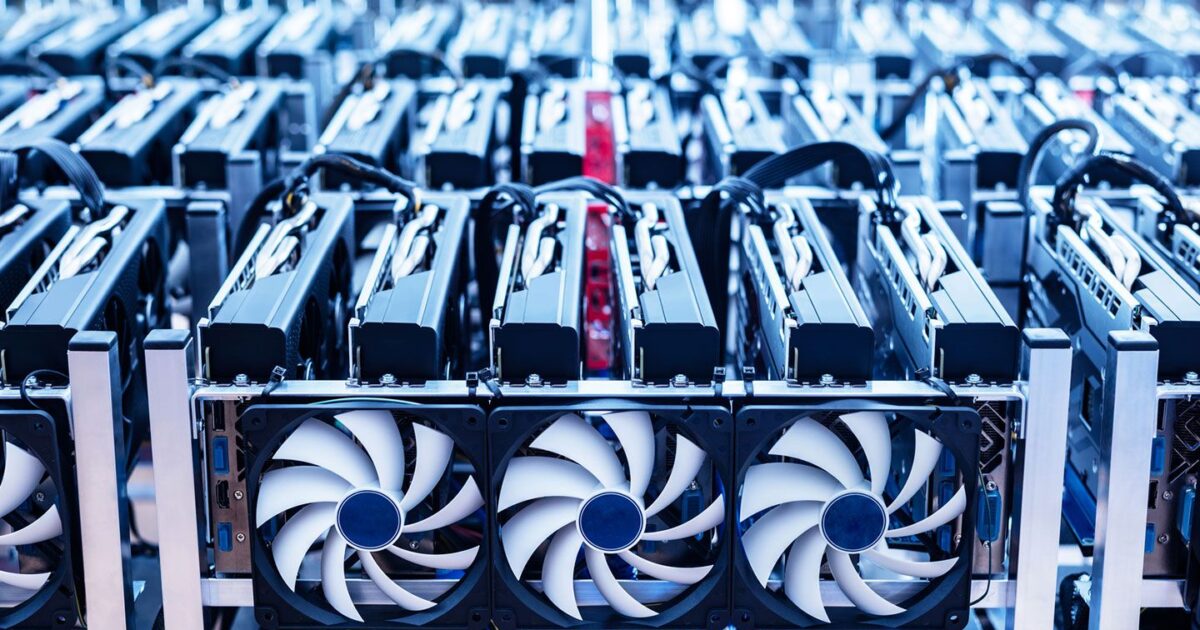

Bitcoin

mining profitability rose by 18.2% in May, due to a 20% increase in the BTC price and a modest 3.5% gain in the network hashrate, investment bank Jefferies said in a research report on Monday.

“BTC’s rally follows the recent gold rally as investors seek inflation-protected assets in anticipation of ballooning fiscal deficits in the U.S., among other countries,” analysts Jonathan Petersen and Jan Aygul wrote.

Hashrate refers to the total combined computational power used to mine and process transactions on a proof-of-work blockchain, and is a proxy for competition in the industry and mining difficulty.

U.S.-listed mining companies mined 3,754 bitcoin in May versus 3,278 in April, the report said. The bank noted that North American miners made up 26.3% of the total network last month compared to 24.1% in April.

MARA Holdings (MARA) mined the most crypto of the group, at 950 bitcoin, a 35% increase month-on-month, followed by CleanSpark (CLSK), which mined 694 tokens, the bank said.

MARA’s installed hashrate remained the largest at 58.3 exahashes per second (EH/s). CleanSpark was second with 45.6 EH/s, the report noted.

The bank reduced its MARA price target to $16 from $18, while reiterating its hold rating on the stock.

Read more: Bitcoin Miners Just Had One of Their Best Quarters on Record, JPMorgan Says