Bitcoin is at the highest level since April 2022, trading at $41.28K and up 4.71% in 24 hours. Following this upswing, the broader crypto market is up 3.4% on the last day.

Bitcoin breaks out above $40k

The $40K milestone has long been a critical physiological area of interest for Bitcoin investors, with many worrying that it may prove to be strong resistance.

Consequently, many traders had remained partially or wholly sidelined or even been shorting Bitcoin as it approached the $40K mark.

However, X commentator Mister Crypto noted that this cautiousness, or even bearishness, is good for Bitcoin. In a recent tweet, the analyst pointed out, “over $3,855,000,000 worth of BTC short positions will be liquidated,” should Bitcoin break above $38.6K.

Short liquidations represent the closure of a sell position on an asset, essentially equating to increased buying pressure.

The analyst was indeed correct, with Bitcoin’s price following a somewhat parabolic trajectory after breaking the $38.6K level and then onwards past $40K.

The move has sparked massive excitement within the market, with Bitcoin’s open interest spiking by 5.77% over the past 24 hours. Open interest represents the amount of open or outstanding trading contracts on an asset.

Therefore, Bitcoin’s open interest increasing as it rallies upwards is a sign that the market is gaining confidence and longing, expecting a higher price ahead.

Following the recent price explosion, Mister Crypto warned traders not to short Bitcoin at its current price but to await a pullback and buy instead. In other words, the analyst suggests that Bitcoin will likely continue to uptrend.

Meanwhile, The Kobeissi Letter noted bullish metrics regarding Bitcoin’s recent uptick.

The analysis highlighted bullish factors like Bitcoin being 175% higher than just over a year ago and its current upward momentum being “by far the strongest we have seen since it hit an all-time high in November 2021.”

In a follow-up tweet, the analyst noted, “momentum has become so strong that FOMO buying is back.”

Evidently, Bitcoin is on a bullish trajectory as it breaks above the crucial psychological level of $40K.

As such, the weeks ahead could see significant price action, potentially creating a parabolic environment for altcoins to thrive.

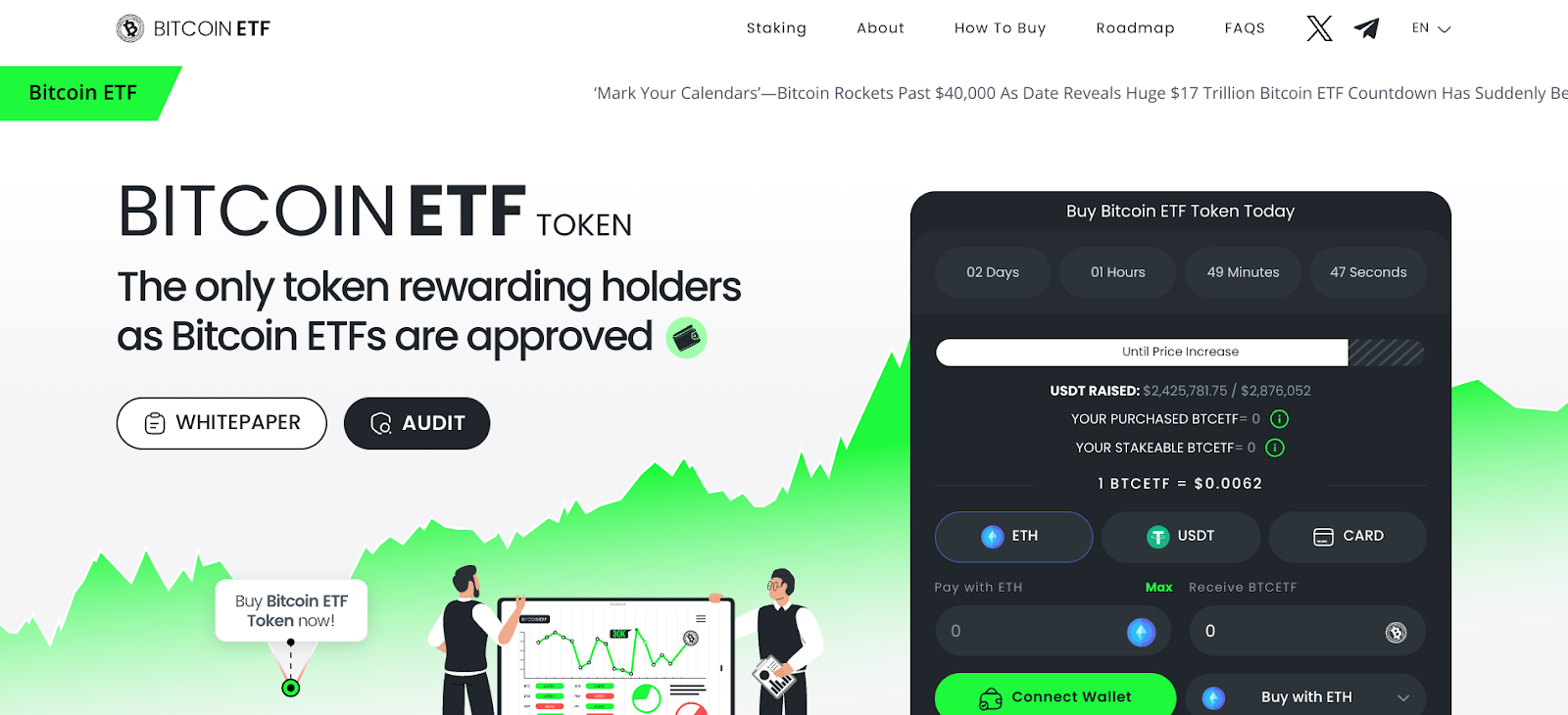

One altcoin on investors’ radar is Bitcoin ETF Token (BTCETF). In the ongoing presale, it has raised nearly $2.5 million.

Bitcoin ETF Token raises nearly $2.5 million in presale

Bitcoin ETF Token has fresh tokenomics, utility, and aims to thrive under the Bitcoin ETF hype.

BTCETF is deflationary, featuring two burning mechanisms correlating with Bitcoin ETF milestones.

First, it will burn 5% of its total supply at five stages of the Bitcoin ETF approvals.

It also features a 5% burn tax on transactions, which will reduce by 1% at each stage.

These phases have been selected to commemorate key advancements, including when the first Bitcoin ETF is approved and when there is over $100 million in BTC ETF trading volume.

Bitcoin ETF Token also supports staking and offers users a 104% APY. However, this will decrease as the staking pool grows.

Lastly, the project provides Bitcoin ETF alerts, pulling the latest news and updates from around the internet into its website.

This makes the project a Bitcoin hub, aiming to foster an active and engaged community.

Investors can buy BTCETF for $0.0062 in the current presale stage.

Visit Bitcoin ETF Token Presale

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.