On Wednesday, Bitcoin’s price dipped below $66,000 as news surfaced of another multi-billion dollar BTC transfer from defunct crypto exchange Mt. Gox .

On Tuesday, July 30, the Mt. Gox estate moved another batch of nearly 34,000 Bitcoin (BTC) — worth around $2.25 billion at current prices — to a new wallet, indicating that the exchange might be actively repaying its creditors after it shut down in 2014.

Per data from Arkham Intelligence, Mt. Gox moved 33,963 BTC to a fresh wallet where the funds are still sitting as of press time. It’s unclear whether the defunct crypto exchange moved the more than $2 billion worth of BTC to a crypto exchange or just reallocated the funds within its own wallets.

Amid the transfer, the price of Bitcoin dropped briefly down to $65,400 before bouncing back above the $66,000 level. As of press time, BTC is trading just above the $66,000 mark, down 5.37% from July 29, when it reached $70,000, according to data from crypto.news.

Bitcoin’s price reactions to Mt. Gox moves

It remains to be seen how these recent transfers will impact Bitcoin’s price compared to, for example, the extended sell-off of confiscated BTC by the German government in early July, which spooked speculators and drove the BTC price down below $55,000.

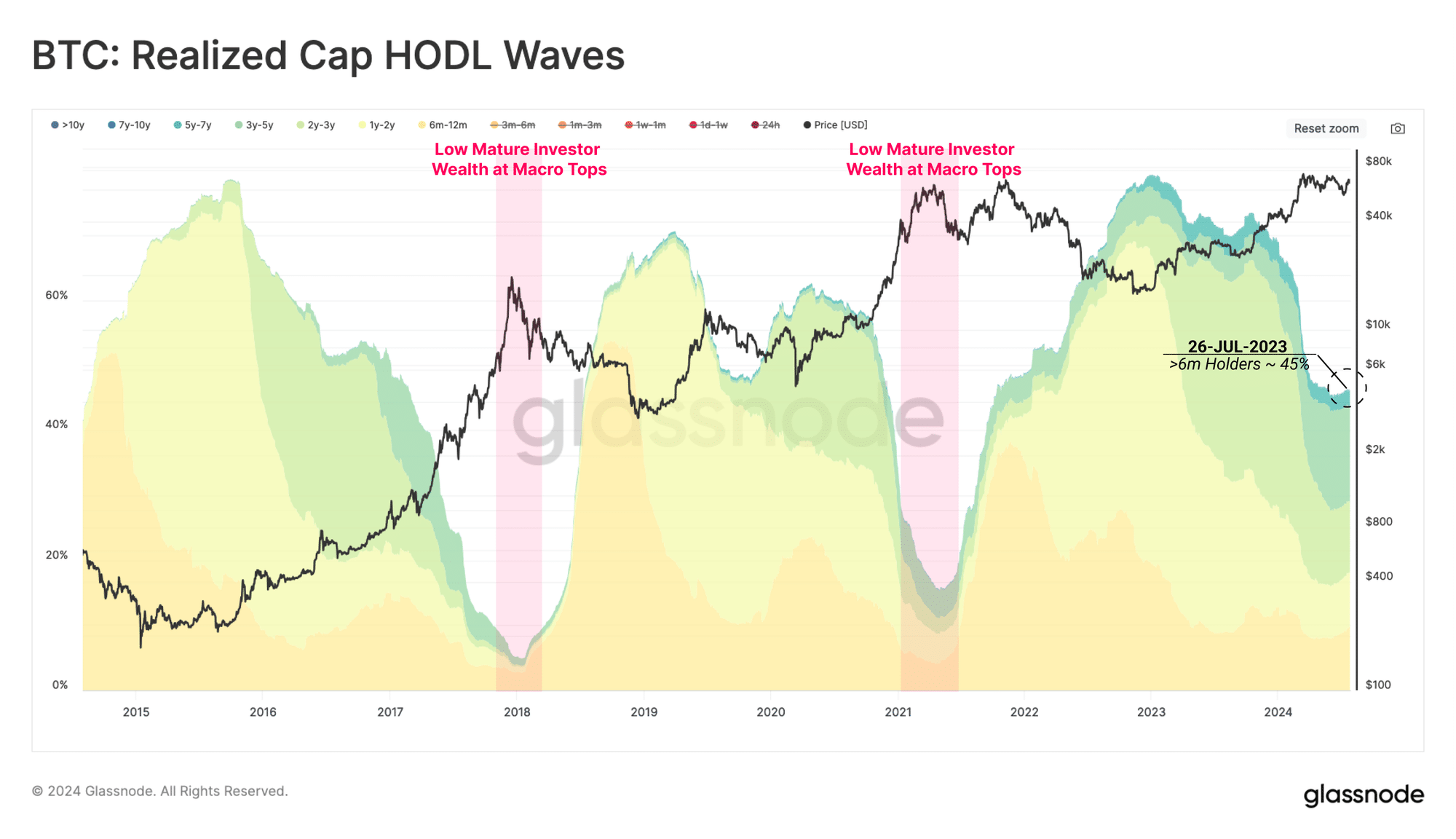

However, preliminary indicators suggest limited sell-side pressure. Glassnode’s July 29 report reveals that out of the 142,000 BTC recovered from the Mt. Gox hack, approximately 59,000 BTC have already been distributed to creditors via major exchanges Kraken and Bitstamp. The report highlights that despite these significant movements, Bitcoin’s price has remained above the $60,000 mark, suggesting a relatively contained market impact.

As a result, the proportion of Bitcoin held by new investors has declined, Glassnode notes, adding that long-term holders now control about 45% of the network’s wealth. This indicates a shift in investor behavior toward holding rather than selling. Nonetheless, Mt. Gox still holds over $5.3 billion worth of BTC in its wallets, according to data from Arkham Intelligence, suggesting that the distribution of these funds could extend over weeks or even months.