brainchild of Proof of Keys organizer, Trace Mayer, the Mayer Multiple divines to what extent it is profitable to buy Bitcoin at a particular time.

To arrive at its conclusions, it uses the current Bitcoin price versus its 200-day moving average. When the multiple is below 2.4, Mayer says, long-term Bitcoin buys saw “the best long-term results.”

The current multiple is 0.97 and has been higher 63% of the time since Bitcoin was created eleven years ago.

Bitcoin Mayer Multiple with 2.4 boundary highlighted. Source: Mayermultiple.info