Bitcoin’s market value to realized value ratio has climbed to its highest level since early April 2022, potentially signaling that a long-term bottom is already in place for the cryptocurrency.

According to data from on-chain analytics firm Santiment, Bitcoin’s (BTC) market value to realized value (MVRV) ratio currently stands at 61.3% — its highest since April 2022. At the time, Bitcoin was trading around $43,000 after retreating from a local peak of approximately $48,000.

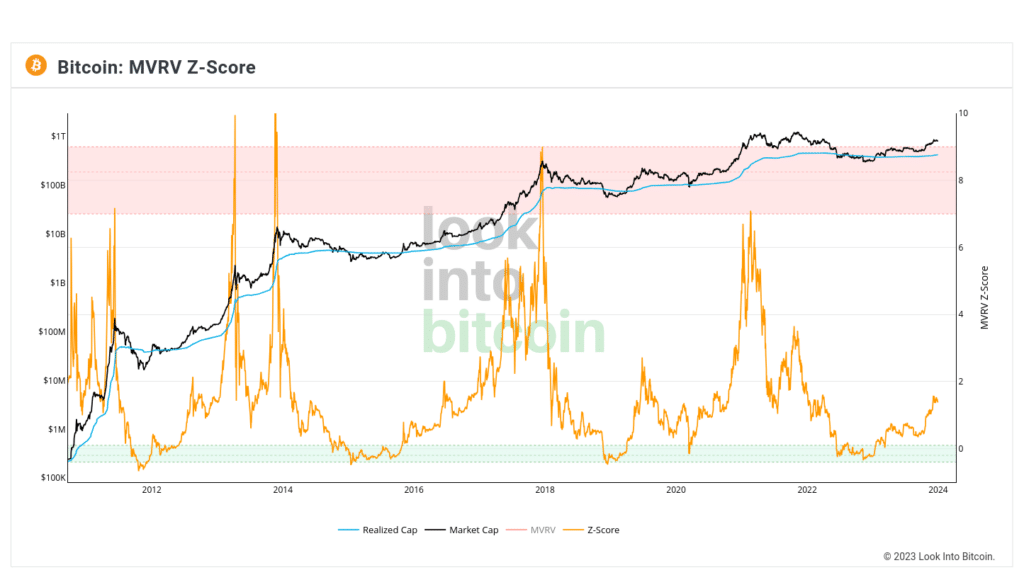

The MVRV ratio calculates Bitcoin’s market capitalization relative to its realized capitalization, representing all coins’ aggregate value at the price they last traded. High MVRV levels indicate Bitcoin’s market value is substantially above its realized value, suggesting possible overvaluation. Conversely, low MVRV levels signal Bitcoin is trading at a discount to its realized value, pointing to undervaluation and potential buying opportunities.

In addition to the rise in MVRV, Bitcoin’s MVRV Z-Score currently sits at 1.53 after departing the “buy zone” in January. The MVRV Z-Score utilizes standard deviation to identify extreme divergences between Bitcoin’s market value and realized value.

Historically, sustained Z-Score levels above 1 have coincided with cycle tops, while moves into negative territory have aligned with market bottoms. The current rise in MVRV coupled with the Z-Score leaving oversold levels implies the bottom is likely already set. However, as with any indicator based on historical data, past performance does not guarantee future results.