Bitcoin Cash price crossed $280 on Feb. 12, as its 20% rally in the past week sent it soaring above Litecoin (LTC) in the race to reach $6 billion market capitalization in 2024.

BCH has gained momentum in recent weeks surpassing Litecoin in terms of market capitalization. What are the key factors driving Bitcoin Cash prices, and what to expect in the coming weeks?

Bitcoin Cash has flipped Litecoin market capitalization

Bitcoin Cash and Litecoin are two rival Proof of Work networks hard forked from Bitcoin (BTC) to create a lightweight and more scalable peer-to-peer payment systems.

Notably, the ongoing crypto market rally has sent mega cap Proof-of-Work (PoW) coins including BTC and BCH into triple-digit price gains respectively. Meanwhile, LTC has only mustered a modest 20% upswing between Oct. 16, 2023 and Feb. 14 2024. Litecoin price has struggled for momentum since its most recent halving in August 2023. Currently trading at $70, LTC price is down 30% from its pre-halving price.

Bitcoin Cash on the flipside, has attracted the attention of large institutional investors in recent weeks. On Feb. 12, BCH price hit a new 2024 peak at $289.4, bringing its year-to-date gains to the 30% mark.

Importantly, looking beyond the short-term price swings, BCH has now overtaken LTC market capitalization. The Santiment chart below shows that BCH market cap climbed to a 2024 peak of $5.4 billion dollars before mild pullback sent it $5.3 billion at the time of writing on Feb. 14, while Litecoin ecosystem is currently valued at $5.1 billion.

Is it better to buy Litecoin (LTC) or Bitcoin Cash (BCH) in 2024?

BCH has surpassed Litecoin in the race to reach the $6 billion valuation milestone. And considering the heightened trading volume and increased short-term price momentum in BCH looks set to stretch the lead further.

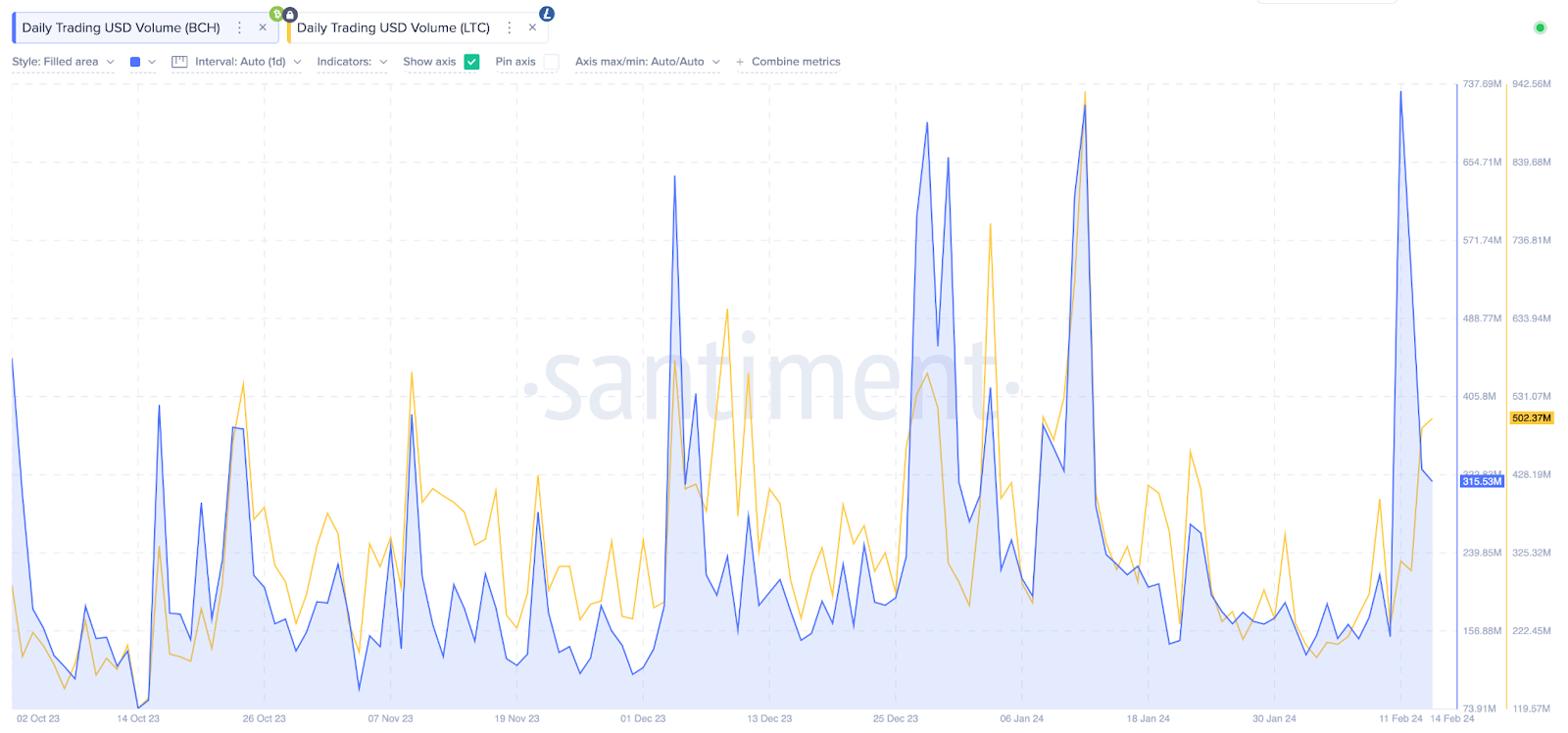

Over the last 3 months, BCH has consistently recorded much higher spikes in trading volume than LTC. During the most recent upswing, Bitcoin Cash has reached a peak trading volume $730.4 million for February 2024 dwarfing LTC’s $315.5 monthly peak trading volume by more than 100%.

LTC relatively flat price action, relatively lower daily volumes could prove dissuasive to swing traders. But in contrast, deeper inquest into the Bitcoin cash on-chain data trends further affirms that whale investors are piling into BCH, a move that will likely trigger another leg-up in the days ahead.

In essence, a higher trading volume depicts greater market participation within the BCH ecosystem compared to Litecoin. Strategic investors could interpret this as a vital signal that BCH has better short-term price prospects than LTC.

Crypto whales could trigger BCH rally with $11.6m buying spree

Increased buying pressure from crypto whales is another critical factor that has propelled BCH ahead of LTC in the race to hit the $6 billion market valuation. Recent trends observed this week suggest more bullish action could follow for BCH price.

Santiment supply-held by addresses chart tracks real time changes in the number of coins deposited in large-holder wallets.

As seen below, whales holding balances of 100,000 BCH (~$250,000) have been on a steady buying spree in recent months. Between Jan 1 and Feb. 14, the whales have acquired a total of 50,000 BCH worth approximately $11.6 million when valued at the 10-day simple moving average price of $232 per coin.

Notably, a closer look at the chart shows that whales have acquired 10,000 BCH, about 25% of the 2024 net-inflows in the last 4 days. This signals that crypto whales have intensified their buying pressure this week.

Considering how the whales buying trends have been closely correlated to previous rallies, BCH price looks set to extend its lead over LTC in the days ahead.