Coinspeaker

Bitcoin Miner Reserves Peak at Two-Year High, Raising Price Drop Concerns

Bitcoin miner reserves have reached a two-year high, sparking concerns about a possible decline in Bitcoin market price. According to a recent report by CryptoQuant, these reserves have soared to 368,000 BTC, equivalent to around $22.36 billion.

Miner Reserves Hit Critical Levels

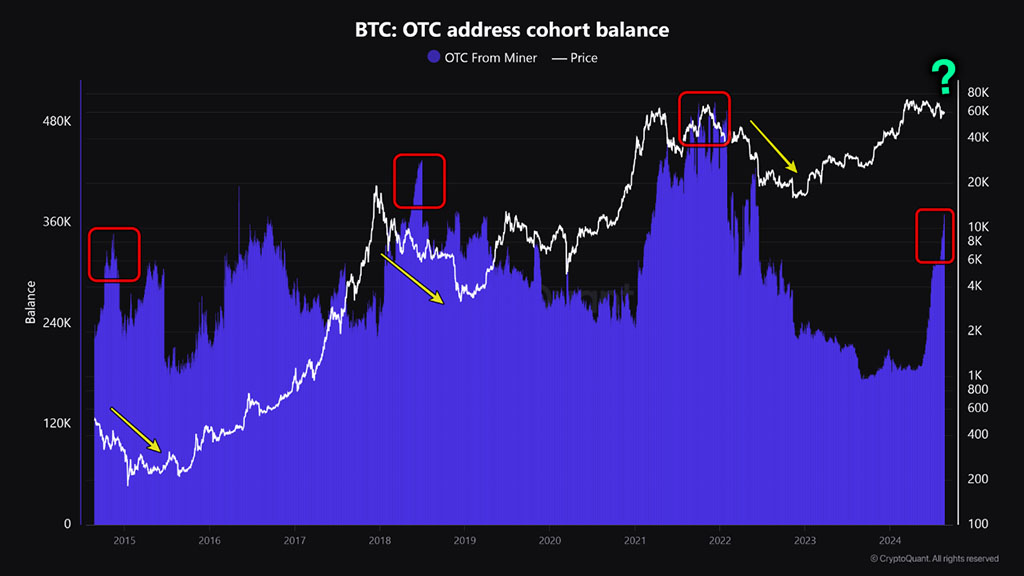

Historically, when miner reserves hit significant levels, it often signals a looming downturn in the cryptocurrency market. The CryptoQuant report highlights that Bitcoin reserves on over-the-counter (OTC) desks have jumped by more than 70% in the last three months, rising from 215,000 BTC in June to 368,000 BTC in August. Such a sharp increase suggests that miners may be preparing to offload large amounts of Bitcoin, potentially putting downward pressure on the market.

Analysts draw parallels to previous instances where similar surges in miner reserves preceded sharp price declines. For example, in May 2018, miner reserves topped 400,000 BTC when Bitcoin was valued at around $8,475. Within seven months, Bitcoin price plummeted by 63% to $3,183. A comparable situation occurred in November 2021 when reserves neared an all-time high of 500,000 BTC, and Bitcoin’s price fell from $64,000 to $35,058 in just two months.

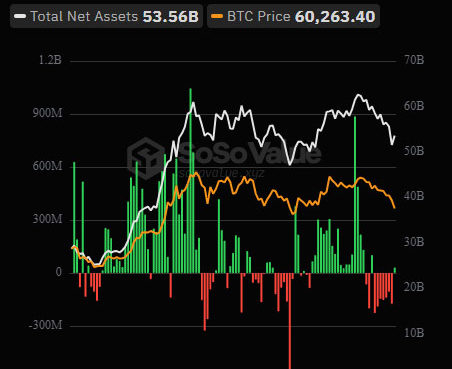

In the current market, the potential impact of miner sell-offs could be moderated by other factors. There has been a noticeable decrease in the amount of Bitcoin available on exchanges, indicating that some market participants might be withdrawing Bitcoin to hold long-term. Additionally, whales have accumulated nearly 94,700 BTC over the past six weeks, suggesting ongoing confidence in Bitcoin’s long-term value despite short-term uncertainties.

Future Outlook Amid Uncertain Conditions

Bitcoin’s future outlook remains uncertain based on current market dynamics. The surge in miner reserves comes at a challenging time for miners. Rising operational costs, coupled with reduced rewards following Bitcoin’s halving in April, have squeezed profit margins. With the current cost to mine a single Bitcoin estimated at $72,224 and the cryptocurrency trading around $60,797, many miners are operating at a loss. This financial strain could prompt more miners to sell their reserves, potentially leading to further price declines.

On the flip side, analysts have noted that macroeconomic factors, such as signals from the Federal Reserve suggesting potential interest rate cuts in September, could influence Bitcoin’s price. Lower interest rates generally make borrowing cheaper and reduce the returns on savings, encouraging investors to seek higher returns in riskier assets, including cryptocurrencies. This could increase demand for Bitcoin, potentially offsetting some of the selling pressure from miners. In previous periods of low interest rates, Bitcoin has seen significant price gains as investors looked for alternatives to traditional investments.

In this context, market participants should watch miner activities closely. While a significant sell-off could trigger a price drop, other market dynamics might soften the blow, leading to a more complex and nuanced outlook for Bitcoin’s near-term future.

Bitcoin Miner Reserves Peak at Two-Year High, Raising Price Drop Concerns