Bitcoin (BTC) and the wider cryptocurrency market fell under as equities markets pulled back at the closing bell after minutes from the Federal Reserve’s December FOMC meeting showed that the regulator is committed to decreasing its balance sheet and increasing interest rates in 2022.

As stock markets corrected, BTC price followed suit by dropping below $44,000, setting off a cascade of liquidations that reached $222 million in less than an hour.

Data from Cryptox Markets Pro and TradingView shows that after oscillating around support at $46,000 for the past couple of days, Bitcoin was hit with a wave of selling that pulled the price to an intraday low of $43,717.

Based on the current situation, it is widely expected that the Fed will begin raising its benchmark interest rate in March, “which would mean that balance sheet reduction could start before summer.”

Here’s a look at what crypto analysts are saying about the latest Bitcoin price drop in BTC and what could be in store in the weeks ahead as the easy money policies of the Fed come to an end and interest rates start to rise.

Capitulation looms below $44,000

A foreshadowing of Jan. 5’s pullback was offered by crypto analyst and pseudonymous Twitter user Rekt Capital who posted the following chart highlighting the “many similarities between this BTC range and May 2021.”

Rekt Capital said,

“Both saw BTC consolidate inside two Bull Market EMAs (i.e., green 21-week & blue 50-week EMA). If BTC is to repeat history, a capitulation event could take place where BTC briefly deviates below the blue 50 EMA.”

BTC needs to reclaim $46,000

A more in-depth look at the price action from May was offered by analyst and Cryptox contributor Michaël van de Poppe, who posted the following chart detailing how BTC performed during the last sharp market pullback.

van de Poppe said,

“And the scenario of the drop beneath $46K is taking place on Bitcoin here. The question becomes will we be hanging here, taking the liquidity & breaking back above $46K? In that case, the bottom is in.”

Should the price not break back above $46,000, the market could be in for an extended bear period that has the potential to see BTC retrace to the low $30,000 range.

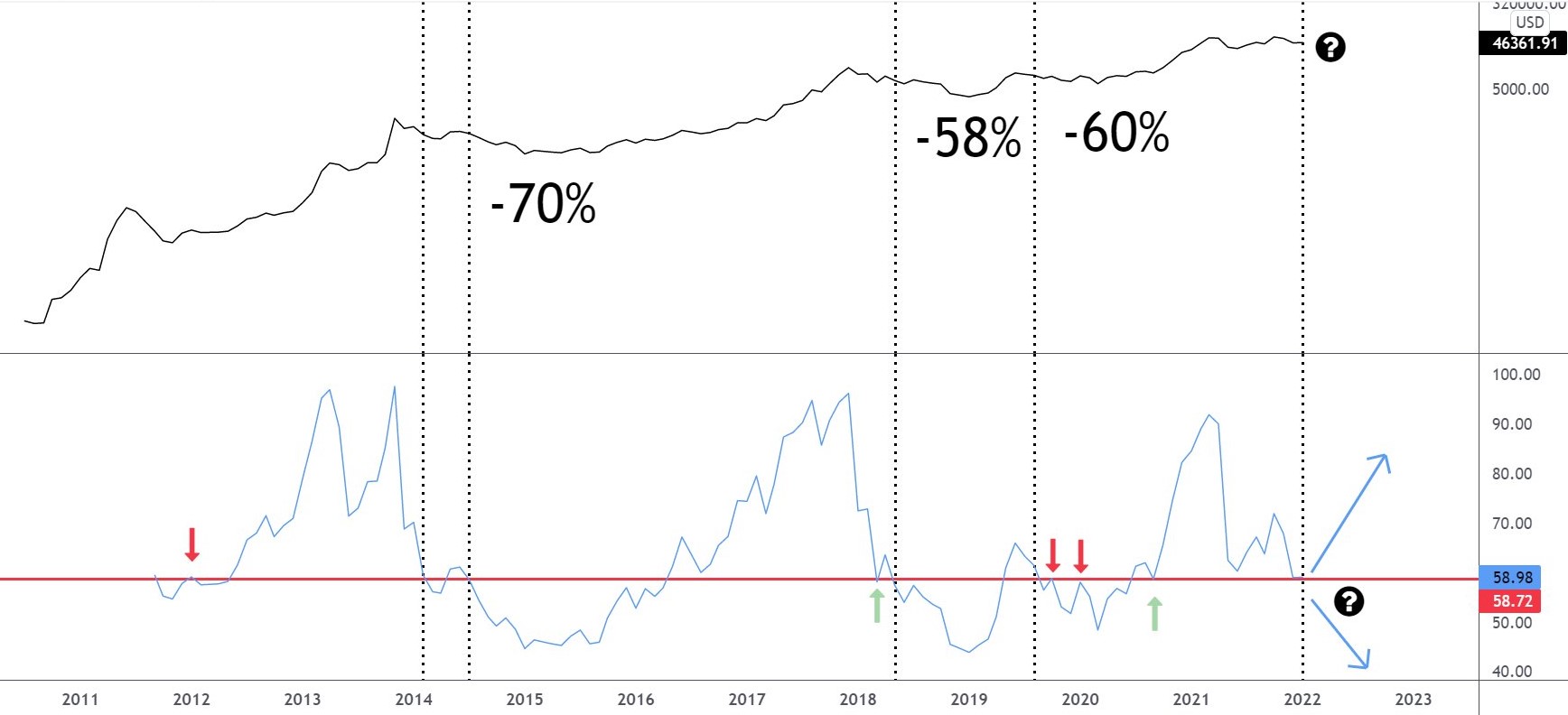

The scenario currently facing the market was succinctly addressed in the following chart posted by options trader and pseudonymous Twitter user Nunya Bizniz.

Nunya Bizniz said,

“BTC monthly: Drops below the current RSI level have been ugly. This time?”

The overall cryptocurrency market cap now stands at $2.123 trillion and Bitcoin’s dominance rate is 39.4%.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cryptox.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.