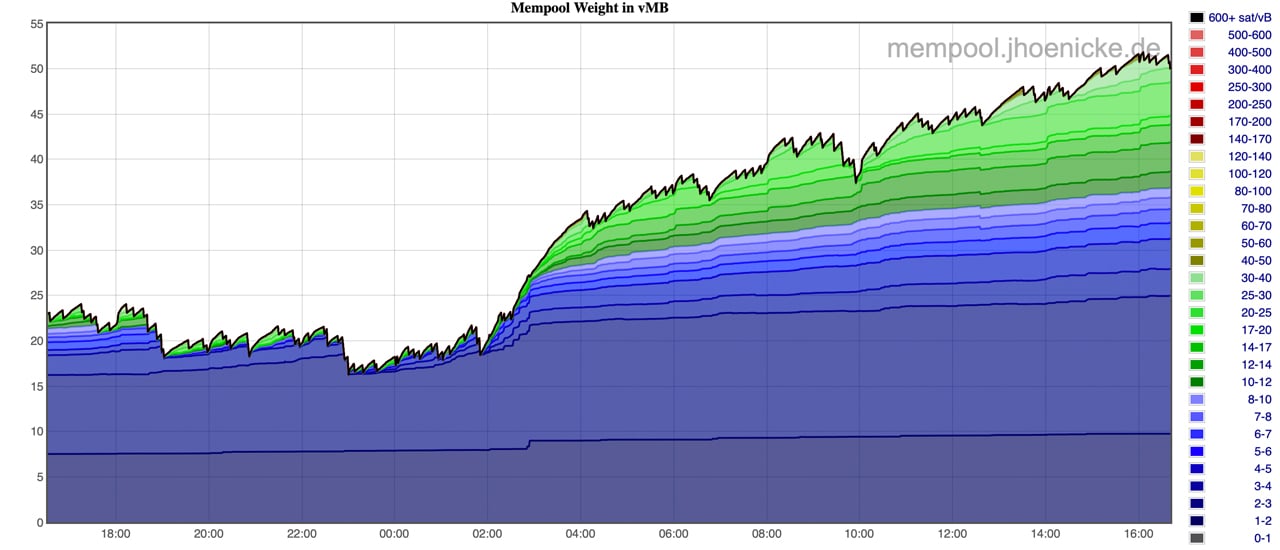

Amidst the buzz surrounding bitcoin’s latest price surge, a significant number of transactions are currently clogging up the mempool. As of writing, 134,986 unconfirmed transactions await confirmation, and block times are lingering above the usual ten-minute mark.

Bitcoin Transactions Backlogged as Mempool Reaches Higher Levels

On the morning of Wednesday, Cryptox.trade News brought to light the decrease in Bitcoin’s global hashrate over the past 24 hours, currently hovering just above the 300 exahash per second (EH/s) range. Meanwhile, block intervals have slowed down and surpassed the average ten-minute mark, with the most recent block taking a total of ten minutes and 50 seconds to be validated.

Even though bitcoin’s price initially soared past the $30K mark earlier today, by 4:00 p.m. Eastern Time (ET) on April 26, 2023, the value had regressed back to a low of $27,242. Since then, the price managed to jump back above the $28K zone. At present, the mempool remains packed with transactions, awaiting their turn to be confirmed.

In essence, the Bitcoin network’s mempool acts as a repository of unconfirmed transactions that must be incorporated in the next block of the blockchain. Every transaction in the mempool comes with its own unique transaction ID, fee, and other pertinent information. Since miners prioritize transactions that offer higher fees, users tend to compete by offering increased fees to expedite the confirmation of their transactions.

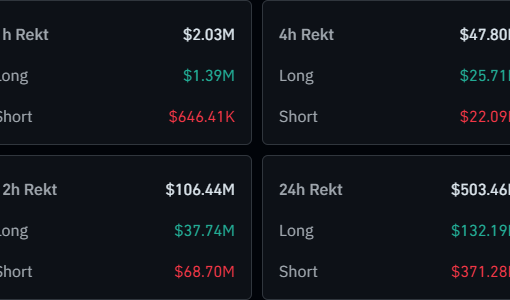

At 4:30 p.m. ET on Wednesday, data obtained from the web portal mempool.space reports 134,986 unconfirmed transactions. Meanwhile, transaction fees vary, with a no-priority transaction costing a 2 sat/vB or $0.08 per transaction, a low-priority transaction setting users back 29 sat/vB or $1.15 per transfer, and a high-priority transaction currently priced at 35 sat/vB or $1.38 per transfer.

Bitinfocharts.com supplies additional data indicating that the average fee for transactions today is 0.000072 BTC or $1.99 per transaction. The same website also reveals a median-sized fee of 0.000035 BTC or $0.97 per transaction.

What do you think could be the reason for the sudden surge in bitcoin transactions? Share your thoughts about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Cryptox.trade does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.