Bitcoin (BTC) has seen an impressive 8% surge since Monday, solidifying $100K as a strong support level. After weeks of volatility and uncertainty, BTC has now reclaimed key levels and is pushing toward an all-time high (ATH) retest. Investors and analysts alike are closely watching Bitcoin’s next move, as bullish momentum continues to build.

Related Reading

Top analyst Axel Adler shared insights revealing that Bitcoin continues to flow out of exchanges, a sign that long-term holders are accumulating. This trend is reducing available supply, which historically has been a key driver for price appreciation in bull cycles. With fewer BTC available for trading, demand pressure could accelerate, potentially fueling a breakout into price discovery.

Now that Bitcoin has regained critical resistance levels, traders are eyeing a push above ATH, which would confirm the next major leg of the bull run. However, market participants remain cautious, as BTC must hold above key levels to sustain its uptrend. The coming days will be crucial in determining whether Bitcoin can continue its climb or enter another consolidation phase before making a decisive move.

Bitcoin Holds Strong Above $105K

Bitcoin (BTC) has experienced high volatility in recent weeks, yet strong price action continues to defy negative market sentiment. After testing key support levels, BTC is now trading above $105K, showing resilience as it looks ready to push above all-time highs (ATH). Investors remain optimistic about Bitcoin’s long-term trajectory, with many expecting a bullish year ahead.

Related Reading

Yesterday’s Federal Reserve meeting added to the positive market sentiment, giving BTC the momentum needed to shift back into an upward trajectory. With institutional and retail demand rising, Bitcoin remains the leading asset poised for another breakout.

Crypto expert Axel Adler shared valuable insights on X, highlighting that a negative Netflow-to-Reserve ratio is a bullish signal. He pointed out that the largest BTC outflow from exchanges occurred at the Bear Market bottom in January 2023, marking strong buying activity and the first accumulation phase of the bull cycle. In 2024, peak buying activity was observed at the $100K level, reinforcing strong demand despite a slight decline in volume.

The key takeaway is that Bitcoin continues to flow out of exchanges, reducing supply and fueling further price appreciation. If demand remains strong, BTC could soon break into price discovery, setting the stage for new all-time highs.

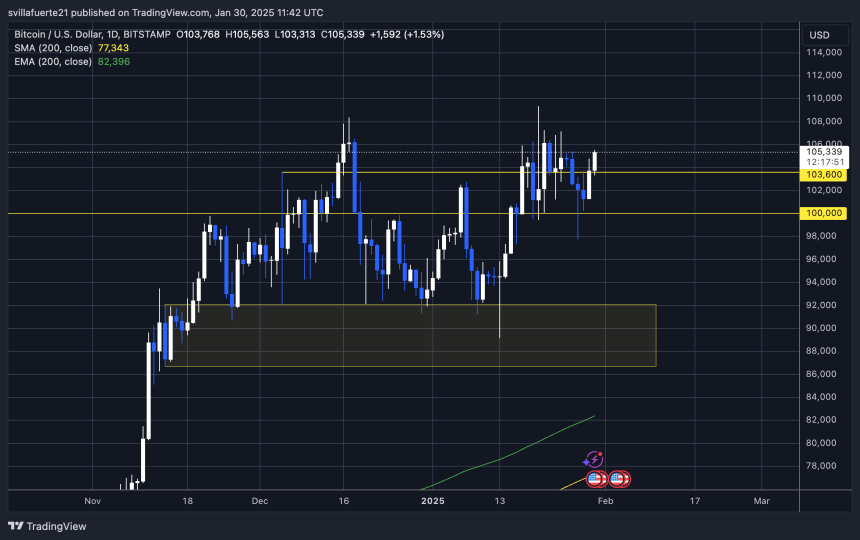

BTC Testing Last Resistance Below ATH

Bitcoin (BTC) is currently trading at $105,200, showing strong momentum as it inches closer to a breakout above all-time highs. The next key level to clear is $106K, which could trigger a move toward the highly anticipated $110K mark. If BTC pushes past ATH with conviction, it would confirm a bullish breakout, setting the stage for further price discovery.

However, bulls must defend the $103,600 level to sustain the uptrend. This price zone has been a critical support, holding Bitcoin in a bullish structure. Losing this level could signal short-term weakness, potentially sending BTC back to test the $100K mark.

Related Reading

For now, Bitcoin’s price action remains strong, and as long as $103,600 holds, momentum should continue to favor the bulls. With demand rising and exchange supply decreasing, BTC is in a prime position to push toward new highs. The coming days will be crucial, as traders watch for a confirmed breakout or a potential retest of key support levels.

Featured image from Dall-E, chart from TradingView