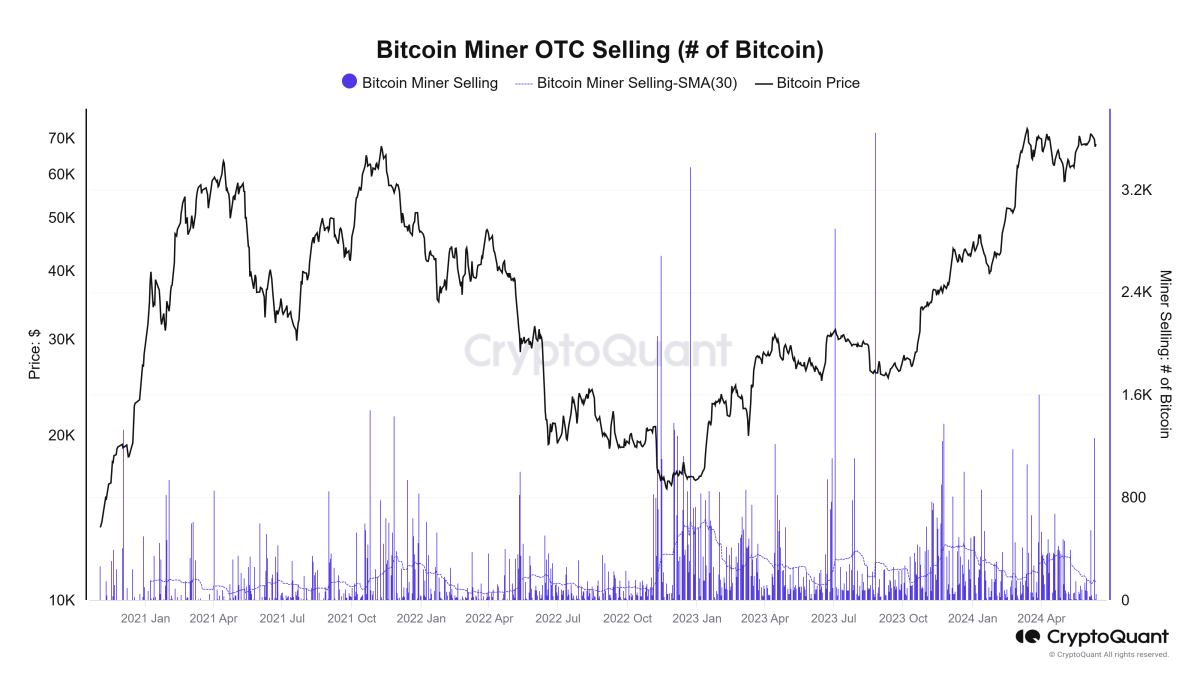

Recent data from CryptoQuant has highlighted a significant shift in Bitcoin Miners behavior, with miner reserves dropping to their lowest levels since 2010 while over-the-counter (OTC) selling activity has surged to higher levels.

What This Means For BTC

At the beginning of the year, miner reserves stood at approximately 1.87 million BTC but have yet to grow to about 1.81 million BTC today, a level not seen since 2010. This reserve decline is notable as it indicates a higher propensity for miners to sell off their holdings.

Typically, this could lead to increased market supply and potential price depreciation, but the scenario has unfolded differently this year.

Despite the drop in miner-held BTC, the value of these reserves remains high, buoyed by a nearly 150% price increase since October last year, keeping the total dollar value of miner holdings near all-time highs at over $130 billion.

Additionally, data from CryptoQuant indicates that Bitcoin miners’ over-the-counter (OTC) sales have peaked daily since March.

Bitcoin In The Spotlight

This miner activity comes amid broader market movements that have seen significant price fluctuations. BTC’s price has retreated by nearly 7% in the past day, dropping from a peak of $66,436 to around $65,269.

The decrease aligns with a general volatility trend that has recently characterized the crypto market. Analyst Willy Woo commented on the situation, indicating that BTC might not see new highs until the current phase of miner capitulation and market boredom resolves, which historically precedes a significant rally.

I know it sucks, but BTC is not going to break all time highs until more pain and boredom plays out.

On the bright side, miners are capitulating and when that is through, it nearly always ends in a huge rally.

Look for compressions in this ribbon. Buy and hodl in these regions. pic.twitter.com/MkPKk3AF47

— Willy Woo (@woonomic) June 19, 2024

Meanwhile, MicroStrategy, a major corporate backer of BTC, has continued its strategy of accumulating Bitcoin amidst these market conditions. Following a recent fundraising effort through the sale of $800 million in convertible notes, the company has added 11,931 bitcoins to its holdings.

This acquisition, conducted at an average price of $65,883 per bitcoin, brings MicroStrategy’s total holdings to 226,331 bitcoins, acquired at an aggregate cost of approximately $8.33 billion, reflecting an average price of $36,798 per bitcoin.

MicroStrategy has acquired an additional 11,931 BTC for ~$786.0M using proceeds from convertible notes & excess cash for ~$65,883 per #bitcoin. As of 6/20/24, $MSTR hodls 226,331 $BTC acquired for ~$8.33B at average price of $36,798 per bitcoin.https://t.co/jE9dGqqnON

— Michael Saylor

(@saylor) June 20, 2024

Featured image created with DALL-E, Chart from TradingView

(@saylor)

(@saylor)