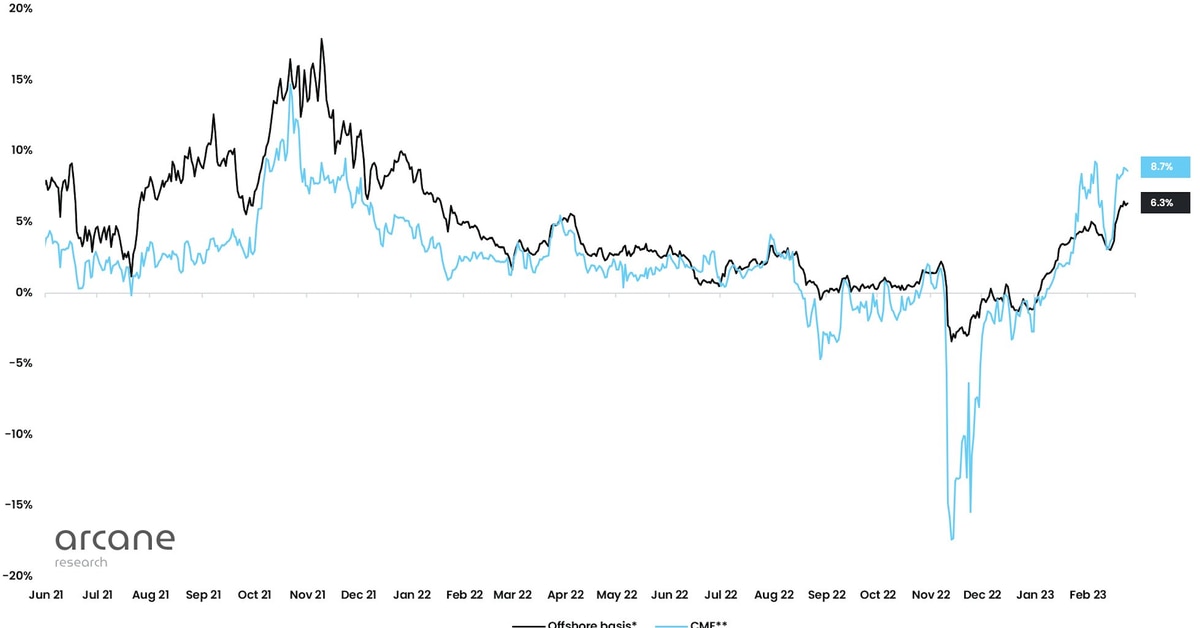

Bitcoin has surged over 45% so far this year, outperforming traditional risk assets, including Wall Street’s tech-heavy Nasdaq index, by a significant margin. Futures typically trade at a premium in a sign of leverage being skewed on the bullish side when the underlying asset is appreciating in value. Conversely, during bear markets, discounts are often observed.

Bitcoin Futures on CME Outpace Those on Binance to Trade at Widest Premium Since November 2021