Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Bitcoin and Ethereum have started Dec. 18 in the red, down 2.53% and 3.67%, respectively. However, the newly launched Bitcoin Minetrix is outpacing other cryptos as its presale surges past $5.4 million.

Bitcoin and Ethereum dip at local tops amid extreme transaction fees

Bitcoin Ordinals took center stage recently, with the prices of related projects climbing astronomically. Meanwhile, ordinal-related activity on the Bitcoin Network has also been soaring, causing Bitcoin transaction fees to spike to an average of $37, according to BitInfoCharts.

There have only been two times in history when Bitcoin fees have been higher, at the 2021 and 2018 bull run peaks.

Consequently, data from Mempool.space shows that this has led to over 290,000 unconfirmed Bitcoin transactions yet to be processed.

This has negatively affected investor sentiment, sparking concerns about how unusable Bitcoin may become as the bull run advances.

According to X analyst WhaleWire, spikes in transaction fees often coincide with a market top.

“Historically, during market peaks, #Bitcoin experiences a surge in transaction fees and network congestion. The media, as always, is not talking about this, but fees are now at dangerously high levels (2nd highest level in history). This signals immense pressure on the network.”

X analyst WhaleWire

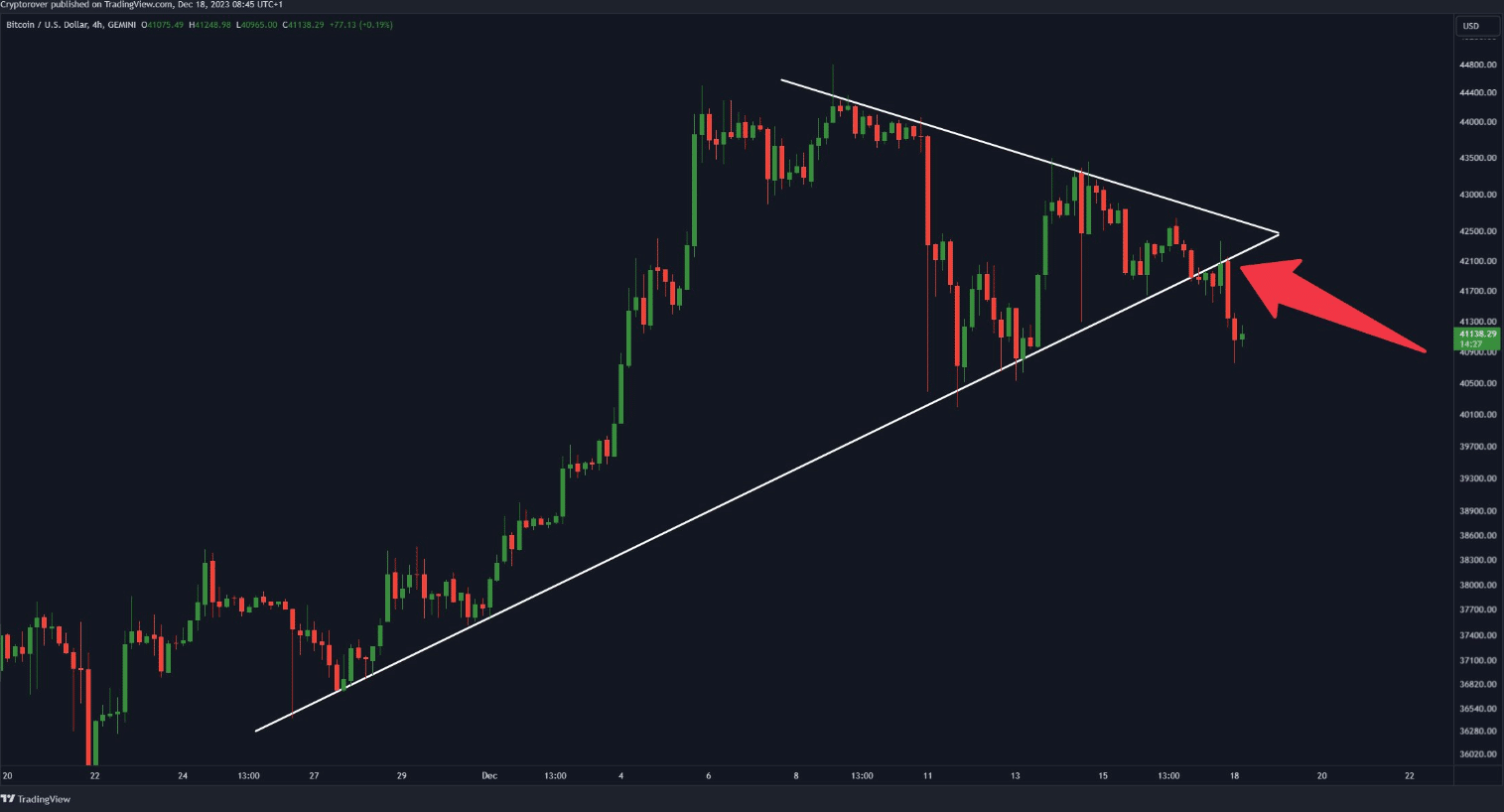

Bitcoin’s price has since dropped below a crucial trend line support, according to analyst Crypto Rover.

In a follow-up tweet, the analyst warns that $800 million of Bitcoin longs will be liquidated should BTC hit $40,600. If this occurs, these positions would be forcibly closed by opening opposing sell positions, causing Bitcoin’s price to retrace much deeper.

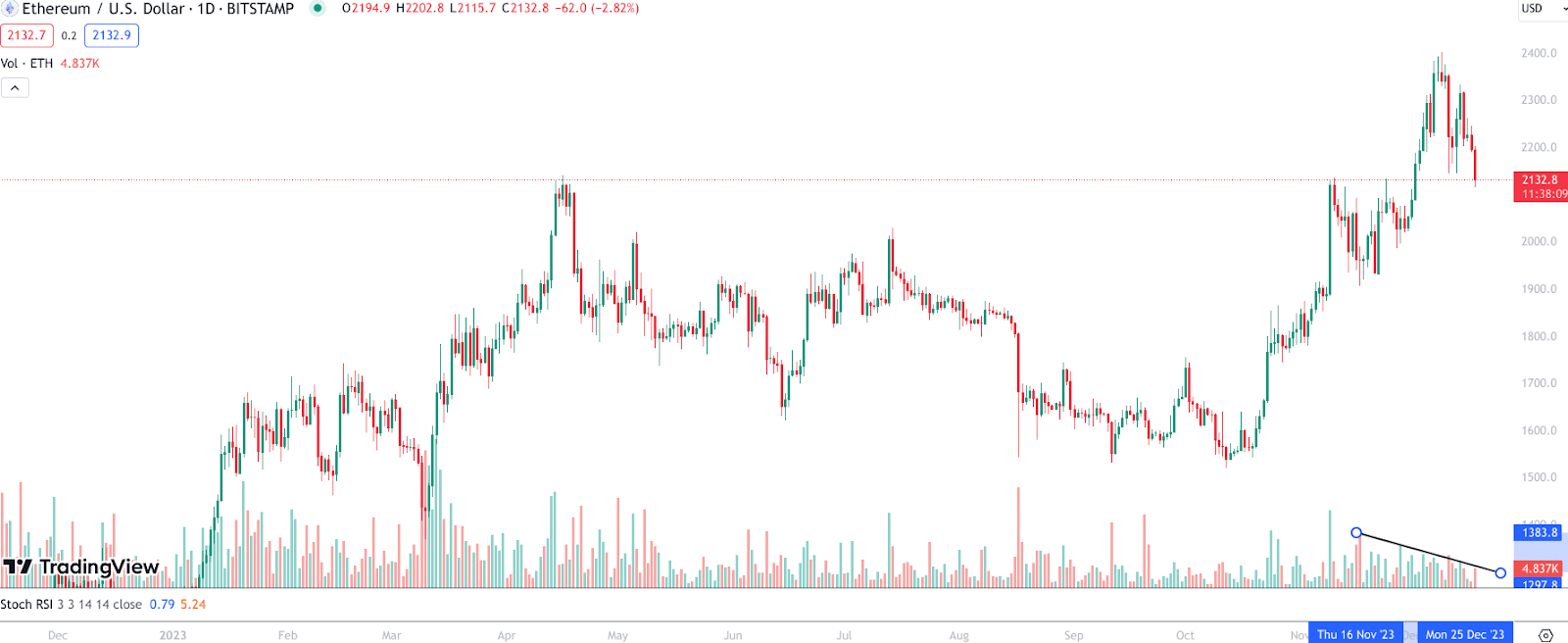

Meanwhile, data from YCharts shows Ethereum has also faced its own transaction fee battle, reaching its highest rates in six months on Friday.

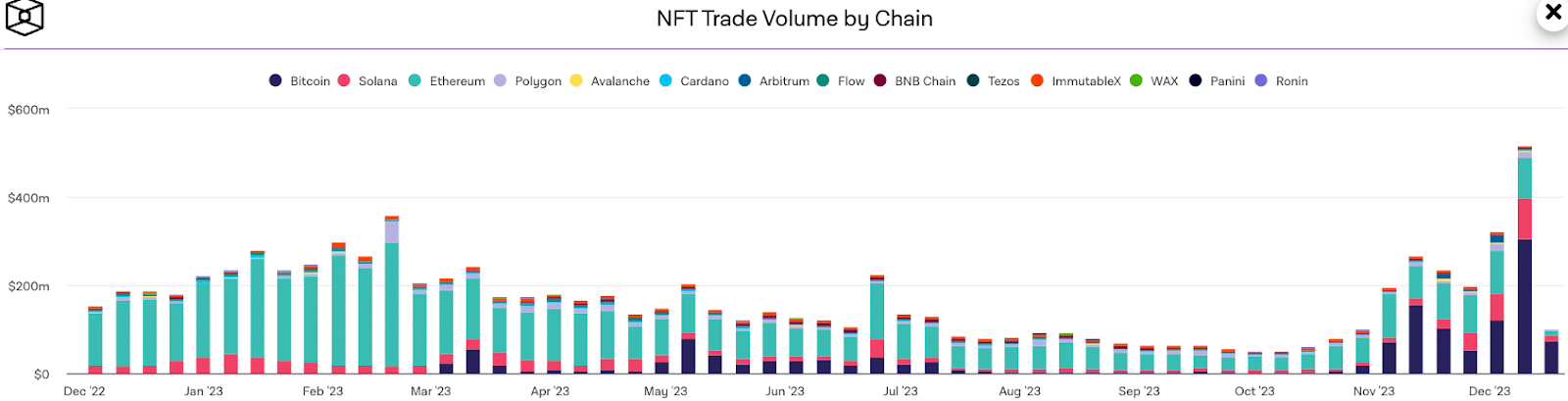

Yet, simultaneously, Bitcoin and Solana have begun capturing Ethereum’s NFT trading volume, with Bitcoin significantly outpacing it in recent days.

At the same time, chains like Cardano, Avalanche, Solana, and Injective Protocol are all gathering momentum. This combination of high fees and market share being lost on multiple fronts is likely damaging Ethereum’s market sentiment, evident in its decreasing price and trading volume, as seen on the price chart below.

That said, the market continues to present lucrative opportunities, with one of the most promising new cryptos being Bitcoin Minetrix, a compelling stake-to-mine protocol currently undergoing a presale.

Bitcoin Minetrix presale surges past $5.4m as analyst predicts 100X

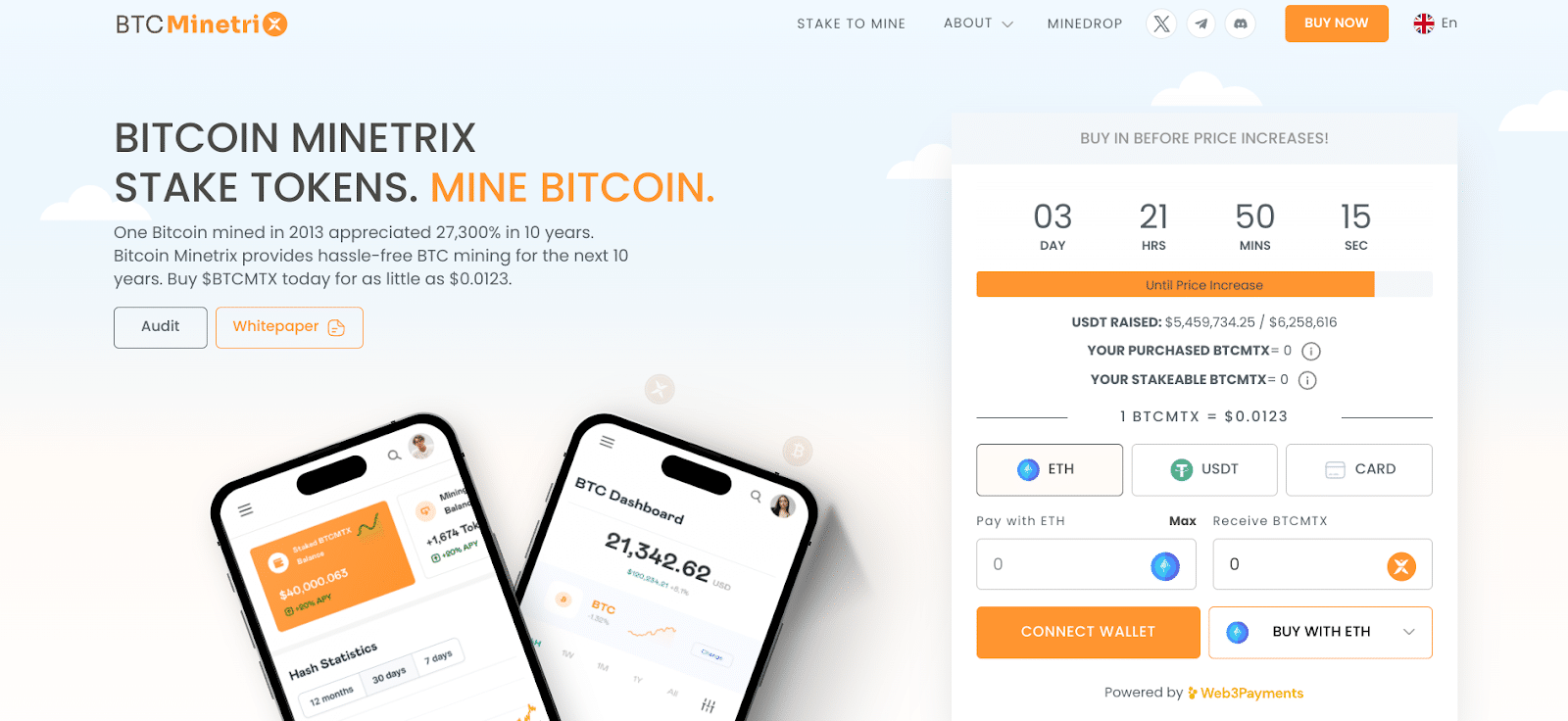

Bitcoin Minetrix is a new cryptocurrency that enables anyone to mine Bitcoin effortlessly and securely.

It is based on a cloud mining system, where users stake $BTCMTX tokens for Bitcoin mining credits. These are non-transferable ERC-20 tokens that they can burn for cloud mining power.

This mean users can get started free of technical expertise, upfront costs, and overhead costs. Moreover, it also provides an invaluable iteration to previous cloud mining protocols.

In the past, cloud mining has been criticized for scams and inefficiencies, where operators ask users for extra cash or do not pay out their Bitcoin rewards. However, the decentralized and immutable nature of $BTCMTX eradicates this risk, ensuring the dapp’s security.

Blockchain auditing firm Coinsult also conducted a smart contract audit that found Bitcoin Minetrix safe and secure.

Its compelling use case, crossed with robust security and the vast utility of $BTCMTX, has led to exciting price predictions from analysts. One of the most promising comes from renowned YouTuber Jacob Bury, who speculates it could rise 100x after its IEO.

So far, the Bitcoin Minetrix presale has raised over $5.4 million, indicating immense community interest. Investors can buy $BTCMTX for $0.123 but must hurry as the price will rise in three days.

Visit Bitcoin Minetrix Presale

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.