The end of the week brought more outflows from spot Bitcoin (BTC) exchange-traded funds (ETFs), pushing the total net outflows for these products to more than $544 million.

According to Farside Investors, spot Bitcoin ETFs saw net outflows amounting to $105.9 million on June 21, making it the sixth successive day with outflows exceeding $100 million.

The bulk of these outflows came from three major funds: the Fidelity Wise Origin Bitcoin Fund (FBTC) with $44.8 million, the Grayscale Bitcoin Trust (GBTC) with $34.2 million, and the ARK 21Shares Bitcoin ETF (ARKB) with $28.8 million going out.

Despite the bearish sentiment in the market, not all ETFs followed this trend. The Franklin Bitcoin ETF (EZBC) managed to buck the trend with an inflow of $1.9 million on the same day. On its part, BlackRock’s iShares Bitcoin Trust (IBIT), the largest Bitcoin ETF by holdings, remained neutral with no significant changes.

The recent trend of outflows is notable, especially considering that spot Bitcoin ETFs experienced $580.6 million in net outflows just last week. This comes after a period of four consecutive weeks of net inflows, which collectively added around $4 billion to these investment products.

Bitcoin’s market woes deepen amidst heightened FUD, whale activity

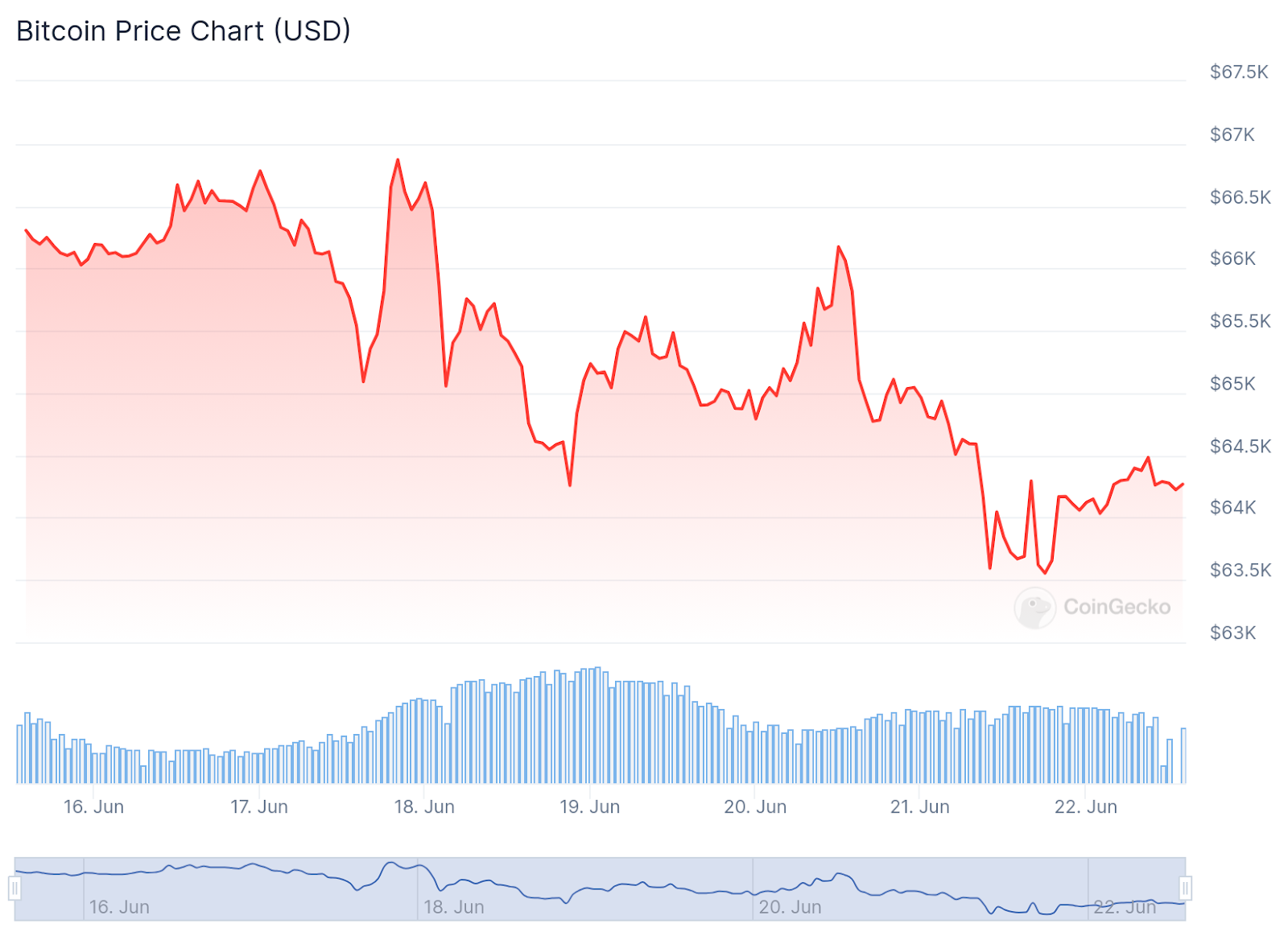

The broader cryptocurrency market has been experiencing heightened fear, uncertainty, and doubt (FUD), which has been reflected in Bitcoin’s price dipping below the $64,500 mark.

On-chain data has also revealed significant activity among Bitcoin whales, who hold significant amounts of BTC. According to information shared by CryptoQuant CEO Ki Young Ju on X, whales sold approximately $1.2 billion worth of BTC over the past two weeks. This trend of cashing out coincided with the negative net flows in spot BTC ETFs.

Ju warned that if this sell-side liquidity is not absorbed over the counter, it could lead to more BTC being deposited on exchanges, potentially impacting the market further.

The cryptocurrency’s price has faced difficulties in recent weeks. On June 21, Bitcoin’s value dropped to $63,500. It has since rebounded slightly, adding around $750 in the last 24 hours, according to CoinGecko.

Nonetheless, the coin has experienced a 7.2% decline over the past 14 days, reflecting the ongoing volatility in the market.