Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

A wave of confusion has swept the crypto market after a cyber security blunder on the U.S. SEC’s X account. Currently, Bitcoin is trading at $45.9K, with the decision on the ETFs still uncertain.

Let’s take a look at how the Bitcoin price could react next.

Apprehension grows amid ETF false start

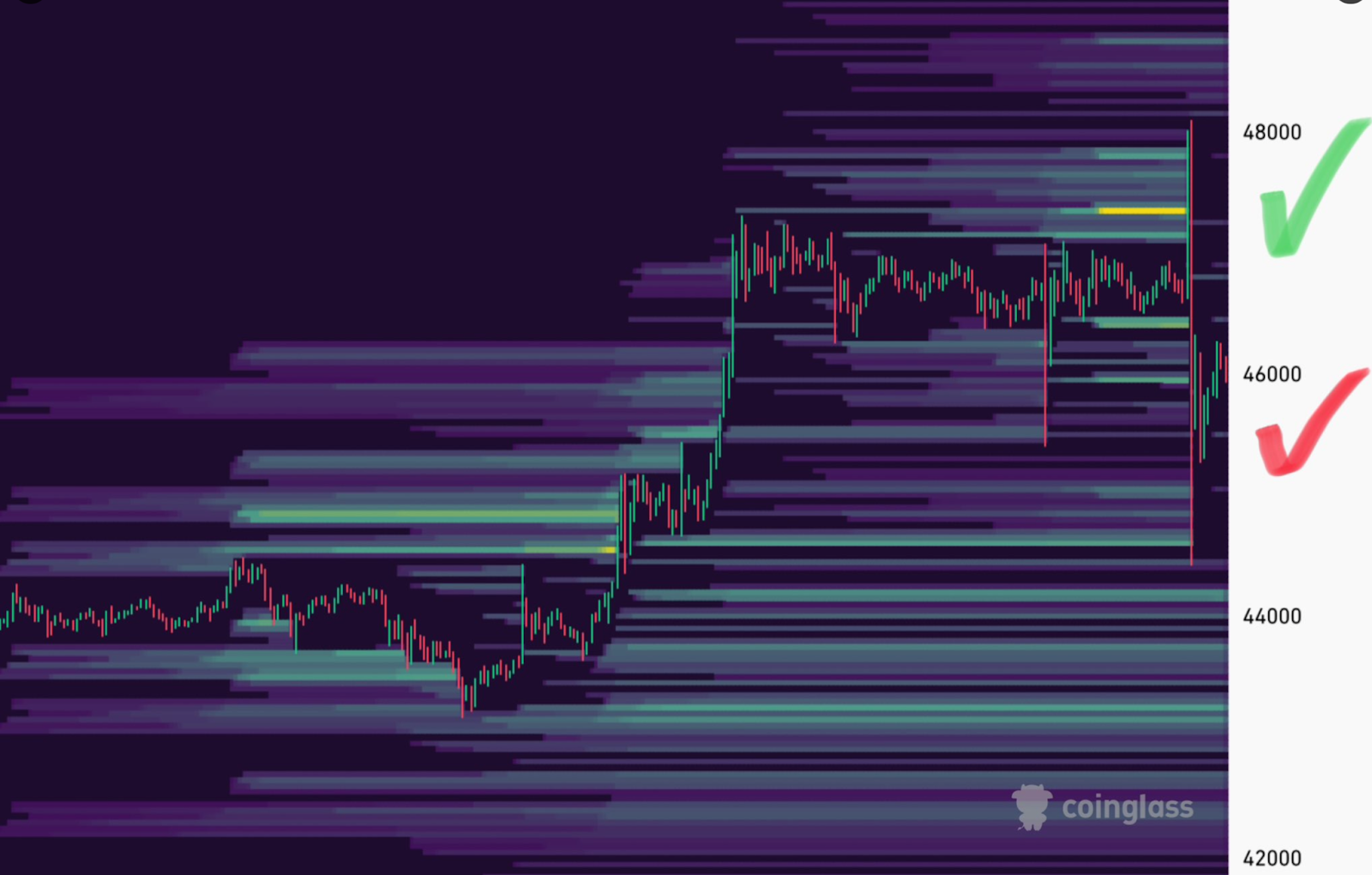

On Jan. 9, the official U.S. SEC X account “falsely” announced that they had approved all the Bitcoin ETF applications. This news pushed the Bitcoin price to around $47.9K.

However, the excitement was short-lived as uncertainty and confusion set in, and the price quickly dropped to $45.4K within five minutes.

Unfortunately for Bitcoin bulls, the SEC redacted its statement, claiming its account was hacked.

In an investigation, X users discovered that the SEC account had been hacked by an unknown individual who gained control over a phone number associated with the account through a third party.

It was also found that the account did not have two-factor authentication (2FA).

However, market sentiment remains skeptical about the motive behind the attack.

Analyst British HODL believes it was an SEC employee mistakenly announcing a decision early or a backhanded market manipulation tactic by the agency.

Yet, the volatility caused by the disruption injected a spark of optimism for some speculators.

CC15CAPITAL noted, “the fake Bitcoin ETF tweet wiped out all the leveraged longs and all the leveraged shorts. It’s all clear now to $50,000 and beyond.”

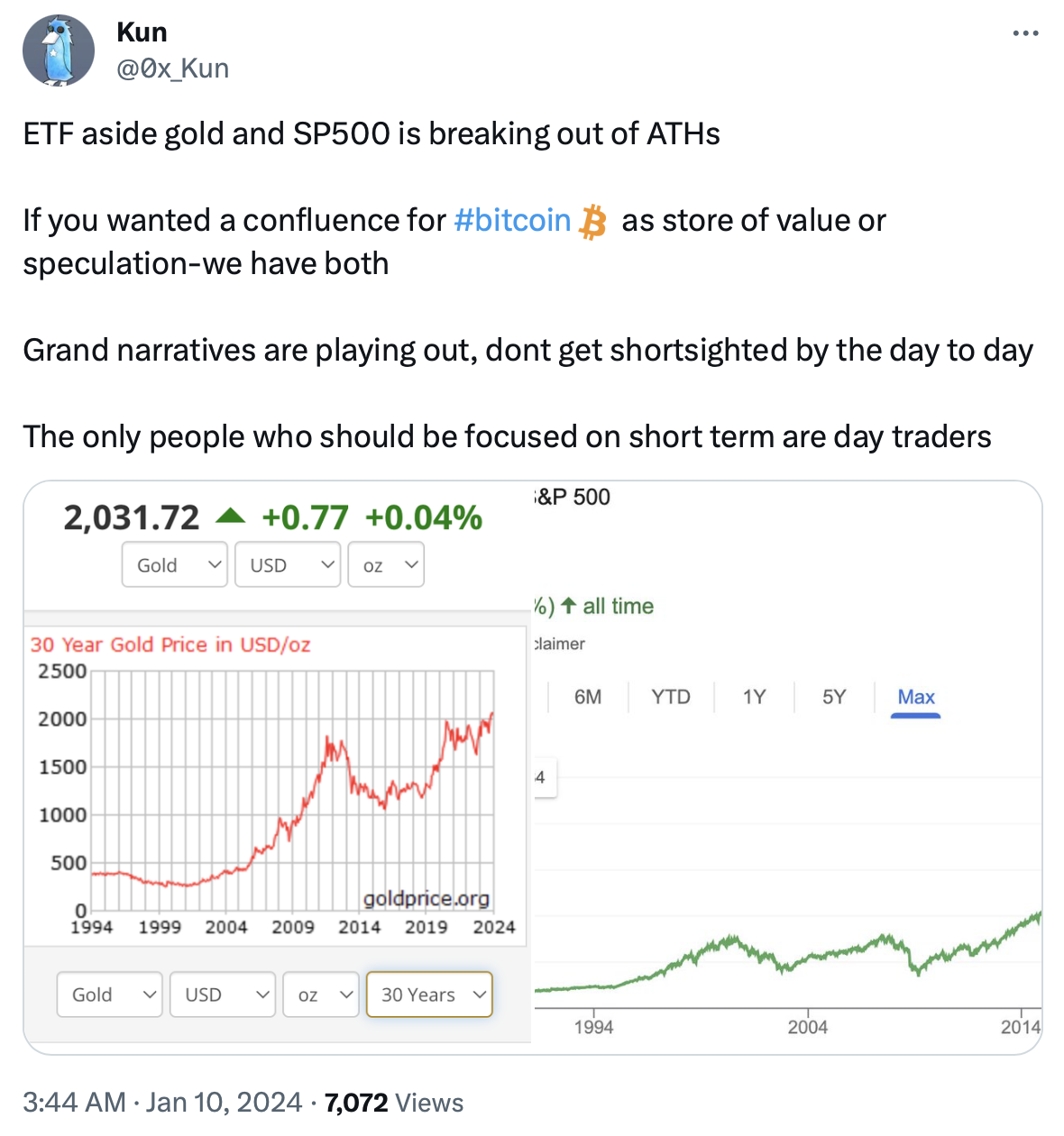

Following the SEC’s woe, analyst Kun highlighted the strength of other risk assets.

Kun stated gold and the SP500 have recently broken all-time highs, implying Bitcoin’s upcoming trajectory will also be bullish.

He also warned inventors not to “get short-sighted by the day-to-day,” insisting that this should be left for day traders.

However, Samson Mow pointed out that the recent announcement could create a sense of hesitancy in the market.

It’s important to note that the market’s response to the SEC’s announcement may not be as strong as it would have been if the hack had never happened.

However, despite the turbulence, a few altcoins are still performing well. Among them is Bitcoin Minetrix which has raised over $8 million in its presale.

Bitcoin Minetrix presale hits $8 million in presale

Bitcoin Minetrix is a crypto project on Ethereum that allows users to mine Bitcoin.

To do this, users stake its BTCMTX tokens, redeeming them for Bitcoin mining credits, which can be burned for BTC cloud mining power.

Anyone can get started with Bitcoin mining, regardless of their technical knowledge or the availability of expensive hardware.

Additionally, the use case eliminates the risk of cloud mining scams, which have become a major concern in the industry.

Bitcoin Minetrix offers a more environmentally friendly way to mine Bitcoin without space and noise constraints.

BTCMTX plays a central role in operations and provides user benefits that could drive demand.

Meanwhile, the BTCMTX supply will be limited as many tokens are locked for staking rewards that mostly pay out in mining credits rather than the token itself.

This combination of rising demand and constrained supply could positively impact prices.

Analyst Jacob Bury backs the coin to rally. Meanwhile, the project has been featured in leading outlets, including crypto.news.

Currently, the Bitcoin Minetrix presale price is $0.0127.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.