Bitcoin’s potential retracement to $70,000 may be an organic part of the current bull market, despite crypto investor concerns regarding the early arrival of the bear market cycle.

Bitcoin (BTC) fell over 14% during the past week to close around $80,708 after investors were disappointed with the lack of direct federal Bitcoin investments in President Donald Trump’s March 7 executive order that outlined a plan to create a Bitcoin reserve using cryptocurrency forfeited in government criminal cases.

Despite the drop in investor sentiment, cryptocurrencies and global markets remain in a “macro correction” as part of the bull market, according to Aurelie Barthere, principal research analyst at the Nansen crypto intelligence platform.

BTC/USD, 1-month chart. Source: Cryptox

Most cryptocurrencies have broken key support levels, making it hard to estimate the next key price levels, the analyst told Cryptox, adding:

“This is a macro correction (US tech will be down by 3% in the future, as discussed), so we have to monitor BTC. Next level will be $71,000 – $72,000, top of the pre-election trading range.”

“We are still in a correction within a bull market: stocks and crypto have realized and are pricing; a period of tariff uncertainty and fiscal cuts, no Fed put. Recession fears are popping up,” added the analyst.

Other analysts have also warned that Bitcoin may experience a deeper retracement toward the “low $70,000’s range, which may “provide a foundation for a more sustainable recovery,” Iliya Kalchev, dispatch analyst at digital asset investment platform Nexo, told Cryptox.

Related: Bitcoin reserve backlash signals unrealistic industry expectations

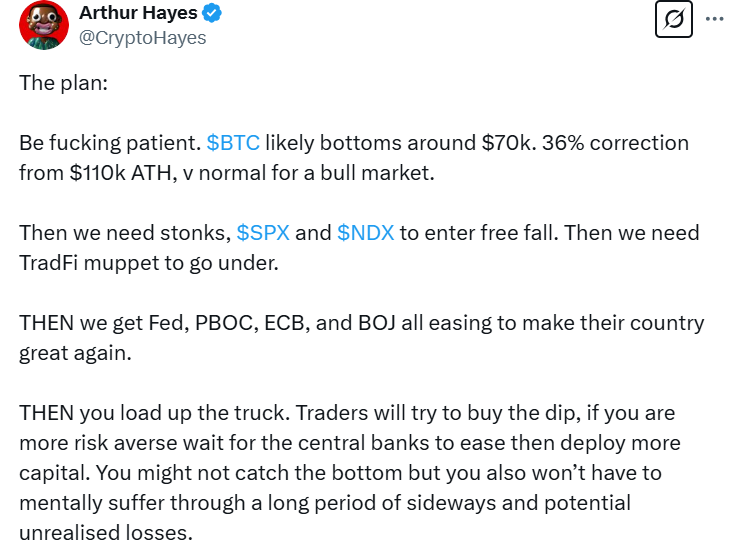

Bitcoin’s 36% correction to $70k “normal” for a bull market: Arthur Hayes

Bitcoin’s potential retracement to the $70,000 psychological mark would still fall within the regular price movement of a bull market, according to Arthur Hayes, co-founder of BitMEX and chief investment officer of Maelstrom.

Hayes wrote in a March 11 X post:

“Be fucking patient. $BTC likely bottoms around $70k. 36% correction from $110k ATH, v normal for a bull market.”

Source: Arthur Hayes

“THEN we get Fed, PBOC, ECB, and BOJ all easing to make their country great again,” added Hayes, referring to quantitative easing, a monetary policy where central banks increase the money supply by buying government bonds and other financial assets.

Related: Bitcoin may benefit from US stablecoin dominance push

Quantitative easing has historically been positive for Bitcoin price.

Bitcoin price rose over 1,050% during the last quantitative easing period, from just $6,000 in March 2020 to $69,000 by November 2021, after the Federal Reserve’s quantitative easing policy was announced during the Covid-19 pandemic on March 23, 2020, buying over $4 trillion worth of assets such as treasuries.

BTC/USD, 1-week chart, 2020-2021. Source: Cryptox/TradingView

Analysts remained optimistic about Bitcoin’s price trajectory for late 2025, with price predictions ranging from $160,000 to above $180,000.

Magazine: SCB tips $500K BTC, SEC delays Ether ETF options, and more: Hodler’s Digest, Feb. 23 – Mar. 1