Coinspeaker

Bitcoin ETFs Witness 4th Consecutive Day of Surging Inflows, Amass 500K BTC Worth $35B

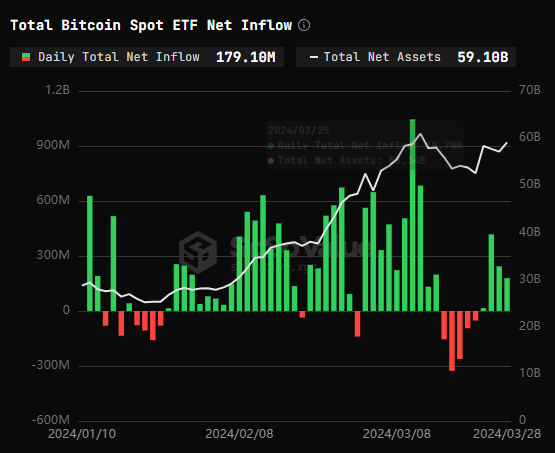

The crypto landscape is evolving rapidly, with spot Bitcoin exchange-traded funds (ETFs) gaining significant traction since their long-awaited regulatory approval earlier this year. This promising development continued through the end of March, as spot Bitcoin ETFs recorded net inflows of $179 million for a fourth consecutive day, according to data from SoSo Value.

Photo: SoSo Value

However, the landscape is not entirely positive. Grayscale’s Bitcoin Trust, the industry leader before the introduction of spot ETFs, experienced constant net outflows. On March 28th alone, approximately $105 million departed from the product, highlighting a potential shift in investor preference toward the newer, more transparent spot ETFs, which offer enhanced clarity.

While spot Bitcoin ETFs witnessed an impressive launch, it’s crucial to note the gradual decline in trading volumes from their peak in early March. Statistics from The Block reveal that cumulative volumes steadily approached $200 billion, currently standing at $177.9 billion as of March 27th. The overall trend is declining after the initial excitement surrounding the launch of these products.

Bitcoin ETFs Amass 500K BTC Worth $35B

Despite the decline in volumes, assets under management (AUM) and on-chain holdings for spot Bitcoin ETFs remained stable since peaking early this month. HODL15Capital, a prominent ETF analyst, reports nine newly launched spot Bitcoin ETFs rapidly amassed a considerable 500,000 BTC since January. Remarkably, this substantial 2.54% of Bitcoin’s circulating supply amounts to $35 billion in just 54 trading days.

✅ MAJOR MILESTONE FOR BITCOIN ETFs👇

The new 🇺🇸 #Bitcoin ETFs purchased more than 500,000 Bitcoin (worth $35 Billion USD) in just 54 trading days 💥 $GBTC converted to an ETF & experienced large redemptions👇$IBIT $FBTC $ARKB $BITB $BRRR $BTCO $HODL $EZBC pic.twitter.com/31mDx6rPq9

— HODL15Capital 🇺🇸 (@HODL15Capital) March 29, 2024

Taking a broader perspective, all spot Bitcoin funds in the US market, including Grayscale, hold approximately 835,000 BTC, constituting around 4% of Bitcoin’s total supply. This week witnessed a positive reversal, with ETF inflows rebounding to $845 million. This influx effectively countered the outflow trend observed since March 18th, signalling renewed investor confidence in the digital asset space.

Further complicating the situation, Bitwise submitted an S-1 application for an Ethereum ETF on March 28th. Eric Balchunas, an ETF expert, expressed doubt about its approval in May, estimating a meager 25% chance. He cited the SEC’s opaque communication as a potential hindrance, possibly leading to further setbacks.

Bullish Signs for Bitcoin

Despite the uncertainty regarding Ethereum ETFs, the overall projection for Bitcoin is favorable. Currently trading at $69870, the BTC price maintains a comfortable position above key technical indicators, the 50-day and 200-day exponential moving averages (EMAs), affirming an upward trajectory.

Photo: TradingView

In the coming days, market participants should closely monitor BTC-spot ETF market chatter, SEC activity, and the US economic calendar, which could influence price movements. While a return to the ATH seems achievable, a drop below the crucial $69,000 support level could signal a correction towards the $64,000 support zone.

Bitcoin ETFs Witness 4th Consecutive Day of Surging Inflows, Amass 500K BTC Worth $35B