In an email dated Jan. 17, 1993, Hal Finney — a developer and early contributor to Bitcoin — shared the concept of “encrypted digital cards,” which are now known as nonfungible tokens (NFTs).

“Giving a little more thought to the idea of buying and selling digital cash, I thought of a way to present it,” Finney wrote at the time. “We’re buying and selling ‘cryptographic trading cards.’”

The most fascinating detail of his email lies in the fact that, by sharing this idea, Finney intended to facilitate the understanding of the concept of digital money. His vision foreshadowed what we saw in 2021 with the NFT boom. Overnight, the crypto space shifted from being solely about financial decentralization to also encompassing the decentralization of art, gaming, entertainment and more.

The narrative that was once theoretical and pushed forcefully became practical and part of the daily culture of millions of people who had never considered buying cryptocurrencies before. And with the introduction of the Ordinals protocol in early 2023, we are witnessing the emergence of such cases.

Related: Bitcoin fragments could become more valuable than full Bitcoins

However, this movement is not being well-received by some “red-eyed guardians.”

The Wizard JPEG that sparked a civil war in Bitcoin

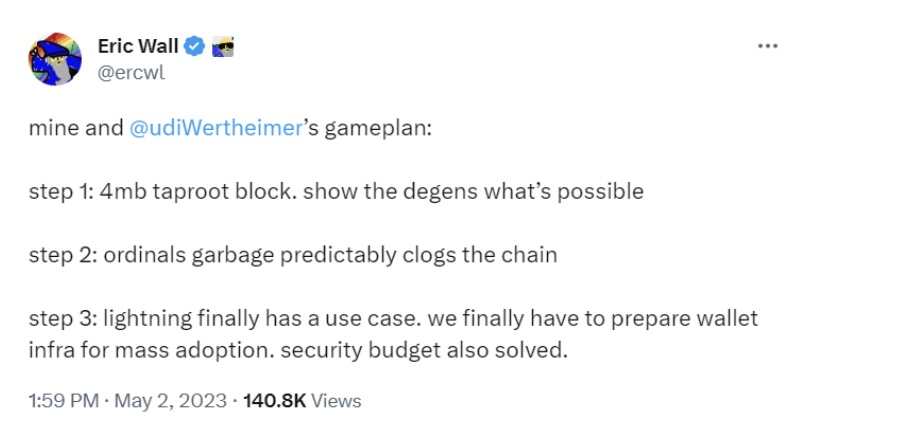

In February 2023, the Taproot Wizards achieved a notable feat using the Ordinals protocol. They generated the largest block ever recorded in Bitcoin’s history at that time, reaching nearly 4 megabytes in size.

Their goal was clear: to challenge the existing norms and cultivate an experimental and rebellious mindset within the Bitcoin ecosystem. More than 14 million inscriptions have occurred since the “Wizard Block,” generating something magnificent: a circular digital economy where assets are priced, bought and sold via Bitcoin (BTC). (Inscriptions inscribe sats with content, creating NFTs.)

Liberté, rare sats and Fraternité

To illustrate the rapid pace of experiments within this ecosystem, in February, traders were buying and selling Ordinal NFTs using Google Sheets since there were no available marketplaces.

“We are experimenters in an experimental protocol. And my goal is clear: to onboard, educate, entertain and experiment on the Bitcoin blockchain,” a figure in the Ordinal ecosystem who goes by “BitGod” told me in an interview.

Yet, in a matter of mere months, notable corporations and projects entered the scene, providing some framework for this market. As a result, the market has witnessed over 140,000 distinct users and a trading volume surpassing $220 billion.

And among the experiments sparking this interest, one narrative has captured the attention of the general public: rare sats.

Many projects are using this narrative to tokenize their artworks. CTRL, for example, was the first project to inscribe on a “Rare” satoshi.

“I think the image symbolizes the CTRL movement and its inflection point at the time of discovering the Rare sat,” Jameson Mah told me. “The movement is diverse, humble, cypherpunk, fresh blood and energy. CTRL is quite literally replacing the vintage $2 bill that represents the old archaic systems, and the hash of the Rare sat inscription peeking out the back. Then Satoshi Nakamoto’s genesis block message that started it all is illuminated by the light of the power of the Rare sat in the center. It’s non-violent, but it’s also clearly rebellious.”

Related: Bitcoin ETFs: Even worse for crypto than central exchanges

Currently, only eight Rare sats similar to the one used by CTRL in their artwork have been found. And one of them has a bid of $600,000 in an auction. The other one is Gansy, the founder of the Rare Satoshi Society. He disclosed that RSS has already generated over $2.5 million by providing satoshis with specific attributes for more than 100 Ordinals projects. With the objective of preserving their status as the leading supplier of rare sats in the market, his team has already transacted over $3 billion in BTC, searching for the gems that constitute their current portfolio.

There are several other experiments bringing fresh blood to the Bitcoin ecosystem. Prominent Ordinals use cases that deserve exploration include BRC-20, bitmap and recursive inscriptions.

What to expect from Bitcoin season 2?

Recognizing Ordinals as a highly complementary movement to the success of Bitcoin is crucial. The ecosystem’s triumph does not hinge on a single solution, but rather a combination of various factors that contribute to its prosperity.

In certain instances, such as in Argentina, the adoption of Bitcoin will be driven by necessity. For others, it will stem from their fascination with the underlying principles of Bitcoin. Institutional adoption through ETFs will contribute a significant portion to the adoption curve. Additionally, the emergence of Ordinals applications will bring a dual benefit to the network, fostering both adoption and the evolution of the ecosystem’s infrastructure.

“My first expectation is that many projects will experiment on Bitcoin,” Mah said, adding, “Next, with this renewed interest, the network will become a lot more expensive to use. Therefore, some of this activity logically should move to layer 2s. Many builders are already experimenting with rollup architecture on top of Bitcoin, for example.”

To conclude, Mah said, “It’s important among the hype to always look for true innovation, substance and creativity — and importantly, Bitcoin-native thinking.”

Lugui Tillier is the chief commercial officer of Lumx Studios, a Web3 studio that counts BTG Pactual Bank, the largest investment bank in Latin America, among its investors. Lumx Studios has previous Web3 cases with Coca-Cola, AB InBev, Nestlé and Meta.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.