Bitcoin (BTC) delivered fresh volatility on Jan. 6 as rangebound behavior saw its first shake-up in weeks.

Open interest remains high

Data from Cryptox Markets Pro and TradingView showed BTC/USD dropping overnight to hit $42,000 for the first time since December.

Although not the upside breakout that many had wanted, the move was nonetheless predicted, Bitcoin essentially “filling” the space left after it briefly wicked to $41,800 early last month.

Those lows were the result of a liquidation cascade, and while long positions also felt pain this time around, scepticism remained as to whether the revisiting of $42,000 had been enough to put in a price floor.

“Honestly surprised we didn’t see more of a flush today if this was aggressive longs built up. Could still resolve to the upside,” analyst William Clemente wrote in a series of tweets about the action.

“All I know for sure is that this party is just getting started.”

Btw this isn’t a doom post. Honestly surprised we didn’t see more of a flush today if this was aggressive longs built up.

Could still resolve to the upside. All I know for sure is that this party is just getting started. pic.twitter.com/RAgXKzHTnl

— Will Clemente (@WClementeIII) January 6, 2022

Clemente was among those already calling for more volatile conditions this month and noted that the majority of Bitcoin futures open interest (OI) remained. As Cryptox reported, OI had hit all-time highs in BTC terms during the week.

As ever, those zooming out found comfort and familiarity in Bitcoin price action versus historical behavior.

Fibonacci levels analyzed by fellow analyst TechDev showed that Bitcoin was still at least attempting to copy patterns built up from previous halving cycles.

Based on everything I have shared for months, and until my invalidation points are reached, it remains my belief that there is a higher than not probability that #Bitcoin finds support near linear 2.618 and moves higher, as it has done twice before.

— TechDev (@TechDev_52) January 5, 2022

“Comparisons to past cycles aside, price/indicator action and volume behavior suggest to me that 2021 was effectively a year of consolidation (similar to 2019-Q3 2020) and that is likely to lead to another market impulse before the next major correction,” he added in his own set of posts as the market began to dip.

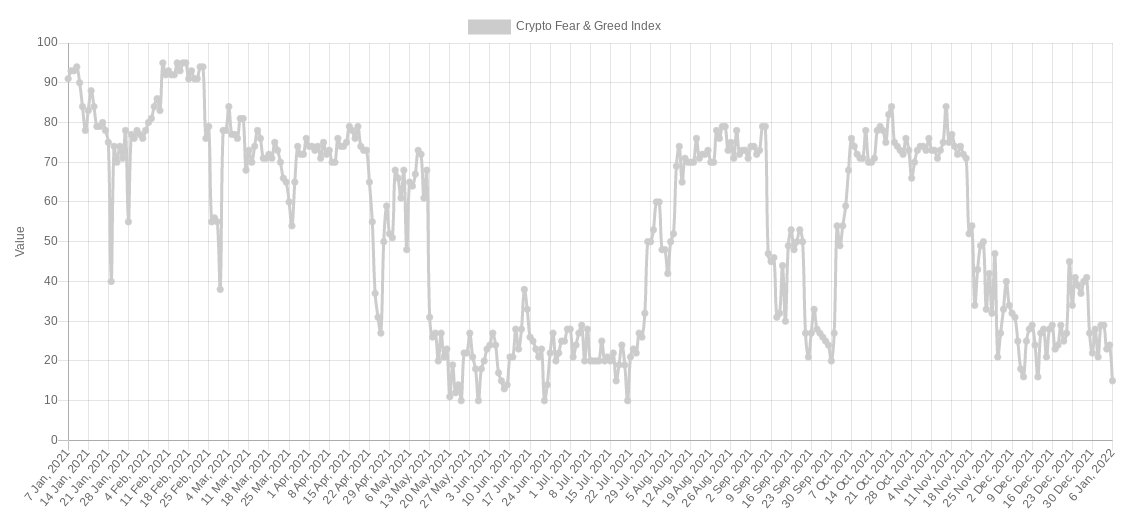

Market most fearful since July 2021

For the average retail investor, however, it looked as if there was little hope left — at least on the day.

Related: New year, same ‘extreme fear’ — 5 things to watch in Bitcoin this week

The Crypto Fear & Greed Index halved during the dip to 15/100 — deep within the Index’s “extreme fear” zone and its lowest level since last July.

At that time, BTC/USD traded at a maximum of $33,000.

As Cryptox reported, jitters in sentiment were already palpable as 2022 began.